Yesterday the stock closed at 40 cents. In August 2008 it traded at $81.

From earth2tech:

A glut of solar panels and crushing prices have made life difficult for solar manufacturers this year, and bad news keeps coming. Longtime solar thin-film maker Energy Conversion Devices, which has factories in Michigan, Canada and Mexico, has suspended manufacturing and will furlough 400 workers.In a December 2009 post, "Trina, Belle of the Solar Ball (TSL; LDK)" we made a couple points that now seem prescient including:

The Michigan-based company said it needs to stop production because it has made more solar panels than it can sell. The company only opened its plant in Ontario, Canada, earlier this year, hoping to take advantage of the regional market’s generous government subsidies. But the company has long been struggling to grow and make money.

While many solar companies experienced big jumps in sales and profits in 2010, Energy Conversion had to implement cost-cutting plans and moved some of its manufacturing to Mexico. It took more cost-cutting measures, including layoffs, earlier this year, and it is now expecting to lay off another 500 workers by the end of this year....MORE

TSL is a favorite of the Chinese government who helped arrange this hunk o'loot...By the Spring of 2010 it was:

While the loans, if confirmed, would be good news for China's industry and (possibly) its environment, it's bad news for U.S. firms like Evergreen Solar ( ESLR), SunPower ( SPWR) and Energy Conversion Devices ( ENER). Plummeting prices recently erased the remaining efficiency advantages of many Western producers, which are themselves moving manufacturing to Asia.Here's Trina's Chairman on Wednesday, from Bloomberg:

Most Solar Manufacturers May Vanish by 2015, Trina CEO Says

Most of the biggest solar-equipment makers may disappear in the next few years as plunging prices erode margins and drive the weakest out of business, according to Trina Solar Ltd. (TSL), the fifth-largest supplier of solar panels.From 2009's "Trina Solar Trumps Them All (TSL)":

“This is the decade of mergers and acquisitions,” Jifan Gao, chief executive officer of Changzhou, China-based Trina, said in an interview. “From now until 2015 is the first phase, when about two-thirds of the players will be shaken out.”

Three U.S. solar companies including Solyndra LLC have gone bankrupt this year, and more led by First Solar Inc. (FSLR) and Yingli Green Energy Holding Co., slashed sales and margin forecasts, reflecting slower growth in demand and stiffer competition. SunPower Corp. (SPWRA) and Roth & Rau AG (R8R) of Germany agreed to takeovers.

Gao, who founded Trina in 1997, predicted that only about five companies may survive through 2020 in each of the three major manufacturing segments. He defined those as photovoltaic panels, ingots and wafers, and the raw material polysilicon...MORE

...One BIG caveat, all the alt-energy companies are currently dependent on politicians for their survival. This means you really have to pay attention to the politics/policy mood or you might wake up one morning to find all the stocks down 60%....There was a reason for our choice of the first recipient of the Climateer Investing "Our Hero" award back in 2007:

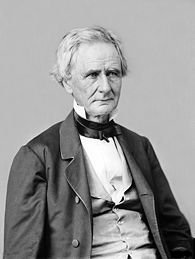

The 26th Secretary of War, the Democrat and Republican (!) Senator from Pennsylvania, Simon Cameron:

Our Hero

"The honest politician is one who

when he is bought, will stay bought."