Nobody know anything, most visibly me.

For weeks we've been trying to thread the needle between assessment of the coronavirus itself:

....I've mentioned that one of my doctors has a tropical medicine sub-specialty. His verdict:And likely market (and policy) reactions:

Coronavirus is virulent, but not that virulent. It's deadly but not that deadly.

His advice? Stay away from areas with active Ebola and Marburg, in fact all the hemorrhagic fevers; don't smoke, lose five or ten pounds.

He tells everyone to lose 5 or 10 pounds.

He doesn't seem all that impressed with Wuhan coronavirus.

February 1, 2020

Note the February countertrend rally on both charts: The first bounce is usually not the best bounce.

Something to keep in mind if one goes long equities on Monday.

Be nimble, be quick, don't burn your butt on the candlestick.

February 27, 2020

At the moment the Fed would prefer NOT to actually do anything, keeping policy actions in reserve for later this spring. So if the U.S. doesn't act the presumptive leader would be the EU + the central banks of Germany, France and Italy, but they too have reason to keep their firepower unused until forced.Which managed to be both right and wrong as we got the soothing words and not much else from the G7 and a couple hours later a 50 basis point cut from the Fed.

Japan has gotten to the point they could buy 100 trillion Yen worth of ETFs and at most get a "Oh look honey, Japan is buying equities again"

So the bet would be, we will hear soothing words.

But like everything concerning central banks and finance ministers nobody know.

March 2, 2020

This isn't a problem that will respond to rate cuts.Between those bookends we had the academic:

Look at the velocity of money from FRED at the St. Louis Fed:

***The money released by Fed machinations isn't turning over. It is getting stuck in the financial system.

Helicopter money for financiers is all well and good but it doesn't address the problem.

(it's the same picture for MZM and M2)

—March 3, 2020

Feb. 25

Regarding the Efficient Market Hypothesis....

On days like today you might find Eugene Fama in some Chicago watering hole with his designated driver, Kenneth French. As we noted in another context ["Is semi-variance a more useful measure of downside risk than standard deviation?"]:

I have no explanation for the market's collective Wile E Coyote moments:...If yous see them together at some Chicago dive bar, Fama is the one with the Nobel around his neck, French the one saying "For Chrissakes Gene."

but I am pretty sure that at Friday's close the market was not pricing in "all available information".

This lack of facile, erudite (sounding) verbiage on my part may necessitate the implementation of either a (tardy) "pivot to video" or cooking tips. We'll try the latter first.

From Britain's Royal Society:...

The practitioner:

February 25

"How Will You Play the Oversold Bounce?"

Homie don't play.

Homie pivots to video

The whimsical:

March 1

Dead Cat Bounce: What is the Terminal Velocity of a Cat?

The worldly:

March 2

Bored With Political Chatter? Tired of Hacks Pussyfooting Around Covid-19? Is Work Cutting Into Your Day Drinking? Try a Shot O'Bryce

...Did I mention Bernstein on the food riots?

Make it a double shot O'Bryce.

The esoteric:

February 29

"Social Responses to Epidemics Depicted by Cinema"

A great resource for portfolio risk managers.

As just one example, what is the trade if the world is confronted by a real-life version of "Blindness (2008, Fernando Meirelles), which deals with a fictional disease that causes epidemic blindness, leading to collective hysteria?"

I mean beyond the simplistic "short Luxottica." Duh.

From Emerging Infectious Diseases Journal, Volume 26, Number 2—February 2020:

And the fatalist:

February 24

Watching 3235 On the S&P 500

This piece mentions Charlie McElligott at Nomura whom we stopped relaying after he stopped being accurate in his calls based on gamma positioning. This time around though. there is something to the number in the headline....

... 3234.50 down 103.25 (-3.09%) with minutes to go 'til the close

Well, the S&P 500 is down another 9.2% in the 11 days since that post and the most honest comment I've seen on the state of the markets was relayed by ZeroHedge yesterday:

Thu, 03/05/2020 - 17:45

"We Don't Know What's Going On": Wall Street Admits It Is Clueless

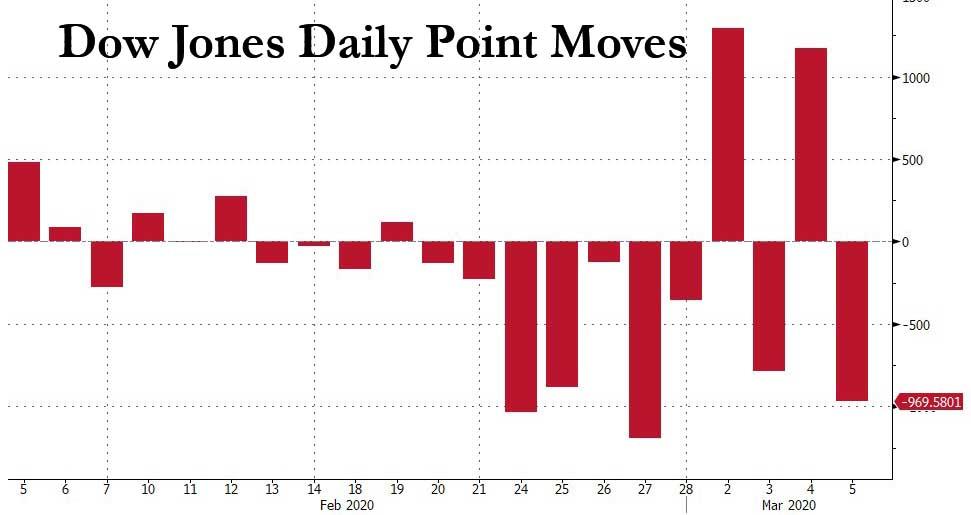

...Then look at the chart below showing the market's harrowing moves in just the past 10 days. It hardly needs an explanation, especially since one doesn't exist for what is clearly a regime change in market sentiment, one which has resulted in four 1,000 point Dow Jones closing moves in the past ten days (today we were just 31 points away from a 5th)...

... and one where nobody really knows what's going on any more. But don't take our word for it.*The full quote is:

"When you have a 4.5% up day in the market and a 2% down day - what does that mean?” Kathryn Kaminski of AlphaSimplex Group told Bloomberg. "It just means we don’t know what’s going on."

“Nobody knows anything...... Not one person in the entire motion picture field knows for a certainty what's going to work. Every time out it's a guess and, if you're lucky, an educated one.”And from our 2018 post "On the Passing Of Storyteller William Goldman (and how to sell a screenplay)":

We had a post earlier today that was in the queue for the weekend but was bumped up on word of Mr. Goldman's death because of its reference to one of his stories: "The Princess Bride".

Goldman wrote a lot of stuff, novels and teleplays a memoir, short stories, just about every medium short of cuneiform tablets. But it was for his screenplays he was best known and for which he picked up a couple Oscars: Best Original Screenplay for "Butch Cassidy and the Sundance Kid" and Best Adapted Screenplay for "All the Presidents Men".

He also wrote a lot of screenplays, adapted and original, that most movie junkies have heard of:

The Stepford WivesFor me though, the eye-opener on just how good the guy was, was the light western Maverick.

Marathon Man

A Bridge Too Far

Twins

Misery

Indecent Proposal

Last Action Hero

A Hollywood friend sent a copy of the screenplay and said if I ever wanted to tell my story all I had to do was learn to write like this and the script itself would be the prospectus for the offering and actually sell the deal:....

Nobody knows anything.

DJIA down 883.60 at 25,237.68

S&P 500 down 102.36 at 2921.58