Following on our own instanalysis, here are some other folks who wish to share their insight and/or spin.

From ZeroHedge, February 14:

Wall Street Reacts To Today's "Hotter Than Expected" CPI Report

There was something for both the hawks and doves in today's CPI report.

On one hand, the YoY measures came in (just slightly) hotter than expected, rising 6.4% for headline (vs exp. 6.2%) and 5.6% for core (vs exp. 5.5%), suggesting the Fed is once again behind the curve. Additionally, some components - such as used car prices - indicated continued price drops even though we know that this lags the recent real-world rebound.

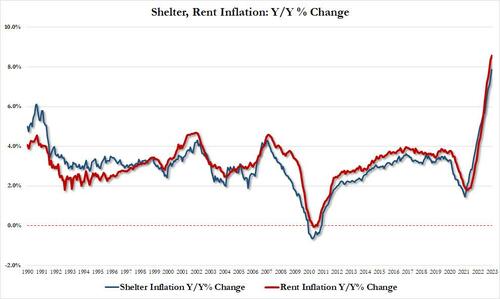

On the other hand, more than half of the core monthly increase was due to shelter...

... which however lags the market by 12 months, so second-half inflation numbers should come down rapidly. Also adding to the dovish picture was that core CPI services ex-shelter (one of Powell's preferred supercore inflation measures) rose just 0.27% in Jan, down from 0.37% in Dec and the lowest since October.

Finally, even though the 6.4% year-on-year CPI increase was higher than the average estimate of economists, it’s still the lowest reading since October 2021 and a tick down from the prior month.

So what is one to make with this data? Below is a snapshot of several kneejerk reactions from Wall Street strategists and economists which confirms that everyone is just seeing whatever they wants to see in today's report.

Dennis DeBusschere, founder of 22V Research, had to say:

“Looks like OER is a driver of the slight headline beat .7 vs .8 last. Recall, OER weight increased in the latest revision. That is why people thought upside risk to the number. Used auto weight decreased. Since private market rent data has collapsed, we know that OER is moving even lower over time. That is why market is taking the inline number OK.”

Infrastructure Capital Advisors: CIO Jay Hatfield:

“we continue to forecast inflation will rapidly decline as the BLS slowly reflects the reality of housing deflation in their estimate of shelter inflation. This lag is approximately 12 months, so second-half inflation numbers should come down rapidly.”

Mohamed El-Erian, strategist at Allianz

“It is less hard for policymakers than market participants. Policymakers have to think about ‘What mistakes can I afford to make?’ The mistake you can afford to make right now given the underlying strength of the labor market is how the economy is paying too much attention to persistent inflation. It is better to get the inflation genie back in the bottle than to relax too early.”

BMO Capital economist Ben Jeffery

“The kneejerk rally was a result of the unrounded core figure, and we’ve seen 10s selloff back to effectively unchanged with 2s/10s similarly back to -84 bp. From here, there is today’s Fedspeak with which to contend, and we don’t think there is anything contained within this read to call into question the FOMC’s hawkish commitment.”

....MUCH MORE

Discerning reader will note that ZeroHedge missed the opportunity to elaborate on our Dickensian theme; "It was the best of times, it was the worst of times" beats the pedestrian "something for both the hawks and doves", hands down.

On the other hand ZH has the tiny directional arrows on their chart, we don't.