Via ZeroHedge, September 17:

The Fed’s Roadmap Matters More Than the Cut

- Stephen Miran’s board appointment favors rate cuts.

- Recent hiring data points to a rapidly weakening labor market.

- Bowman, Miran, and Waller are likely to support more aggressive easing.

The Federal Reserve’s interest rate outlook is about to grow more dovish…

Today brings a much-anticipated catalyst for investors across the globe. The Federal Reserve is set to release its latest monetary policy decision. Wall Street expects a 25 basis point rate cut, the first since December. It will bring the federal funds target to a range of 4.00% to 4.25%.

But let’s be clear: the cut itself isn’t the story. It’s already priced in. What matters most is the Fed’s outlook on monetary policy moving forward. As you can see from the table above, Wall Street expects the fed funds target range to drop by a total of 75 basis points to a range of 3.25% to 3.50% by December.

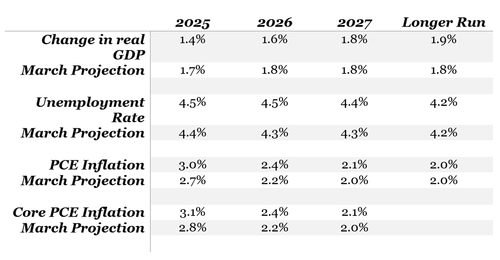

As a result, the most anticipated release tomorrow will be the Summary of Economic Projections (“SEP”) from policymakers. It will show where they believe the path of interest rates is headed over the next few years. The details will indicate the pace of policy easing by year-end and whether Wall Street’s current assumptions are correct.

Based on recent dynamics, it appears the Fed’s outlook should grow more dovish when forward guidance is released. I wouldn’t be surprised if the data endorses a total of three rate cuts by the end of 2025. That should underpin the outlook for economic growth and a steady rally in the S&P 500 Index.

But don’t take my word for it—let’s look at what the data’s telling us…

The Federal Open Market Committee (“FOMC”) meets eight times a year to set rates. It’s made up of seven board members and five rotating regional bank presidents—twelve voting members in total. But once a quarter, all nineteen officials (including non-voting district presidents) submit their forecasts for key economic indicators. These are aggregated and released in the SEP.

Here’s what they projected at the June meeting…

Now compare that to where we are: GDP is tracking close to 1.4%, unemployment sits at 4.3%, PCE inflation is 2.6%, and core PCE is 2.9%. The fed funds rate is currently 4.4%. So, most of the projections aren’t far off, but the rate path is likely to shift lower for two key reasons: weakening employment and a more dovish Fed board.

Let’s start with the labor market....

....MUCH MORE