First, the obligatory disclaimers, this version is from 2012, there are many, many others:

Modelling vs. Science

If an experiment is not reproducible it is not science.

If an hypothesis is not falsifiable it is not science.

Finally, our two guiding principles regarding models:

"The map is not the territory"

-Alfred Korzybski

"A Non-Aristotelian System and its Necessity for Rigour in Mathematics and Physics"

presented before the American Mathematical Society December 28, 1931

...................................................................................................................................................................."All models are wrong, but some are useful"

-George E.P. Box

Section heading, page 2 of Box's paper, "Robustness in the Strategy of Scientific Model Building"

(May 1979)

And the headliner:

This is a repost from March 2013.

The Joy of Randomness: Central Bank Strategy, Management Technique and Stock Selection

From Technology Review's Physics arXive blog:

Computer Simulations Reveal Benefits of Random Investment Strategies Over Traditional Ones

Central Banks could use random investment strategies to make markets more stable, say econophysicists

We've looked at the phenomena in a couple other contexts:

Back in 2001, a British psychologist carried out an unusual experiment in which he asked three people to invest a virtual £5000 in the UK stock market. The three people were a professional trader, an astrologer and a 4 year old girl called Tia.

The results were something of an eye-opener. At the end of the year, the trader had lost 46.2 per cent of the original investment and the astrologer 6.2 per cent. Tia, on the other hand, had made 5.8 per cent. Others have carried out similar experiments with similar results in which investments were chosen by a chimpanzee or by throwing darts.

The implication in these experiments is that random investment strategies are as good as, or even better than, traditional ways of making investments.

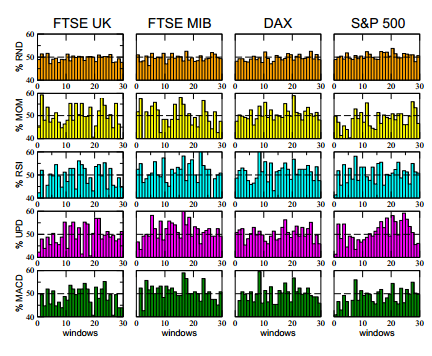

Today, Alessio Biondo from the University of Catania in italy and a few pals test this idea for themselves. These guys have simulated the performance of four traditional strategies using 10 years of historical data from the UK, German and US stock markets. They then compare the results with those from an entirely random strategy.

The traditional approaches are all based on the past performance of the market and include, for example, the “momentum strategy” which measures how fast the price of something has changed in the recent past and then uses this to predict how much it will change in the near future. Another approach is called the “up down strategy” in which the prediction for tomorrow’s market behaviour is exactly the opposite of today’s....MORE

Random Stock Selection Again Beats Index; 99.9% of High Priced Managers

There may be a problem or two with the sample size, replication, error bars, pretty much the whole statistical schmear, but if I put that in the headline would you have read this far?And:

From Joe Meth (Stock Chartist)...

Okay, Enough With Politics: Attention Managers, You Can Improve Corporate Efficiency by Randomly Promoting Employees

That last piece of research was awarded Harvard's own Ig Nobel prize in 2010.

Ya see, ya got your complex systems and ya got your chaotic systems and then ya got your complex-chaotic systems like weather or the economy or the stock market and when you endeavor at those levels of sophistication you realize:

"Nobody knows anything"

-William Goldman

Completely off-topic sidebar:

If you're interested, Mr. Goldman will show you how to write a movie script.