Two from ZeroHedge. First up, lifted in toto, the headline story:

“Extremely hawkish,” says Dennis DeBusschere, founder of 22V Research.

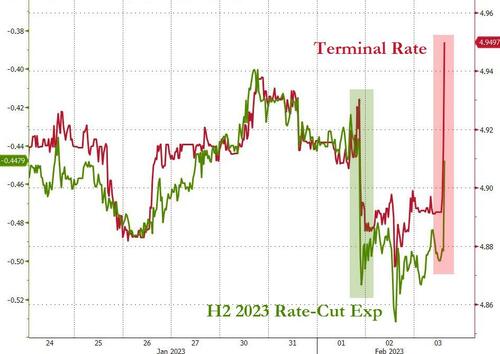

'Good' news on the labor market (lowest unemployment rate since 1969... after 450bps of rate-hikes?!) is a disaster for the 'soft landing' narrative and sent rate-hike expectations soaring above pre-Powell levels...

Source: Bloomberg

Bloomberg Intelligence Chief US Interest Rate Strategist Ira Jersey says the much stronger-than-expected payrolls report may finally be the data point that convinces the market the Fed won’t be cutting this year.

“As such, we think the long-end range may once again be re-tested with the 10-year Treasury topping 3.75% again, but we think a more pronounced selloff unlikely. Meanwhile a re-test of 4.4% on the two-year note seems possible if 2023 rate cuts are priced out.”

This sent stocks tumbling...

And bond yields are soaring back to pre-Powell levels...

Gold tumbled back to $1900...

“Is Powell now wondering why he didn’t push back on the loosening in financial conditions?” asks Seema Shah, chief global strategist at Principal Asset Management.

“It’s difficult to see how wage pressures can possibly soften sufficiently when jobs growth is as strong as this and it’s even more difficult to see the Fed stop raising rates and entertain ideas of rate cuts when there is such explosive economic news coming in.”

The only thing flying high is the dollar...

Source: Bloomberg

Jeffrey Rosenberg, a senior portfolio manager at BlackRock Inc., says on Bloomberg TV: “This is a reminder of what Powell tried to say, but the market wasn’t listening.”

Regarding financial conditions we caught that with: "Financial Conditions Continue To Loosen".

Also at ZeroHedge: "January Payrolls Explode To 517K, 8-Sigma Beat To Expectations; Unemployment Rate Tumbles To Record Low"

One quibble. 8-sigma events don't happen. In the 2007 quant-quake Goldman Sachs CFO David Viniar said Goldman were seeing 25-sigma events which elicited chuckles from a small (grantedly, very small) subset of his intended audience:

“We were seeing things that were 25-standard deviation moves, several days in a row”Several folks, when they finally quit laughing, pointed out how blatently Mr. V was spinning.

Most however underestimated how infrequent 25SD events are, the most common guess being once in 100,000 years. Tee hee.

In a snappy little eight page paper "How Unlucky is 25 Sigma" we see that at 7 Sigma the odds are:...The reader will note that as k gets bigger the probabilities of a k-sigma event fallThe authors go on to describe the problems involved in computing numbers on the cosmological scales required for 25 standard deviations. A good read, both for the statistically challenged and for pros like Viniar, a very highly paid PR guy, in addition to his CFO duties.

extremely rapidly:

• a 3-sigma event is to be expected about every 741 days or about 1 trading day

in every three years;

• a 4-sigma event is to be expected about every 31,560 days or about 1 trading

day in 126 years (!);

• a 5-sigma event is to be expected every 3,483,046 days or about 1 day every

13,932 years(!!)

• a 6-sigma event is to be expected every 1,009,976,678 days or about 1 day

every 4,039,906 years;

• a 7-sigma event is to be expected every 7.76e+11 days – the number of zero

digits is so large that Excel now reports the number of days using scientific

notation, and this number is to be interpreted as 7.76 days with decimal point

pushed back 11 places. This frequency corresponds to 1 day in 3,105,395,365

years....