From Harvard:

Yu-chin Chen Kenneth Rogoff Barbara Rossi

(University of Washington) (Harvard University) (Duke University)

June 29, 2008

Abstract.

We show that "commodity currency" exchange rates have remarkably robust power in predicting global commodity prices, both in-sample and out-of-sample, and against a variety of alternative benchmarks. This result is of particular interest to policymakers, given the lack of deep forward markets in many individual commodities, and broad aggregate commodity indices in particular. We also explore the reverse relationship (commodity prices forecasting exchange rates) but find it to be notably less robust. We offer a theoretical resolution, based on the fact that exchange rates are strongly forward looking, whereas commodity price fluctuations are typically more sensitive to short-term demand imbalances.I was reminded of this snappy little 48 page PDF by something Izabella Kaminska wrote at Alphaville this morning:

The death of volatility?

Central bank puts have done a great job of removing tail risks.

Such is the conclusion of the team at Bank of America Merrill Lynch upon analysing the remarkable drop in trade conviction of late.

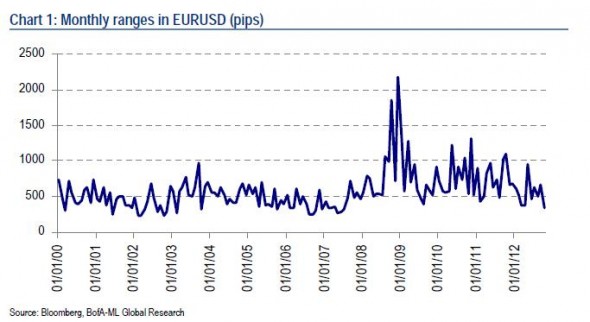

In FX, the move in volatility has been notable:

As the analysts note, four years since the 2008 financial crisis the monthly ranges in EURUSD are back to pre-crisis levels and are now close to the 2006 all-time lows. But don’t let those statistics fool you into thinking things are any more certain.

From the analysts:

It is perhaps somewhat counter-intuitive, as low volatility has traditionally been associated with low uncertainty, but we are still seeing high levels of uncertainty in FX. This is understandable given the large number of risks across multiple regions (for example, Eurozone financial crisis, weak US growth, US fiscal cliff and China slowdown). Further, these types of risks leave investors tracking policy makers and trading news headlines for policy trajectory information. This is resulting in sudden and rapid moves in FX followed by periods of range-trading.Which, as far as we can tell, means that overall volatility is dropping but incidents of very short-term blow-outs is increasing, even as levels return to trend. Meanwhile, there is still uncertainty with regards to the direction of the longer-term trend.

It’s an interesting thesis and one that, in many ways, compliments the findings of Joseph W. Gruber and Robert J. Vigfusson in a recent, and fascinating, paper that looks at the influence of interest rates on volatility and correlation in commodity prices....MORE