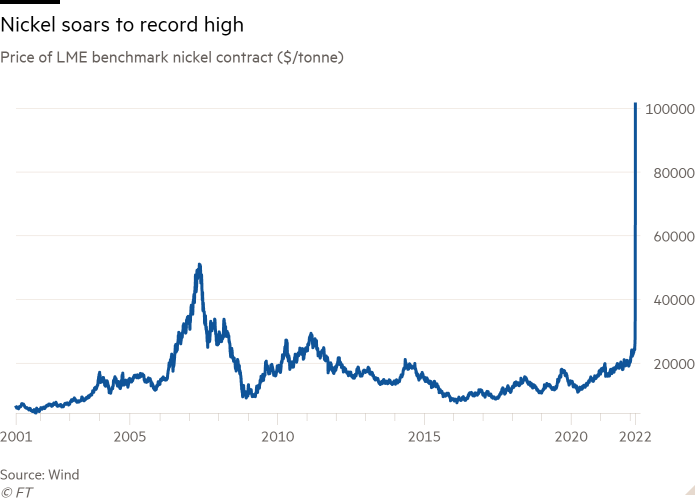

Nickel, very important for the current [!] favorite battery chemistry.

From FT Alphaville:

To paraphrase a commodity trading Crocodile Dundee talking to the denizens of r/wallstreetbets — “that’s not a short squeeze; this is a short squeeze”:

The London Metals Exchange has halted trading in three-month futures after prices leapt by 250 per cent (yes, you read that right):

Broken. pic.twitter.com/F1gnZD0ifw

— Neil Hume (@humenm) March 8, 2022In this instance, the surge seems to be down to the inability of China Construction Bank, a big state-owned lender, to meet margin calls on a short position in the shiny, grey metal....

....MUCH MORE, quite a story

Previously:"Electric vehicles and the nickel supply conundrum: Opportunities and challenges ahead"

"Nickel stockpiles on the London Metal Exchange recently fell for the 51st straight day."

Green Revolution Sends Nickel Prices To Seven-Year High"

Tesla Strikes $1.5 Billion Deal For U.S.-Sourced Nickel

France Plans $1.1 Billion To Secure Battery Metals

2021: ICYMI: "The king of nickel is betting big on a green future in batteries"

No, not Kyle Bass, though as far as I know he still has his nickels.*

*2019: "Hedge-fund manager Kyle Bass on decade-worthy investments, trade talks and that nickel collection"