What say ye to 6-8% up from last Thursday's low and a collapse into the New Year?

From Six Figure Investing:

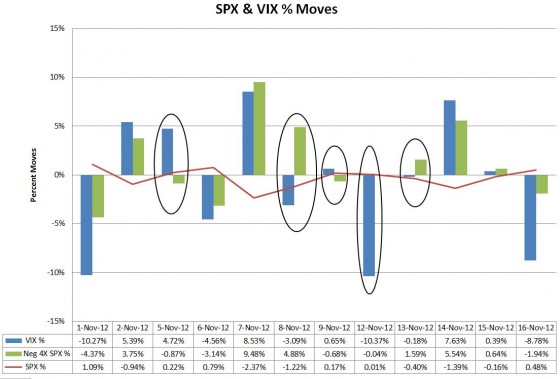

The last couple of weeks there’ve been a lot of comments about the CBOE’s VIX Index being broken or manipulated. Generally I expect the percentage moves in the VIX to be around a factor of 4 in the opposite direction of SPX (S&P 500). But there are significant eccentricities in the VIX that I factor in, for example Fridays tend to be down days, Mondays tend to be up.

The chart below shows the percentage moves at close for VIX (blue bars) and SPX (red line) for the first 12 trading days of November, along with my -4X rule of thumb (green bars). The black ovals show 5 days where the VIX went opposite the expected direction. In addition, on two days, the 1st and the 16th the VIX moved far more than a -4X factor.

One of these days, the 12th, has at least a partial explanation. That was the day that the VIX calculation shifted from using November / December SPX options to December / January options. If you’re interested see Bill Luby’s post for more information on this phenomenon....MORE