As to the cause of the price rise, see, for example, Vontobel: "ESG is Inflationary".

From ZeroHedge:

Prices of rare earth metals [sic!] used for battery making have soared in recent days as the parabolic growth in the electrification of vehicles forces automakers to lock in supplies.

Nickle, one of the key components in lithium-ion batteries, hit a seven-year high on Tuesday, rising as much as 3.4% to $21,500 a ton on the news that Tesla signed a nickel supply deal with Talon Metals Corp's Tamarack mine project in Minnesota.

Notice how nickel trading on the London Metal Exchange marches higher as stockpiles continue to slump on increasing demand due to accelerated electric car production.

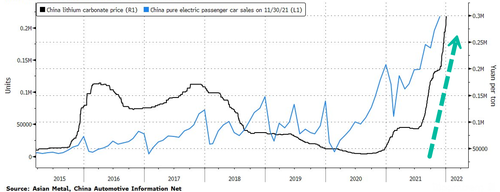

On Monday, lithium prices hit a new record high. Lithium carbonate trading in China was about 300,000 yuan (just over $47k per ton), an increase of about six times from January 2021. Soaring prices come as electric-car makers, such as Tesla, report exponential growth in the US, Europe, and China.

Lithium, nickel, and cobalt are the essential elements in battery technology powering electric vehicles that steadily replace combustion engines....

....MORE

I am not sure why rare earths showed up in the context of nickel and cobalt, for they occupy very different spots on the periodic table. It is probably one of the junior Tyler Durdens* who wrote this.

*They are multiple. Textual analysis reveals at least three and possibly as many as six different scribes using the 'Tyler Durden nom de non-hedge.

Regarding nickel, our latest linkage was to an excellent Platts piece: "Electric vehicles and the nickel supply conundrum: Opportunities and challenges ahead"