From The Big Picture:

I have a few good quotes about secular bear markets in The Bear: Dead or Just Sleeping?:

“And, in fact, many in the bear camp believe the market is destined to meet its maker as soon as the Fed starts to raise interest rates – which could happen late this year.

“When rates go up, it becomes more expensive to borrow, corporate profits slide – all the negative things that take place that make the market less appealing as an investment opportunity,” Mr. Ritholtz says.

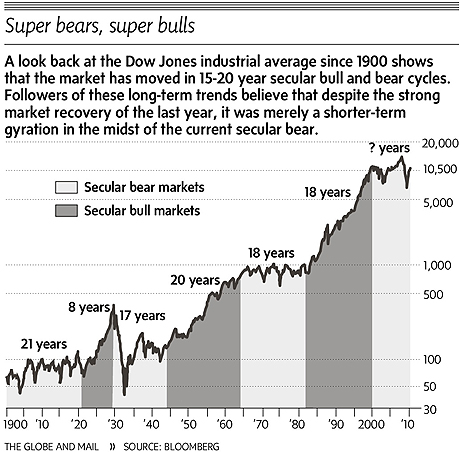

In fact, Mr. Ritholtz is one of several commentators who believe this rally has merely been a temporary cyclical swing in the midst of a longer-term bear market – one that began roughly a decade ago and is far from over. These long-term, or “secular,” market trends tend to last 15 to 20 years.

“This does not have the characteristics of a secular bull market,” Mr. Ritholtz says. Not only would it be starting ahead of schedule, he argues, but even at the market lows of a year ago the stock valuations were never as low as they typically get at turning points in secular market trends.

“In the past, at the start of these big secular bull markets, you have really cheap stocks … I’m not sure we ever got to that point,” he says. “Stocks became reasonable in March [2009] for a month. Now, there are plenty of stocks that are expensive and there are plenty of indexes that are pricey.”

There is a lot more in the article . . .

>

Julian Robertson: US To Face Poor Economy for 10-15 Years (And Warren Buffett Stops By)

December 31, 1964: DJIA 874.12Where in the Bear are We?

December 31, 1981: DJIA 875.00

"Now I'm known as a long-term investor and a patient guy, but that is not my idea of a big move."

-Warren Buffett

In this 1999 Fortune article "Mr. Buffett on the Stock Market". Granted the time and tape he was talking about was even worse...

Dow Chart with P/E, 105 Years

click for larger chartOne etymology of the word speculation:

Source: Crestmont Researchc.1374, "contemplation, consideration," from O.Fr. speculation, from L.L. speculationem (nom. speculatio) "contemplation, observation," from L. speculatus, pp. of speculari "observe," from specere "to look at, view" (see scope (1)). Disparaging sense of "mere conjecture" is recorded from 1575. Meaning "buying and selling in search of profit from rise and fall of market value" is recorded from 1774; short form spec is attested from 1794. Speculator in the financial sense is first recorded 1778. Speculate is a 1599 back-formation.That is not the etymology grandmother taught me. Hers had to do with Italian merchants keeping watchtowers manned to spot sails over the horizon, enabling those who could see furthest to sell off inventory before goods-ladened ships made harbor and crashed the market. More like this etymology at Wictionary:From Latin speculātus, past participle of speculor (“‘look out’”), from specula (“‘watchtower’”), from specio (“‘look at’”)Either way, the current market does not lend itself to either contemplation or seeing over the horizon....

**From Investing the Middle Way (2006):

Source: Profutures, click to enlarge

Death of the American Dream? (nah)

Markets: Is This Bull Cyclical or Secular?

Best strategy for long bear market 2010-2020

Gail Dudack on What's Ahead for the Stock Market

Stock markets – secondary or primary bull?

Four Stages of a Secular Bear Market

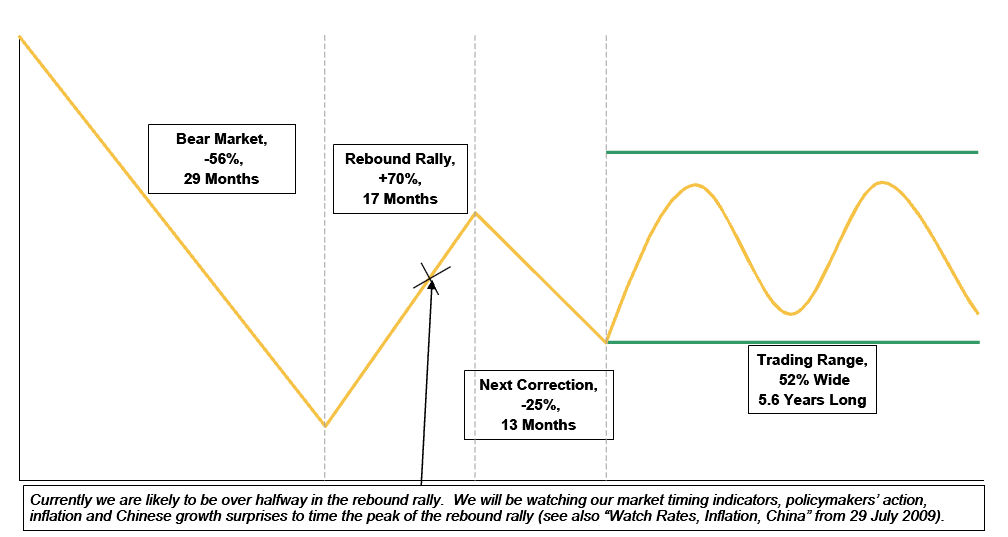

Typical Secular Bear Market and Its Aftermath

The Chart represents typical secular bear markets based on MS’s sample of 19 such bear markets as shown after the jump....MORE

Markets: What Happened to the Bears?

Where Will Growth Come From ?