And someone is selling U.S. treasury futures as though they don't care what price they receive. On the 10-year note you have to go back to the Fall of 2019 to find a lower print/higher yield. The yuan is at 6.3446 after getting as strong as 6.3376 to the dollar.

From ZeroHedge:

China's Property Sector Is Crashing Again And This Time It Has Reached The Country's Biggest Developer

The crisis engulfing China's property sector - which has prompted Beijing to capitulate on its tightening ambitions yet again, and forced China to launch an increasingly more aggressive easing campaign, which so far culminated in the first rate cut in Chinese official rates in almost two years - has impacted the country's biggest developer, sending the shares and bonds of Country Garden Holdings - which is even bigger than Evergrande - plunging amid fears that a reportedly failed fundraising effort may be a harbinger of waning confidence.

Country Garden is one of the few remaining large, (arguably) better-quality private developers that had been largely unscathed by the liquidity crunch, even as peers such as Shimao Group Holdings - a recently investment grade developer whose collapse in December was viewed as "more devastating than debt crises at Evergrande and Kaisa" - dramatic reversals in their credit ratings.

At least until now... and now that Shimao has imploded, Country Garden remains perhaps the final and most visible bellwether for contagion risk, as unprecedented levels of stress in the offshore credit market threaten to drag good credits down with bad.

Since taking the top spot from China Evergrande Group in 2017, Country Garden has remained the nation's largest developer in China by contracted sales. It employs more than 200,000 people.

Headquartered in the southern city of Foshan in Guangdong province, the firm - like China Evergrande Group - has focused in recent years on building housing developments in lower-tier cities.

And, like Evergrande, Country Garden has also relied heavily on access to funding in the offshore credit market; actually not just Evegrande but virtually all developer peers that binged on debt to fuel growth in the past decade only to see the window slam shut now. According to Bloomberg, it has the largest pool of outstanding US dollar bonds among China's biggest property firms, excluding defaulters, with some US$11.7 billion outstanding, Bloomberg-compiled data showed.

Founding chairman Yeung Kwok Keung transferred his controlling stake to his daughter Yang Huiyan in 2005. She is now the firm's vice-chairman and is the richest woman in China, according to the Bloomberg Billionaire Index.

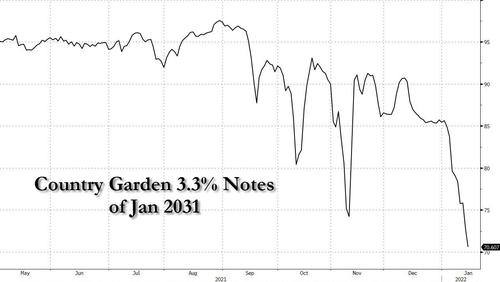

Or at least she was, because on some of Country Garden's US dollar notes plunged to record lows in the wake of a report that the firm failed to win sufficient investor support for a possible convertible bond deal. Longer-dated bonds were trading as low as 69 cents on the dollar as of late Friday.

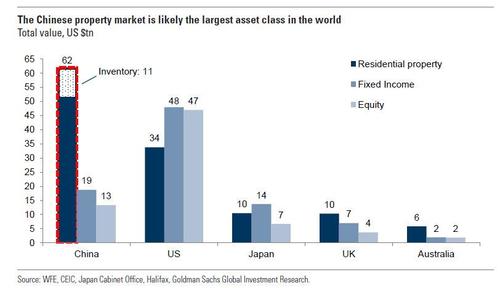

This is notable because China's developer was relatively resilient in the face of the liquidity crisis sparked by a government crackdown on excessive borrowing by builders and housing market speculation, and had been unscathed by the crisis at industry giant Evergrande. But just as we warned back in September, China's slow-motion real estate crisis which revolves around what Goldman calculated last year was the world's largest asset which absent significant stimulus from Beijing, is facing a very painful derating.

According to Bloomberg, while Country Garden is not facing imminent repayment pressure - it has US$1.1 billion of dollar bonds due this year and had 186 billion yuan (S$39.5 billion) of available cash as of June last year - risks may emerge if it is seen to have limited access to funding. Any sign of doubt in the firm's capacity to weather liquidity stress risks may prompt a widespread repricing of other higher-quality developers. With more than 3,000 housing projects located in almost every province in China, Country Garden's financial health has immense economic and social consequences, far greater than Evergrande.

Worse, if the firm starts showing signs of stress, it will severely damage already fragile investor and homebuyer confidence, posing threats to China's economy and even social stability. And that's when China's Lehman moment will truly emerge.

Where it gets challenging is that similar to Evergrande, more than 60% of Country Garden's contracted sales in mainland China came from the third- and fourth-tier cities, said its 2021 interim report. Demand in lower-tier areas may significantly weaken in 2022, said a forecast by Fitch analysts. Being a "pure developer", it is less flexible when it comes to raising cash by selling assets, said Bloomberg Intelligence analyst Andrew Chan.

Country Garden's strategy is to manage its current assets effectively, in addition to expanding its business, the told Bloomberg News, although it clearly did not anticipate the recent meltdown in its bonds. "The firm is experiencing less volatility than the overall market" amid a broader market downturn, it said. The developer sold bonds and asset-backed securities in the local market in December, reflecting support from both investors and regulators, and maintained its ratings at all 3 major rating firms last year, said the comments.

Country Garden holds both investment-grade and high-yield credit ratings from the 3 major risk assessors, making it a so-called crossover name that could be vulnerable to becoming a 'fallen angel'. That could in turn raise its borrowing costs and eliminate yet another builder from the dwindling pool of higher-rated developers that investors can turn to during the credit squeeze.

It has the equivalent of an investment-grade triple B rating at both Moody's Investor Services and Fitch Ratings, and the highest possible speculative-grade rating at S&P Global Ratings. Still, the borrower is likely to "strengthen its financial resilience by controlling debt growth and maintaining disciplined land acquisitions", S&P analysts wrote in a September report that reaffirmed its rating.

Still, the builder may find it difficult to revive sales in 2022 with weakening market sentiment in lower-tier cities, where 77 per cent of its land bank is located, said Bloomberg Intelligence analyst Kristy Hung. The firm's sizeable amount of newly acquired land continues to be located in such areas, raising further concern about cash collection, she wrote.

Meanwhile, in the latest wave of selling, investors are now scrutinizing Country Garden's capacity to raise funding from a variety of channels, particularly as the offshore credit market remains effectively closed to most developers. It needs to repay or refinance some US$1.3 billion on bonds this year, the majority of which are dollar notes. Its next maturity is a US$425 million bond due Jan 27....

....MUCH MORE