From Bloomberg via MSN, September 14:

BYD Co. faces pressure to restore investor confidence after a $45 billion stock selloff, with growing concerns over its ability to fend off competition amid a destructive price war in China.

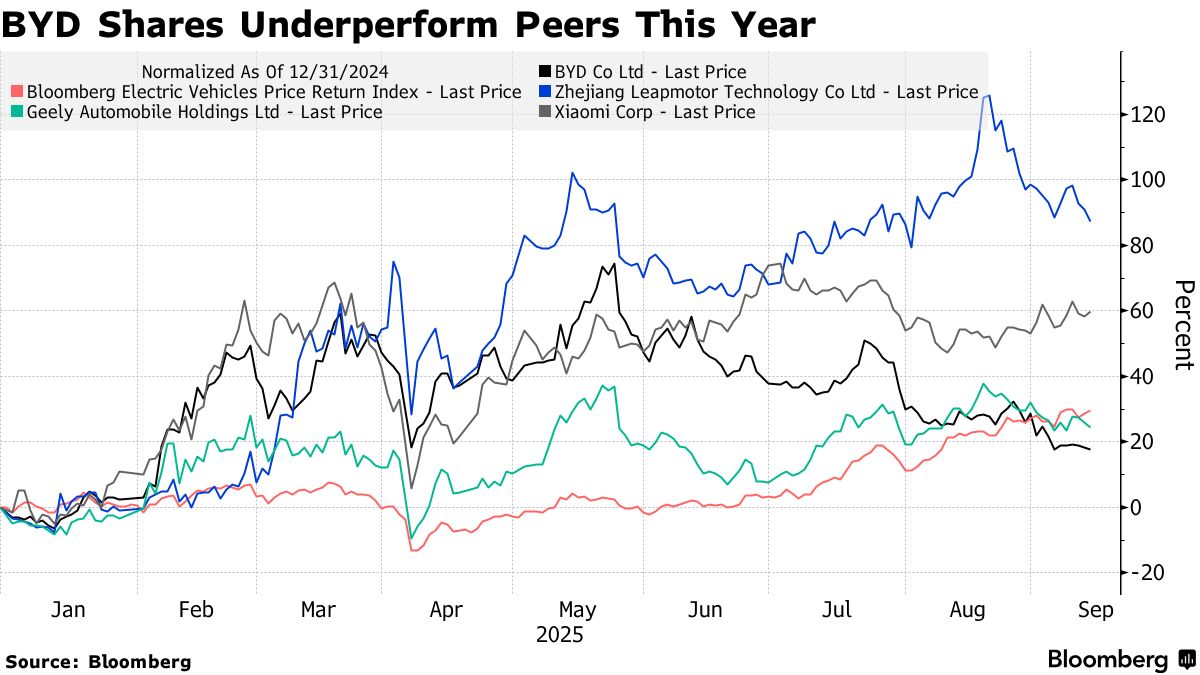

The Chinese electric-vehicle maker’s Hong Kong-listed shares have tumbled more than 30% from the all-time high reached just four months ago, underperforming peers. Analyst sell ratings on BYD have surged to the highest level since 2022, Bloomberg-compiled data show.

Investors are losing patience with BYD’s strategy of taking the lead on deep discounts, while the government is clamping down on the so-called involution wreaking havoc on the industry. At the same time, rivals including Geely Automobile Holdings Ltd. and Zhejiang Leapmotor Technology Co. are gaining ground.

“While I believe investors retain a positive long-term view, there is a real concern around BYD’s aggressive ‘market share gain by pricing pressure’ strategy in the anti-involution context,” said Kevin Net, head of Asian equities at Financiere de L Echiquier. “In the short term, this should still weigh on both topline and margins.”

The company reported a 30% plunge in its June-quarter profit, its first decline in more than three years on the price war impact. China’s top EV maker, BYD has been a major driver of the multiple rounds of discounts over the past few years as makers fight for market share.

Meanwhile, Beijing has become increasingly vocal in its efforts to rein in excessive competition it sees as creating deflationary pressure and damaging the international reputation of Chinese manufacturing.

BYD now expects to deliver 4.6 million vehicles this year, a steep drop from its earlier target of 5.5 million. To meet even this lowered goal, the company must deliver some 1.7 million units in the last four months — that’s a tall order given its aging product lineup and the new regulatory environment.

The unveiling of new models in the first quarter of 2026 will be a key stock catalyst for BYD, market watchers say. The company postponed some launches to next year so it can make the vehicles more competitive, and as rivals notched success with recent offerings.

“No OEM could keep their product cycle strong forever — even BYD cannot,” said Xiao Feng, co-head of China industrial research at CLSA Hong Kong. BYD’s offerings have become stale since its dominance over 2018-2024, and buyers have turned to “new faces” like Geely and Leapmotor....

....MUCH MORE