[picking up nickels in front of a steamroller? -ed)

From Six Figure Investing:

Taming Inverse Volatility with a Simple Ratio

The vast majority of dollars invested in volatility oriented securities are bets that volatility will go up. Sometimes these bets are speculative, but more often they’re portfolio insurance. These long volatility bets have proved to be quite expensive—the holding costs are high.

Taking the other side of the deal—shorting volatility, or buying products that track daily inverse volatility is quite profitable most of the time, but when volatility spikes the losses can be heavy.

Consistent profits in inverse volatility are contingent on achieving these two goals:

- Be out when there are big volatility spikes

- Take advantage of the contango/time premium that drains value out of long volatility positions (75% to 80% of the time on average).

Recently I found a strategy that that looks promising for achieving these goals.

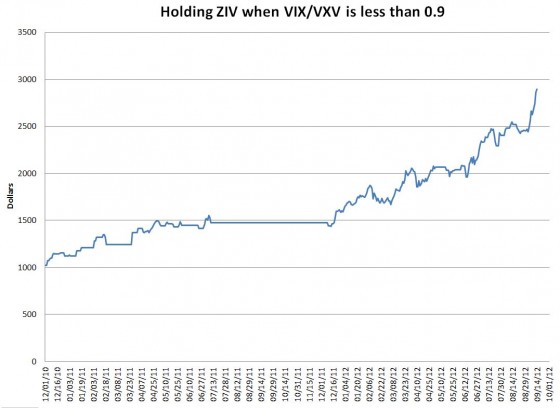

The strategy uses ZIV, VelocityShares’ Medium-term inverse volatility fund combined with the VIX/VXV ratio, an objective volatility measure, to switch between fully invested and cash. The backtest of this strategy starting at ZIV’s inception in 2010 is shown below:

Annualized gain was 70%, maximum drawdown was 6%, and the Sharpe ratio was 9. The strategy switched allocations 41 times, or on average about once every two weeks....MUCH MORE