From Krebs on Security:

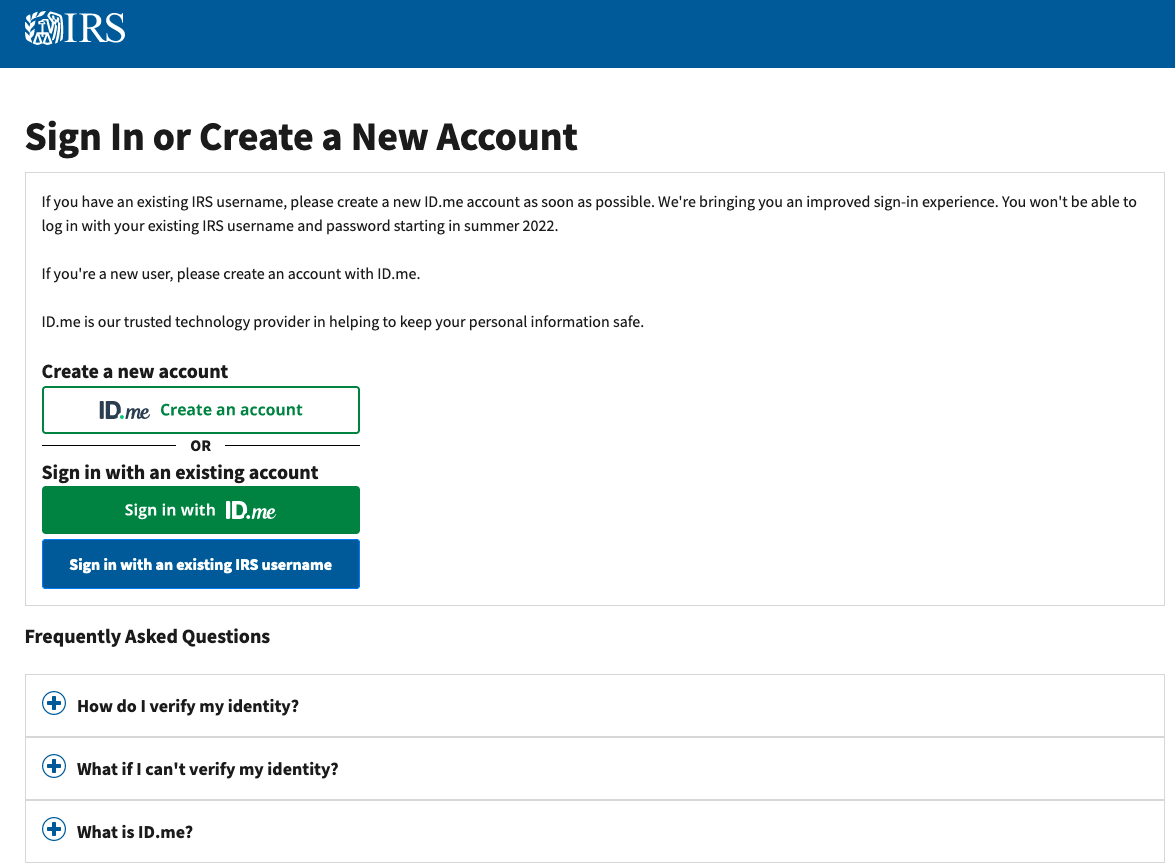

If you created an online account to manage your tax records with the U.S. Internal Revenue Service (IRS), those login credentials will cease to work later this year. The agency says that by the summer of 2022, the only way to log in to irs.gov will be through ID.me, an online identity verification service that requires applicants to submit copies of bills and identity documents, as well as a live video feed of their faces via a mobile device.

McLean, Va.-based ID.me was originally launched in 2010 with the goal of helping e-commerce sites validate the identities of customers who might be eligible for discounts at various retail establishments, such as veterans, teachers, students, nurses and first responders.

These days, ID.me is perhaps better known as the online identity verification service that many states now use to help staunch the loss of billions of dollars in unemployment insurance and pandemic assistance stolen each year by identity thieves. The privately-held company says it has approximately 64 million users, and gains roughly 145,000 new users each day.

Some 27 states already use ID.me to screen for identity thieves applying for benefits in someone else’s name, and now the IRS is about to join them. The service requires applicants to supply a great deal more information than typically requested for online verification schemes, such as scans of their driver’s license or other government-issued ID, copies of utility or insurance bills, and details about their mobile phone service.

When an applicant doesn’t have one or more of the above — or if something about their application triggers potential fraud flags — ID.me may require a recorded, live video chat with the person applying for benefits....

....MUCH MORE

I don't know how the the ID.me sign-in will coordinate with the IRS' outreach to the thieving community:

—IRS Publication 17 via the Erie County Sheriff's Office.

....Sharing/gig economy.

Generally, if you work in the gig economy or did gig work, you must include all income received from all jobs whether you received a Form 1099-K, Payment Card and Third-Party Network Transactions, or not. See the Instructions for Schedule C (Form 1040) and the Instructions for Schedule SE (Form 1040).