In finance, common stocks are the longest dated paper that corporations issue as they are theoretically perpetual.

In law they are just a residual claim after everybody else has gotten paid.

The interplay of these two facts helps get me up in the morning.

From FT Alphaville:

The contrarian corporate liability switch

Some interesting stuff on corporate balance sheets from SocGen’s Albert Edwards on Wednesday.

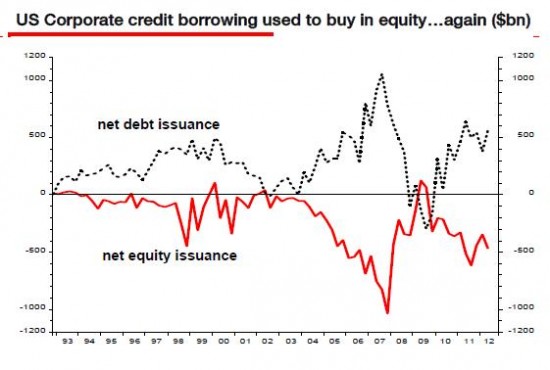

Alberts observes, for example, that corporate leverage is finally recovering after a temporary retraction:

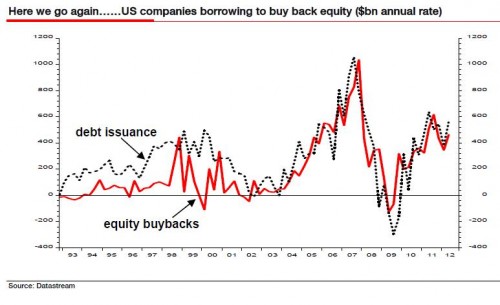

However, as he also notes, it seems companies are using most of the money for equity buyback purposes rather than investment purposes:

We look at the recovery in the credit aggregates and find all that is happening is that US corporates are once again engaging in their bad old destructive practices. For despite all the talk of cash rich US corporates, that has not stopped them returning to the credit markets to leverage up their balance sheets even more – spending the proceeds, almost dollar for dollar on equity buybacks (see chart below). History suggests this always ends badly. Maybe this time will be different, but I fear otherwise.

According to Albert the rate at which supposedly cash-rich companies are piling into credit to buy back their own stock in equal measure is somewhat phenomenal. He estimates a $500bn annual rate.Recently:

Much of the lending is sourced directly from the corporate bond markets rather than banks, as corporates rush to take advantage of low yields....MUCH MORE including:

"...What does this tell us?

Our take is slightly different to that of Edwards. We agree it’s not exactly healthy for the economy but we’d argue that this is also another sign that corporates are doing everything they can to support the appearance of profitability, and doing so by acting with cartel-like instincts (albeit unwitting). At the end of the day, corporates are stuck. They can’t reinvest their cash income (because investing into insufficient demand only kills the market, the margin and is ultimately self-defeating) so are forced into hoarding the cash as a liquidity buffer instead. Since this yields them very little, they become motivated to load up on cheap credit to support equity prices instead. They do this because it lets them synthetically support dividends even as the overall dividend pool may be contracting (in some part because of the hit taken on cash income or earnings more widely)...."

Season's Greetings From Société Générale's Albert Edwards (Nov. 14, 2012)

We Knew Société Générale's Albert Edwards Was Crazy But This is Nuts (Sept. 27, 2012)