Economy fears to stall rally in fertilizer prices

Renewed

fears for the world economy are to put the brakes on the rebound in

fertilizer prices, Rabobank warned, in the second caution within hours

of a "wait-and-see" attitude emerging among farmers.

While

nutrient prices look set to increase in the early part of the

October-to-December quarter, helped by demand from South American

growers during corn and soybean sowing periods, "further rises are

likely to be modest", the bank said.

Falling

crop prices had reduced farms' "ability to absorb" fertilizer prices

which have recovered strongly from a nadir in early 2009, if not

returning to record levels reached in 2008, at the peak of the last

spike in farm commodity prices.

Potash prices were, at the end of last week, 38% higher than a year ago, with urea values soaring 56%.

'Wait-and-see'

Furthermore,

world economic uncertainties, reflected in falling farmer confidence

besides tumbling share and commodity prices, looked set to stem

purchases.

"Buyers

and end users may prefer to adopt a wait-and-see approach to future

fertilizer prices, due to the global macro-economic uncertainty,"

Rabobank analysts said....MORE It is worth paying attention to Rabo, they are very good in this space. If they say prices don't have a lot of upside be careful with the equities.

Here's Dragonfly Capital:

Some chart patterns stick out stronger than others. One of these for me is the Three Advancing White Soldiers. Without looking at a chart the name connotes goodness and strength. Think about it. White Soldiers, not the Dark bad guys, and they are Advancing, taking new ground. The Japanese were masterful at naming their patterns....MORE

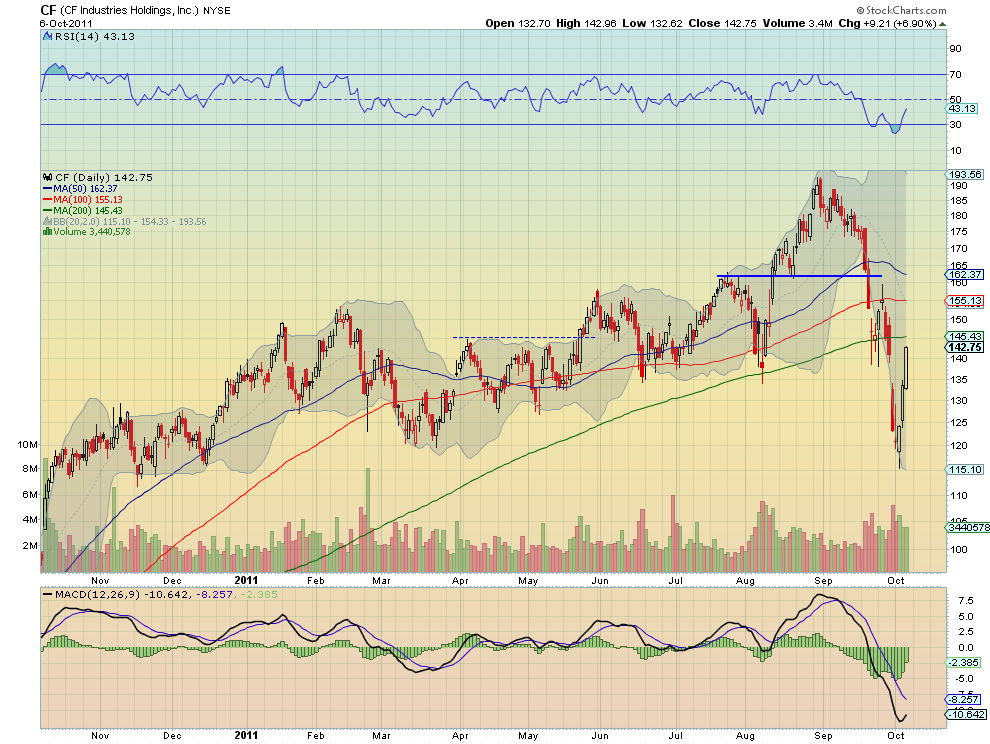

This one is a series of three long bodied bullish candles in a row, each finishing at or near the high of the day. This is a bullish continuation pattern and gains even more strength if it occurs after a consolidation from a lower area or a fall. If there are gaps or jumps between the real bodies then the action may be getting extended. And if there are long upper shadows or the real bodies are getting smaller on the advance this is a sign of the move running out of steam. Today’s market shows two very good examples of each variation of this pattern, in the Fertilizer space. Check them out and stick with the strongest.

Long and Strong

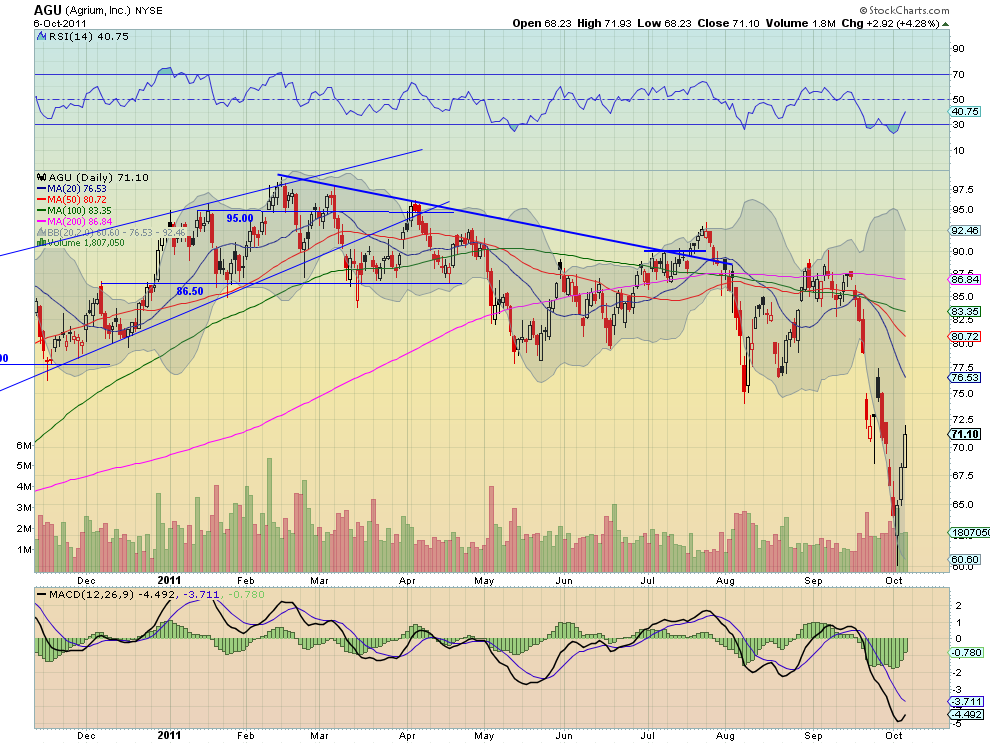

Agrium, $AGU

CF Industries, $CF

Extended

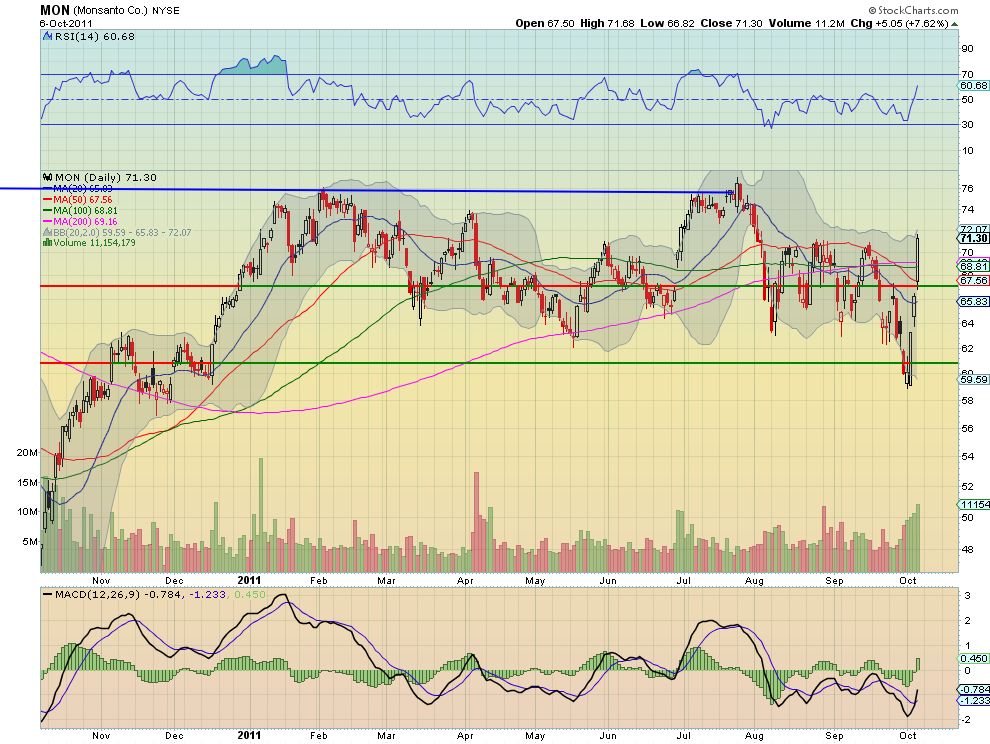

Monsanto, $MON