....like the strength or weakness of the dollar, play an oversized role.

From Reuters via Mining.com, February 3:

Graphic: Disruptions raise the chance of copper supply tightness

Production disruptions in major copper producing regions Latin America and Africa have raised the stakes for a tighter market this year, but analysts say it is too soon to downgrade forecasts for global supplies.

Interruptions to supplies in Latin America combined with the easing of covid measures in top consumer China fuelled a rally in copper prices last month, taking them to a seven-month high of $9,550.50 a tonne....

....MUCH MORE

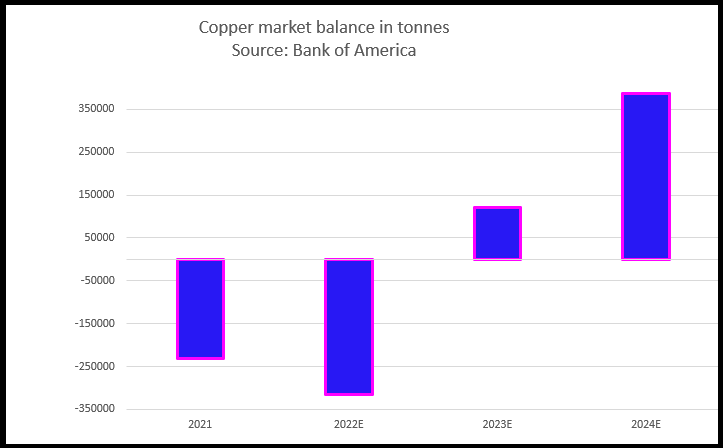

Here's the chart from whence came our headline:

and another chart that bears watching, NYMEX front futures via FinViz:

A smaller-than-2% up-move could reverse to a down-move visit to the gap at $3.94 and possibly much lower.

$4.0475 up 0.0125.

DXY (cash) 103.47 -0.15

Related, earlier today: "Dollar reversal breaking people's dreams?"

And from back on November 24, 2022:

Copper: What's Your Timeframe?

Four from Mining.com:

Tomorrow through month-end? Dollar Index down again is almost mechanistically supportive for commodities priced in bucko's.

Next month? "World’s biggest copper mine moves closer to strike"

Next year? "BHP sees 2-3 years of elevated costs, near-term copper oversupply"

Next decade? "Codelco sees copper deficit at 8 million tonnes by 2032"

For now and into Q2 2023 the West and maybe China have a recession they have to get through.

And enough with this nonsense: "Copper price rises on China’s property support".

As we've said a few times, government support of the overindebted property developers is not nearly the same thing as supporting the construction of new housing.