If your job requires having some idea of the forces that will shape the next three to six months of economic news and market reactions to same, this is one of the more important set of facts you are likely to find.

Capital deepening (investment) has been going on at places like Amazon for years and what it means is that when the headline reads "AMZN hires 500,000" the underlying story is that the Bezos beast has taken revenues from other businesses that may have required a million or 1.5 million workers at those other companies that lost the sales. And this is happening across the economy as the behemoths that can afford to invest continue to pull ahead in, say, unit labor costs which over time makes them unbeatable.

See, for example "Flywheel Effect: Why Positive Feedback Loops are a Meta-Competitive Advantage".

Dear Workers, While You Were Out We've Been Automating Your Job

From Upfina, May 7

The Q1 Productivity and Costs report was very impressive. It’s great news for economic growth. Annualized productivity growth rose from -3.8% to 5.4% which beat estimates for 5.4% despite the 0.4% positive revision to Q4 results. Output growth was 8.4% and hours worked were up 2.9%. Unit labor cost growth was -0.3% which was above estimates for -0.6%. This was down from 5.6% growth in Q4. Compensation growth of 5.1% was offset by the high productivity growth we mentioned earlier. It’s amazing for corporations if productivity can grow quicker than wages. That offsets the big cost increase that’s coming this summer now that we are seeing labor shortages.

🇺🇸Nonfarm business labor productivity jumped 5.4% (saar) in Q1 2021 as output rose faster than employment:

— Gregory Daco (@GregDaco) May 6, 2021

🟢 Output +8.4%

🟢 Hours +2.9%

Unit labor cost -0.3% (saar) as compensation +5.1% offset by +5.4% productivity pic.twitter.com/J4TkRjIJh7Now let’s look at results compared to Q4 2019 because that was the last quarter not impacted by the pandemic. Business output is down 0.6%. Hours worked were down 4.3% which makes sense because we don’t have as many people working. Productivity is up 3.9% which makes sense anecdotally. There has been a large increase in software spending which is supposed to make workers more efficient. Compensation is up 8.1% and unit labor costs are up 3.9% from before the pandemic. It’s fun to see just how much the pandemic re-worked the economy. We will finally see the long term impact after it’s over.

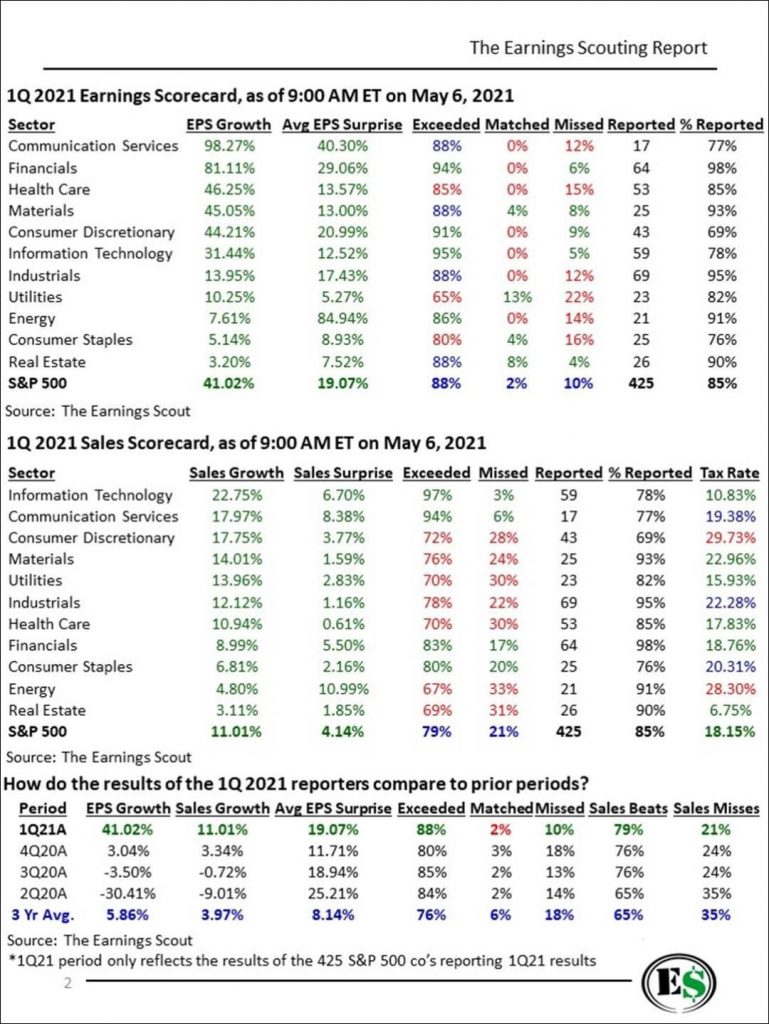

Q1 Was A Winning Earning SeasonWith Q1 earnings season 85% over as of May 6th, we can look at the almost final results. This quarter was amazing. EPS growth has average 41.02%. The average EPS beat was 19.07% and 88% of firms beat estimates (3 year average is 76%). The 3 year average beat is 8.14%. Keep in mind the past few quarters are pushing that average higher than it is usually.

94% of financial beat estimates and EPS growth was 81.11%. This was one of the best earnings seasons ever for the sector. Sales growth was also amazing. S&P 500 sales growth was 11.04%. The average beat was 4.14%. 79% of firms beat sales estimates which is above the 3 year average of 65%. The average tax rate was 18.15%. Tech firms only paid a 10.83% tax rate. Taxes are about to move a few percentage points higher based on Biden’s corporate tax increase and the 15% global minimum tax rate implemented by the G-20.

It’s amazing to watch the increase in EPS growth estimates in Q2 and Q3. Q2 will have peak earnings growth since we will be lapping the worst of the pandemic’s impact on the economy. Q2 EPS growth was expected to be 37.92% at the start of the year. With the vaccine distribution going so well and a stimulus passing, the consensus EPS growth estimate has risen to 56.53% as of May 6th. Q3 EPS growth estimates have risen from 13.98% on March 1st to 18.94%. Finally, growth will normalize in Q4 as analysts expect 15.95% growth. We could see estimates come down like they usually do leading up to Q4 since the comp will be much tougher than the first 3 quarters of the year.

Reopening Shift

The economy went through dramatic shifts in the past 14 months. There was an extremely quick increase in the use of technology to connect people and order goods/services. The entire economy went digital within a few months. We are lucky to live in such a technologically connected world. Had this pandemic occurred 15 years ago, technology wouldn’t have been able to save the economy like it did in 2020. In the long term, we will benefit from all the innovation that occurred last year....

....MUCH MORE

This is just one piece of the puzzle, we will have much more next week.

Related:Jobs Report: Analysts React (coherence supplied by Izabella Kaminska)