First up, the Editor-in-Chief of the Atlantic Magazine (and one of the people who lied us into the Iraq War), Jeffrey Goldberg:

"Fetterman has basically been forced to contend with the effects of a severe brain trauma while working an absurdly demanding job in one of the most polarized and toxic political climates the country has ever known." -- @JenSeniorNY:https://t.co/57sey4ucfi

— Jeffrey Goldberg (@JeffreyGoldberg) February 18, 2023

By publishing that "been forced to contend" in the magazine, and then highlighting it on his Twitter feed Goldberg is telling an enormous fib. Senator Fetterman, his wife, and his political handlers knew exactly his physical and mental condition and decided to make the Senate run anyway.

There is no forcing. and if things are as bad as portrayed, resigning from the Senate is a sensible option. But for Mr. Goldberg, slipping into Decept Mode seems effortless.

Slightly more sophisticated and thus more egregious is the New York Times' Paul Krugman who seems to have embraced Voltaire's dictum as an operating principle:

"Ils ne se servent de la pensée que pour autoriser leurs injustices,

et emploient les paroles que pour déguiser leurs pensées"

—François-Marie Arouet--'Voltaire', Dialogue xiv. Le Chapon et la Poularde (1766).

"Men use thought only to justify their wrong doings, and employ speech only to conceal their thoughts"

Now, with no further ado, JustTheFactsDaily administers what used to be known as a proper Fisking to the Laureate/blogger, February 17:

Krugman’s Accounting of the National Debt is Jailworthy

The national debt has risen at a blistering pace over recent decades and is now higher than any era of the nation’s history—even when adjusted for inflation, population growth, and economic growth (GDP).Denying this reality, Nobel Prize-winning economist Paul Krugman recently wrote two columns for the New York Times in which he claimed that the debt is an “overhyped issue” and “isn’t all that unusual” from a historical perspective. His attempts to support these assertions employ the kind of fraudulent accounting that could land a corporate executive in jail.

Projections v. Realities

Krugman insists that taming the “federal debt should be well down the list” of government “priorities” after “climate change” and “child poverty” because debt projections have become “much less dire” over the past decade or so. In reality, the debt is far higher than projected, and Krugman’s own words prove it.

In 2009, when the Democrat-controlled Congress and President Obama began racking up debt and projecting $9 trillion in deficits over the coming decade, Krugman wrote that “even if we do run these deficits,” federal debt would be 90% of GDP in 2019, or “substantially less than it was at the end of World War II.”

The debt in 2019 turned out to be 109% of GDP, which is 21% higher than Krugman projected and just 8% below the debt from World War II.

That was one year before government reactions to the Covid-19 pandemic drove the debt/GDP ratio to unprecedented heights. This was mainly caused by state government lockdowns that crushed the GDP as the federal government spent liberally on “Covid relief.”

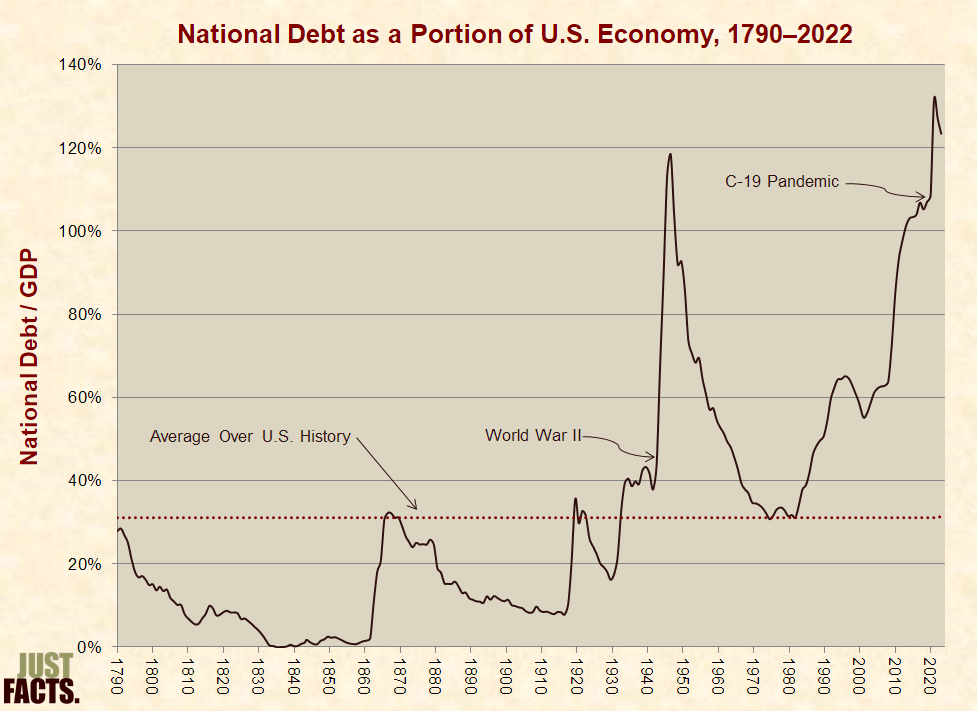

Even though GDP rebounded as lockdowns were lifted, and the worst inflation in 40+ years has temporarily reduced the debt/GDP ratio, it is still higher than any other period of U.S. history, clocking in at 123% of GDP at the end of 2022:

Worse yet, the national debt is on a trajectory that makes the current debt look small by comparison. Under CBO’s decade-old projections, which have thus far undershot reality, the U.S. debt/GDP ratio is on track to eclipse Britain’s after it was intensely firebombed during World War II.

Because the debt from WW II was the highest in U.S. history, Krugman and other scholars used to argue that the modern debt situation isn’t awful by comparison. What they failed to mention is that the war debt was a passing anomaly caused by the deadliest and most widespread conflict in world history, while the modern debt is a systemic, escalating problem driven by ongoing federal policies.

If left on autopilot, the debt is on track to double WWII levels in the coming three decades and grow thereafter to about nine times the peak of WWII.

Current Law v. Current Policy

Beyond ignoring his own debt projection, Krugman spins a yarn that is diametrically opposed to reality by exploiting his readers’ ignorance about differing types of debt estimates published by the Congressional Budget Office (CBO).

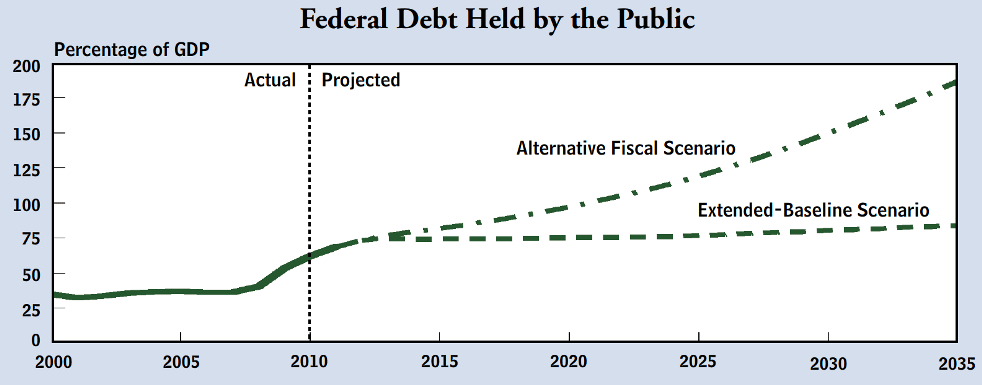

At various times, CBO has calculated two major types of projections for the national debt. The first reflects current law and is called the “extended baseline,” while the other is based on current policy and is called the “extended alternative fiscal scenario.” There are often major differences between these projections, as shown by this chart on the cover page of a 2011 CBO report:

The main reason for these differences is that federal laws are commonly rife with accounting gimmicks and other provisions that understate future debt.

A prime example is the 2010 Affordable Care Act, informally known as Obamacare. This legislation was enacted with a CBO analysis showing it would “produce a net reduction in federal deficits of $143 billion” over the coming decade. In reality, most of the deficit-reducing provisions of the bill weren’t implemented, while nearly all of deficit-increasing ones were.

The chasm between what the Affordable Care Act specified and what actually occurred is so great that its true costs are still unknown. Congress’ Joint Committee on Taxation wrote that it hasn’t calculated the realized budgetary impact of Obamacare “because of the many modifications to that law,” and CBO says it “cannot readily provide a retrospective analysis” of the law.

The bottom line is that the current law scenario made the Affordable Care Act seem like it would lower the debt, but the actual outcome was so different that federal budget agencies don’t know the real number.

Bait and Switch

With those facts in mind, watch how Krugman craftily jumps between current law and current policy projections.

In another of his columns about debt that proved to be dead wrong, Krugman declared in 2013 that “budget office projections show the nation’s debt position more or less stable over the next decade.” Emphasizing that point, he wrote, “So we do not, repeat do not, face any kind of deficit crisis either now or for years to come.”

Krugman’s basis for that claim was CBO’s current law projections, which showed the publicly-held debt/GDP barely changing from 76.3% in 2013 to 77.0% in 2023, a rise of only 1%. What Krugman neglected to reveal is that the current policy projection showed the debt growing by 14% in the same period. And for the record, it has actually grown by about 28%, or 28 times the current law projection cited by Krugman.

Fast forward to 2023, and Krugman is arguing that CBO’s latest debt projections have become “much less dire” since 2011. To support this claim, he compares current policy projections from CBO in 2011 to current law projections from CBO in 2022. He then compares those projections for 2035, thereby avoiding a comparison with actual outcomes....

....MUCH MORE