From the Federal Reserve Bank Of San Francisco, March 28, 2022:

Inflation rates in the United States and other developed economies have closely tracked each other historically. Problems with global supply chains and changes in spending patterns due to the COVID-19 pandemic have pushed up inflation worldwide. However, since the first half of 2021, U.S. inflation has increasingly outpaced inflation in other developed countries. Estimates suggest that fiscal support measures designed to counteract the severity of the pandemic’s economic effect may have contributed to this divergence by raising inflation about 3 percentage points by the end of 2021.

Few people would question the devastating economic consequences of the COVID-19 pandemic, which resulted in a dramatic collapse in economic activity and loss in employment worldwide. The United States introduced unprecedented fiscal and monetary policy responses to provide rapid economic relief. The Coronavirus Aid, Relief, and Economic Security (CARES) Act was signed into law in March 2020. In the same month, the Federal Reserve lowered the target range for the federal funds rate to 0–¼% and introduced additional measures to ease liquidity.

As we begin the third year since the start of the pandemic, the U.S. economy has rebounded at an astonishing rate. Unemployment recovered from a high of 14.7% in April 2020 to 3.8% in February 2022. Meanwhile, the gap between actual GDP and its potential rate has nearly closed to less than 0.5%, as calculated by the Congressional Budget Office. However, global supply chain distortions persist, and subsequent waves of COVID-19 infections continue to disrupt service-oriented industries.

There are many reasons to expect inflation to be higher than normal (Barnichon, Oliveira, and Shapiro 2021; Bianchi, Fisher, and Melosi 2021; Shapiro 2021a,b). In this Economic Letter we widen the recent analysis with an international comparison. Though many of the pandemic distortions are common to other countries, we show that U.S. inflation has risen more quickly and increasingly diverged from inflation in other OECD (Organisation for Economic Co-operation and Development) countries. In seeking an explanation, we turn to the combination of direct fiscal support introduced to counteract the economic devastation caused by the pandemic. Importantly, we trace the effect of these measures over time. The interplay between when assistance was delivered and how households responded to successive COVID waves created complicated dynamics in the economy. Building these dynamics into a simple model suggests that they may have contributed to about 3 percentage points of the rise in U.S. inflation through the end of 2021.

U.S. inflation is now higher than abroad

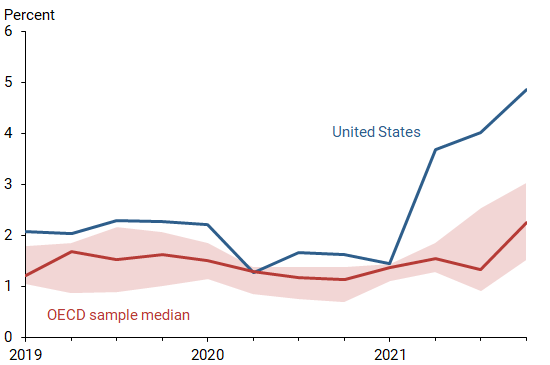

One way to illustrate what has happened with U.S. inflation is to compare it with the average rate of inflation across a group of OECD economies: Canada, Denmark, Finland, France, Germany, Netherlands, Norway, Sweden, and the United Kingdom. We rely on core inflation measures, which remove the more volatile food and energy prices. To align with what is available in all the countries in our study, we use consumer price index (CPI) inflation instead of the personal consumption expenditures price index, the preferred measure of inflation used by the Federal Reserve.The blue line in Figure 1 displays the year-over-year percent changes in U.S. core CPI inflation. The figure also shows the median (red line) and the range between the 25% and 75% largest values (also known as the interquartile range and shown by the shaded area) of inflation for our OECD sample. A tighter range indicates that most OECD countries in our sample experienced inflation rates similar to each other. The figure shows that, before the pandemic, U.S. core CPI inflation remained, on average, about 1 percentage point above the OECD sample average. The small difference between U.S. and OECD inflation during this period is well known as many of the OECD countries struggled to get inflation up to target following the Global Financial Crisis and subsequent euro-area sovereign debt crisis.

Figure 1

Annual core CPI inflation: U.S. versus OECD

Note: Shaded area reflects interquartile range for OECD sample.

Source: OECD Household Dashboard: cross country comparisons.

By early 2021, however, U.S. inflation increasingly diverged from the other countries. U.S. core CPI grew from below 2% to above 4% and stayed elevated throughout 2021. In contrast, our OECD sample average increased at a more gradual rate from around 1% to 2.5% by the end of 2021. These differences in inflation readings cannot be explained by measurement issues.

U.S. direct fiscal transfers are also higher than abroad....

....MUCH MORE

HT: ZeroHedge