From Bloomberg via Yahoo Finance, January 17:

Ocean shipping rates are expected to stay elevated well into 2022, setting up another year of booming profits for global cargo carriers — and leaving smaller companies and their customers from Spain to Sri Lanka paying more for just about everything.

The spot rate for a 40-foot container to the U.S. from Asia topped $20,000 last year, including surcharges and premiums, up from less than $2,000 a few years ago, and was recently hovering near $14,000. What’s more, tight container capacity and port congestion mean that longer-term rates set in contracts between carriers and shippers are running an estimated 200% higher than a year ago, signaling elevated prices for the foreseeable future.

Large customers of sea-borne cargo like Walmart Inc. or Ikea have the heft to negotiate better terms in those deals, or absorb the added expense. Smaller importers and exporters — especially those in poor countries — that rely on carriers to haul everything from electronics and apparel to grains and chemicals, can’t easily pass those costs along or weather long periods of stretched cash flows. The situation is throwing a spotlight on the market concentration of shipping lines, and their legal immunity from antitrust laws.

“Small- and medium-sized enterprises are being badly affected,” said Amruth Raj, managing director of Green Gardens, a vegetable processor based in rural India. After container rates shot up in the past year, more than 50% of his company’s capital was wiped out when European buyers balked at the higher costs. “They exploit our desperation.”

In the developing world, it’s not just business survival that’s at stake. Achil Yamen of the Cameroon National Shippers’ Council, raised concerns about inequities in Africa on a recent conference call hosted by the United Nations trade body.

“If nothing is done to reverse the trend, the risk in terms of inflation and food security can grow very, very high,” Yamen said.

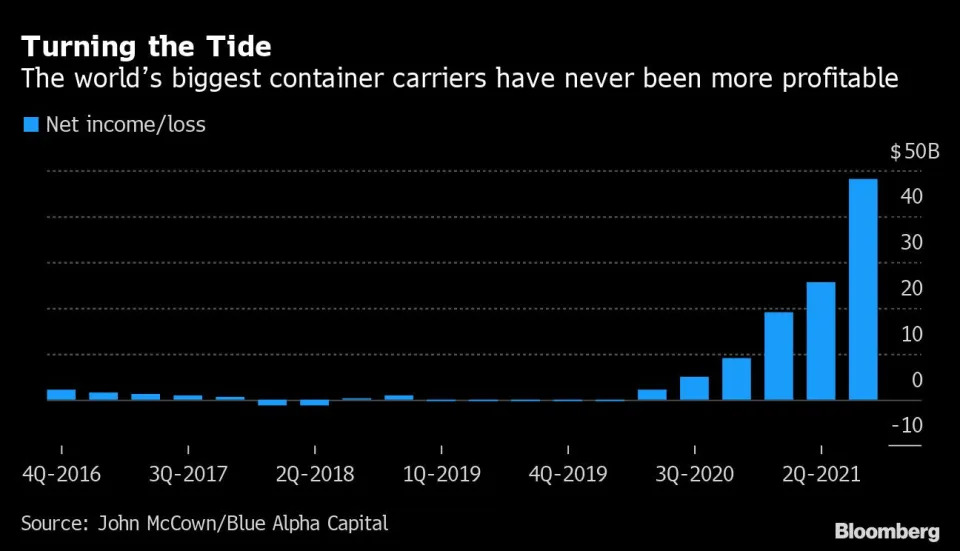

Meanwhile, the backbone of the postwar march toward globalization is coming through the pandemic in the strongest position in its history — a stark reversal of years losing money in the capital-intensive business. Ocean-freight carriers pulled in estimated profits of $150 billion in 2021 — a nine-fold annual jump after a decade of difficulty eking out any gains.

Denmark’s A.P. Moller-Maersk A/S, the world’s second-largest container carrier, was on track for an annual profit last year that would match or surpass its combined results from the past nine years. Its shares hit a record high this month, as did stock in Hamburg, Germany-based Hapag-Lloyd AG, the No. 5 player. The largest, Mediterranean Shipping Co., is a closely held company based in Switzerland that is controlled by Italy’s powerful Aponte family.

Surging Shipping Costs and the Dangers of Inflation

The extended windfall has touched a raw nerve across the political spectrum as economists warn that persistently high transportation prices are stoking inflation and clouding the recovery. High costs for freight that used to fan only temporary spells of inflation upticks are becoming longer-term features of economies in the U.S. and elsewhere.

Nicholas Sly, an economist with the Kansas City Fed, has done research that found, in the past, a 15% increase in shipping costs led to a 0.10 percentage point increase in core inflation after one year. Shipping rates, he said, currently are a persistent — rather than temporary or transitory — challenge.

“Those types of shocks tend to have lasting effects 12 to 18 months out,” Sly said....

....MUCH MORE

You know how much money is sloshing around? This much (2021):

Supply Chain Crisis: Beanie Babies Airlifted From Chinese Factories to Chicago Amid Holiday Crunch

And this much (2019):

Banksy Creates Physical Crypto-Kitties

Related:

CryptoKitty Trading Volume Collapses: Andreessen, Union Square and Climateer Hurt Worst

"Still humping the American Dream, that vision of the Big Winner somehow emerging from the last minute pre—dawn chaos of a stale Vegas casino. Big strike in Silver City. Beat the dealer and go home rich. Why not? I stopped at the Money Wheel and dropped a dollar on Thomas Jefferson—a $2 bill, the straight Freak ticket, thinking as always that some idle instinct bet might carry the whole thing off. But no. Just another two bucks down the tube. You bastards! No. Calm down. Learn to enjoy losing....

Excuse me, I have to take a moment

And to hell with the "shipping lines are causing inflation" or "packing plants are causing inflation."

Let's try too much money chasing everything but CryptoKitties is causing inflation