Is there a concerted effort to destroy the German economy?

Sometimes it seems as though German politicians are in league with the Americans, with maybe a dash of two centuries of Britischer foreign policy—to keep Germany and especially its economy, from getting any more dominant than it already is.

From Palladium Magazine, February 9:

The German Economic Council calls its car industry “the lifeblood of the German economy.” Even in these volatile markets, Porsche recently completed a landmark IPO and went public at the highest market capitalization of any European public offering ever. German cars can be found in every corner of the world, and it is no coincidence that the catchphrase “German engineering” was popularized by an Audi ad.

But with the global transition to electric vehicles underway, there is now a threat looming over the future of the German automotive industry. Europe’s largest economy is more dependent on gas-powered cars than is commonly realized, and because of how its economy is structured, transitioning to electric vehicles will be more difficult than most people imagine.

The transition to electric cars is going to completely upend Germany’s economy—and probably not for the better.

Germany’s Automotive Reliance

On paper, the German auto industry represents approximately 10 percent of the country’s GDP. But even that figure is an underestimate of its economic centrality. A Germany Trade and Investment report found that the auto industry generates nearly 24 percent of all German domestic revenue and 35 percent of its R&D. Automotive employment is usually described as employing 800,000 people, but that is merely the number directly employed in motor vehicle manufacturing—another 1.8 million jobs are indirectly tied to the automotive industry, with some estimates even higher. Volkswagen, Germany’s largest car company, is also Germany’s largest employer overall. Most notably, Germany’s automotive employment estimates have remained stable even as manufacturing employment has fallen by some 10 percent since 1991, meaning that cars are a higher share of manufacturing employment than twenty years ago.

The German economic system is efficient partially because it is based on a highly tracked society that starts sorting workers at the earliest possible ages. As early as 10 years old, children are put onto tracks that determine the rest of their lives: whether they go to university or learn a trade. From there, Germans that are not on the university track are predominantly taught the skills needed to fit into the industrial complex, rather than a more comprehensive education.

If they go to university, they will likely earn a functional degree designed to meet the needs of a Volkswagen or a Merck. If they don’t, they will probably work at a Mittelstand, a small or mid-sized business that accounts for 52 percent of German GDP, 70 percent of employees, and 82 percent of trainees, in contrast with the United States, where only 46.4 percent of all employees are employed by small businesses. Mittelstands are often family-owned; on average, the owner is 57 years old and the company is 70 years old. But with this stability comes brittleness—Germany’s long-term unemployment rate is well above the OECD average.

The German automotive sector relies heavily on the Mittelstands for industrial power components, specialized parts, and chemicals, and they contribute up to 70 percent of the value-add for a manufactured vehicle. Without this automotive demand, many specialized Mittelstands would go out of business, causing significant knock-on effects. German engineering is well-regarded not just because of its quality but also because of its value—the customer pays a reasonable price for an excellent product. Without the subsidy of automotive demand, German products in other industries that share manufacturing supply chain nodes would have to command premium prices to make similar profits, putting them in competition with higher-end goods....

....MUCH MORE

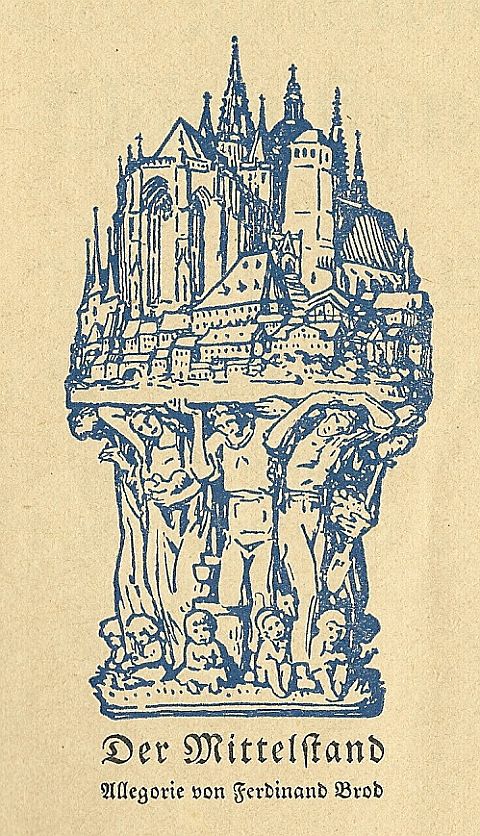

When I see the word Mittelstand I think of this depiction, most recently seen in "The State of European Tech 2022" and in "China Now Pressuring German Manufacturers In the EU Market":

....A decade ago when it became apparent the Chinese were buying German technology they couldn't copy, e.g. "The Invisible Hand Touches Germany in No-no Place: China Grabs Putzmeister" there was a hue-and-cry that the Mittelstand, the mid-sized companies which supply the export giants and upon which the entire system depends, were at risk. Seven years later the German powers-that-be were still worried about the takeover angle and not addressing the competition aspect of the Chinese threat:

"Wary of China, Germany plans rapid state intervention to protect key industries"

The German concern for their small and medium sized enterprises goes back quite a ways. Here's an old-timey pic via Wikipedia:

role of the Mittelstand in Walter Wilhelms

„Mission des Mittelstandes“ (Mission of the Mittelstand, 1925)

Without the Mittelstand you are without Germany's export engine and without exports (and with Mutti's recent comments on free speech, yikes!) you are left with a Teutonic Belarus.

But without the charm.

If interested see also: "China’s strategic investments in Europe: The case of maritime ports"