Those are the first two sentences of today's Markets Now, hosted on the FT Alphaville platform:"The WEF Global Risks Report is an odd annual ritual where

business wonks list big stuff they want to be seen to be fretting

about. It works sort-of like those 'what I’ll be reading on holiday' lists

except for worry."

11:00am GMT - The WEF Global Risks Report is an odd annual ritual where business wonks list big stuff they want to be seen to be fretting about. It works sort-of like those “what I’ll be reading on holiday” lists except for worry.

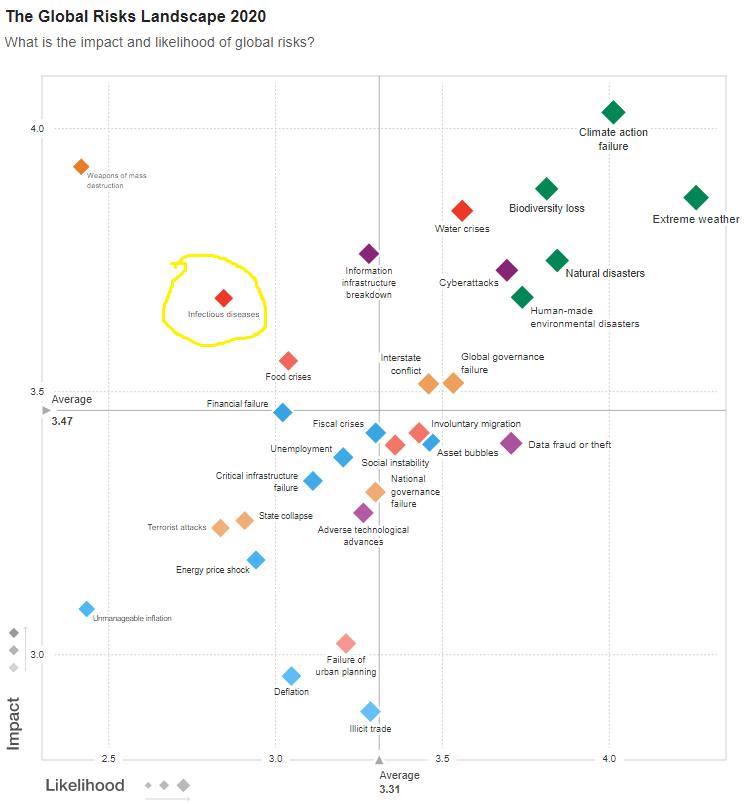

As many have pointed out already, there was a widespread assumption that all future financial crises would look like 2008 and that the next market failure would come from within. Nevertheless, the WEF’s Global Risks survey is always a platform for relaxing wee flights of fancy into the realms of the exogenous. Here are the 2020 headline lists:

Did you spot it? It is there, at the bottom of the long-term impact ones, though absent on the likelihood ones. Here it is again on the scatter plot, (circled yellow) with an impact rating nowhere close to cyber attacks and a likelihood slightly below energy price shocks:

It’s not news that Davos generates bunk, and it’s perhaps unfair to apply hindsight to use a survey that ran from early September to late October 2019. Nevertheless, given reports from Wuhan were already alarming in the days before this year’s WEFfest, the multistakeholders won’t emerge from 2020 looking any sharper than the 2008 delegation (who are, of course, mostly the same people). They’ll be back up the mountain in 2021 , but perhaps by then we’ll remember not to listen.....MUCH MORE

Monday markets have a familiar look:....

Well, for all the business journos, tomorrow's a new day and hope for the future is eternal.