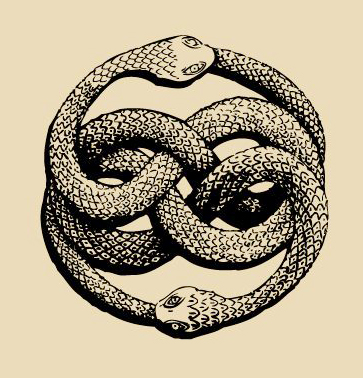

Besides the whole ouroboros thing with Nvidia investing money that will come back to Nvidia as chip sales. Something we pointed out in November 2024's "Nvidia Reportedly Weighing Investment in Musk’s xAI" (NVDA; ELON):

Although the A.I. biz is not yet incestuous it does have a bit of an ouroboros vibe to it....And then, be still my heart, will the chips learn to train the next generation?

Getting a bit of a double ouroboros vibe here:

Here at Ouroboros Group we believe a self-referential vortex of strange loops is the key to exceptional market depravity and thus dream demon returns at rates essentially double those of typical simple ouroboros techniques and paradigms.

—from 2018's Unicorns Backing Their Own VCs? Welcome to Peak Tech

More on cousin marriage in September 5's [2024] "ChatBots Are Not The Be-All And End-All Of Artificial Intelligence".

Additionally, there are serious antitrust implications/concerns with the combined vertical and horizontal integration implicit in Nvidia's business model.

And the headline story from Barron's, September 23:

Nvidia’s $100 billion OpenAI deal has been cheered by investors and analysts alike.

But Wall Street hasn’t exactly rushed to hike price targets on the AI chip maker or upgrade estimates.

Nvidia shares slid 0.8% to $182.22 in premarket trading Tuesday after the stock hit a record closing high of $183.61, up 3.9% on the day. The move came after the company announced plans to invest as much as $100 billion in ChatGPT maker OpenAI to support the buildout of AI data center capacity.

The world’s leading maker of artificial intelligence chips, Nvidia, is making an increasingly large footprint in the broader AI ecosystem with its latest partnership with OpenAI—just days after announcing a multibillion-dollar deal with Intel.

As part of the agreement, OpenAI would deploy some 10 gigawatts of AI data centers using Nvidia systems, including millions of its graphic processing units (GPUs) and other products.

“For Nvidia, this [is] an opportunity to leverage its strong balance sheet and cash position to help grow the broader AI ecosystem and potentially accelerate demand for its chips and hardware systems,” said William Blair analyst Sebastien Naji in a note dated Monday.

While analysts were broadly positive on the news, many still held on to their estimates.

“Although we are encouraged by the agreement, we are not adjusting our model higher at this time as the incremental benefits are yet unclear,” Benchmark analyst Cody Acree said, maintaining a Buy rating on the stock with a $220 price target. “We have always counted OpenAI as a significant customer in our estimates, with plans for a material increase in the company’s data center capacity already considered.”

D.A. Davidson analyst Gil Luria maintained a Buy rating and kept his price target at $210. “While the announcement is positive for OpenAI’s ability to ramp, we are concerned NVDA has become the ‘investor of last resort’, bailing out OpenAI’s overextended commitments,” he said.

Several analysts see the deal as translating to a $400 billion to $500 billion return of Nvidia revenue....

....MUCH MORE

Also at Barron's, September 23:

Nvidia Exposes a Stock Market Problem. How the Fed Can Solve It