However, judging by Warren’s recent moves, perhaps senility is finally taking grip of the great one’s gigantic brain. Buying Apple is almost like taking money and simply throwing it away....That's just straight up lazy-thinking nonsense. After watching Warren at the annual meeting, I am more concerned about my decline into senescence than his. At age 85 he still has the command of both the alpha and the numeric that got Berkshire to where it is.

Charlie on the other hand...

Just kidding, Munger can run rings around two-thirds of the Fortune 500 CEOs while napping.

There is a potential problem however.

You almost want to reprise Admiral Ackbar's "It's a trap!" realization scene, in this case a value trap, along the lines of Berkshire's $12 billion IBM position.

AAPL $93.88 Up 3.36 (3.71%) on the news (and broader market move)

BRK.a $212,530.00 up $390.00 because the billion doesn't really matter.

Here's the latest from Izabella Kaminska at FT Alphaville:

Smartphone gluts and inadvertently hoarded iPhones

Anxieties over a “Peak Apple” moment in markets eased temporarily on Monday when it was revealed Warren Buffett’s Berkshire Hathaway had taken a stake in the Cupertino company valued at more than $1bn.

Nevertheless, concerns about Apple’s capacity to keep the world hooked on its products have not been entirely eliminated. Some in the market are still digesting news that chipmaker TSMC cut production targets because of weaker demand expectations in the second quarter. Others, meanwhile, fret over whether the iWatch and other new products will ever achieve the mass appeal of the iPhone.

If that’s the case we could soon see Apple stock being valued less as a flashy growth-focused tech stock (where the attention is on product launches) and more as a boring old non-cyclical (where the attention is on product lifespans and upgrade cycles).

Although, even here, some are concerned about Apple’s ability to keep the upgrade cycle turning as quickly in an environment where the latest generation of phone becomes slightly less innovative than the last.

In that respect, it’s worth asking: how many of us have ever kept an iPhone until its dying day, anyway? And might we be more inclined to do so if newer versions give us little in the way of new tools or features?

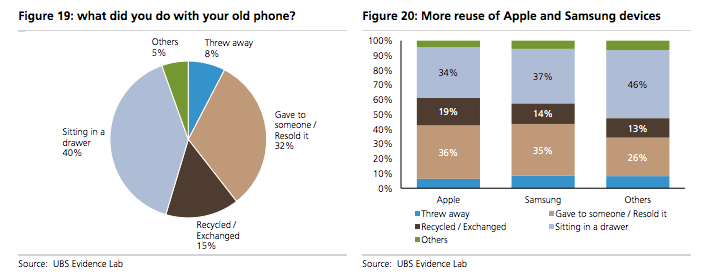

UBS’ global research team has conducted some, er, research. Currently, up to 40 per cent of us chuck the old phones into a drawer, forget about them and move on to the new ones.

As a whole, the drawer phenomenon is believed to be a good thing for Apple. The more functional iPhones are retired to drawers rather than recycled, exchanged, passed on or refurbished, the smaller the secondary market, the better the chances they will be replaced with primary market purchases direct from Apple....MUCH MORE

Even so, notes UBS, there are some indications the drawer trend could be abating (our emphasis):...

We'll be back to this later in the week, in the meantime some prior posts that may be of interest.

(your Climateer early warning system):

April 24, 2016

"Decline in iPhone Shipments Could Make Apple Worst-Performing Top Five Smartphone Brand of 2016" (AAPL)

Jan 6, 2016

Apple Has 20% Downside (AAPL)

Aug. 20, 2015

Peak Smartphone: "Smartphone Sales Declined for the First Time in China"

June 2015

"The End of the Smartphone: What It Means for Investment Professionals"

July 2015

Gartner on Consumer Electronics Markets: Goodbye Growth

April 2015

Smartphone-Enabled 3D Replicators Are Still 3-5 Years Away, Caltech Professor Says

I want my iPhone 3D replicator NOW!

But no, it's always nanophotonic coherent imager tomorrow, never nanophotonic coherent imager today.*

January 2015

Izabella Kaminska and This Year's Consumer Electronics Show: "What Comes After the Smartphone"

Nov. 2012

Patently Absurd: Apple Invents Rounded Corners (AAPL)

July 2015

Gartner on Consumer Electronics Markets: Goodbye Growth

April 2015

Smartphone-Enabled 3D Replicators Are Still 3-5 Years Away, Caltech Professor Says

I want my iPhone 3D replicator NOW!

But no, it's always nanophotonic coherent imager tomorrow, never nanophotonic coherent imager today.*

January 2015

Izabella Kaminska and This Year's Consumer Electronics Show: "What Comes After the Smartphone"

Nov. 2012

Patently Absurd: Apple Invents Rounded Corners (AAPL)