First up, from Wolf Street, September 26:

The 12-month overall PCE & core PCE price indices, which the Fed uses for its target, are worse than a year ago.Inflation is in services, where it accelerated further, even in the inflation index that the Fed prefers, the PCE Price Index released today by the Bureau of Economic Analysis, though Powell has been denying it in recent speeches, blaming instead imported goods and tariffs for the current inflation impetus. But the PCE price index for durable goods, many of which are tariffed, fell (negative readings) in August for the second month in a row, while inflation in services, which are not tariffed, accelerated further.

Both the overall PCE price index and the core PCE price index accelerated further year-over-year, and their increases (+2.7% and +2.9%) are now worse than a year ago.

The core services PCE Price Index, which excludes energy services, accelerated to +0.34% (+4.1% annualized) in August from July, the fourth month in a row of acceleration. The increase was driven by rents (+4.4% annualized, the worst since March) and some non-housing services (blue in the chart). The 3-month index accelerated to 3.5% annualized, the worst since March (red).

This confirms what we have already seen in the primary inflation index of the US, the CPI, whose August data were released earlier in September by the Bureau of Labor Statistics: the month-to-month increase of core services was above 4% annualized for the second month in a row, the worst since January.

Rent inflation jumped in August, increasing by 4.4% annualized from July. The six-month index ticked up to 3.9%, the worst increase since March.

Year-over-year, the core services PCE price index accelerated to 3.51%, the second month in a row of acceleration. It is substantially above the pre-pandemic range and accelerating away from it.

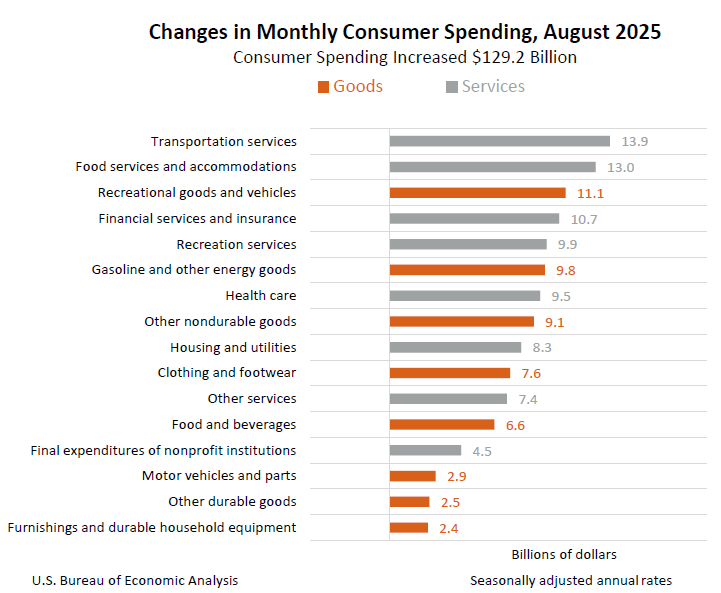

Two-thirds of consumer spending is for services, and this year-over-year inflation rate of 3.5% powers the overall PCE price index and the core PCE price index.....

....MUCH MORE

And from the recently released BEA PCE report:

If interested see also Sept. 26 - Inflation: PCE Price Index UP 0.3 Percent, Core UP 0.2%