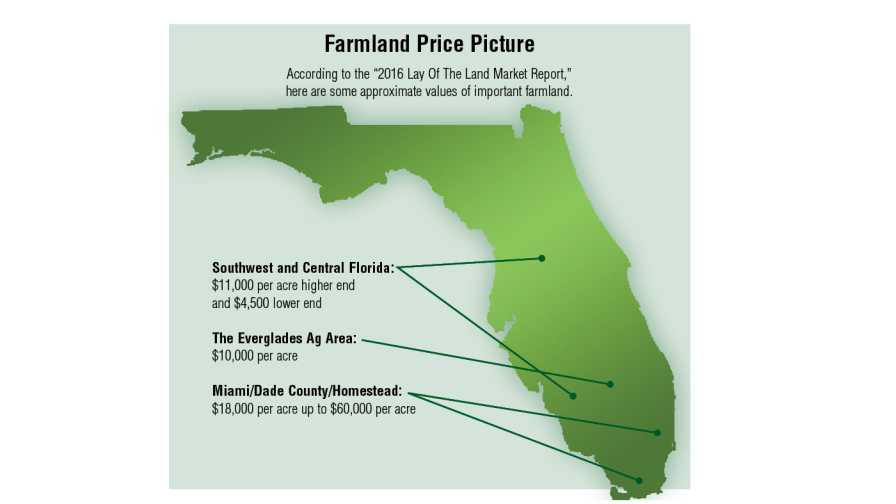

The 2016 Lay Of The Land Conference drew a large crowd of land owners and others to Champions Gate recently to learn the latest values of properties across the state. The take-home message from the event was Florida is a hot property where people want to be because of the things that make the state great — sun, water, climate, and a business-friendly environment.

And, for agricultural properties, institutional capital continues to look for investment opportunities in the state. Dean Saunders, owner of Coldwell Banker Saunders Real Estate and host of the Conference, told attendees that agricultural lands have proven to be a safe and stable place to put money.

“There is a lot of capital looking for a place to go,” Saunders said. “And, the number the investors have to beat is 1.75% (Treasury Bill rate). They believe the safe place to be is in land. The game they are in is not necessarily to make money, but not to lose money.”

Saunders noted that with commodity prices down, institutional investors who had been investing in land in the Midwest are turning their attention to places like Florida.

The Big DealsMany believed the 380,000-acre St. Joe Paper Company sale in 2014 was the high-water mark for big land deals. But, Saunders reported the Foley Timber and Land Company transaction in 2015 raised the bar even higher. The deal consisted of nearly 563,000 acres of timberland valued $712 million.

In 2015, Premier Citrus sold to International Farming Corporation. Saunders said the deal was complicated, multilayered, and included nearly 26,000 acres valued at $155 million. The third large transaction of the year was Sunbreak Farms purchase of more than 20,500 acres for just less than $71 million.

Saunders noted the timber market has been good and accounts for less transition of timberland into farmland.

“Looking at timberland, it has been driven primarily by institutional investors,” he said. “And there are two types — those seeking to establish greater returns and those seeking wealth preservation.”

With Florida’s economy rebounding and the state back adding 1,000 people per day, it bodes well for timber.HT: Farmlandgrab

“We are building houses,” he says. “They are going to need wood and that will impact timber prices.”

The Latin America EffectSaunders said he has seen a considerable uptick of interest in Florida property from buyers in Latin America. Political turmoil in parts of the region are encouraging people who have money to move it....MORE

See also:

Rate Of Farmland Price Decline Moderates (FPI; LAND)