If oil in the ground should someday become a stranded asset, the Saudi's plan since the rise of MbS has been to be the producer that pumps the last barrel. And although Ghawar is no longer able to produce at $2-5 per barrel, $10-20 is definitely achievable meaning there are very few places in the world that can compete on price.

The second point is a bit of a corollary of the first.

As Texas and North Dakota become less economical, the bankers who at the moment are allowing the E&P's to produce flat out to make interest payments will come to the realization the producers are burning through the collateral underlying the whole edifice of the shale biz.

Which means at some point less production of oil, which means less "associated" natural gas being brought up, which means less pressure on the gas-focused producers. Too late for CHK but not for some of the less leveraged companies.

From ZeroHedge:

When we discussed Saudi Arabia's shocking decision on Saturday to reverse on years of prudent oil policy following Friday's stunning collapse of OPEC+, with the kingdom now set to obliterate the OPEC cartel by flooding the market with heavily discounted oil in hopes of sending its price plunging, crippling competitors (such as US shale producers) and capturing market share (a repeat of what Saudi Arabia unsucessfully attempted back in Nov 2014), we made the following assessment on what the Saudi decision could to the price of oil once oil resumed on Sunday:

According to preliminary estimates, with Brent trading at $45, a flood of Saudi supply as demand is in freefall, could send oil into the $20s if not teens, in a shock move lower as speculators puke on long positions in what Goldman calls periodically a "negative convexity" event.... Oil traders are looking to historical charts for an indication of how low prices could go. One potential target is $27.10 a barrel, reached in 2016 during the last price war. But some believe the market could go even lower.

... those wondering what is the worst case scenario for oil prices, consider that Brent traded at an all time low of $9.55 a barrel in December 1998, during one of the rare price wars that Saudi Arabia has launched over the last 40 years... similar to just now.

In retrospect, one difference between the oil supply shock of 1998 and now, is that back then there was no concurrent demand shock. Instead, to find the last combo of both a positive oil supply shock and a massive negative demand shock, one would have to go to the depths of the Great Depression as Rapidian Energy notes in a WSJ article:

It’s the very rare combo of a massive negative #oil demand shock, positive supply shock & no swing producer that makes #crude ‘s looming price implosion as historic as deep. Last time this terrible trifecta happened - 1930-1931. @RapidanEnergy https://t.co/yNMBr0WAui pic.twitter.com/RVrNDEszRE— Bob McNally (@Bob_McNally) March 8, 2020

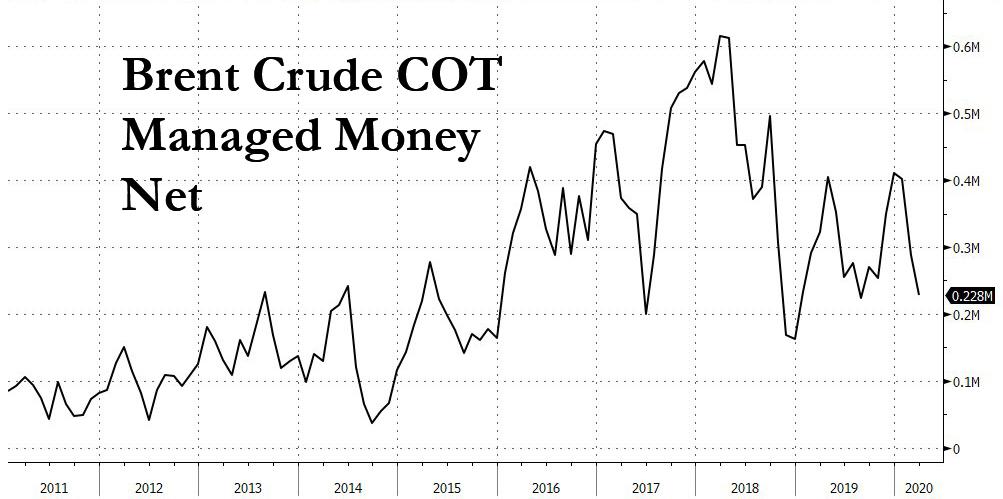

This suggests that the worst case scenario is potentially even more dire than that observed in 1998. Furthermore, considering the high number of Brent net specs, there is the potential for an even more violent puke as countless speculators are stopped out of margined underwater positions.

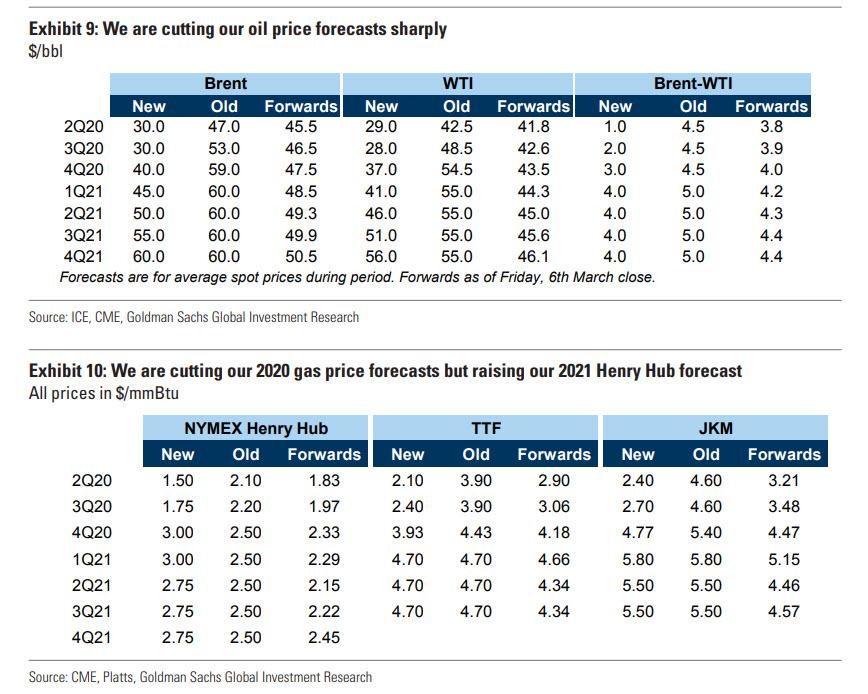

Of course, we will know for sure what happens in just a few hours when Brent reopens but first, moments ago Goldman's commodities team just blasted out a note titled "The Revenge of the New Oil Order", which has some very bad news for oil longs: Goldman now sees Q2 and Q3 2020 Brent prices plunging to $30/bbl from its previous forecast of $47/$53 for Q2/Q3, "with possible dips in prices to operational stress levels and well-head cash costs near $20/bbl."

In short (as we also said on Saturday): there will be blood... perhaps literally........MUCH MORE, including Goldman's summary.

That McNally quote on simultaneous supply and demand shocks is pretty profound and if you've ever read some of the stories of the Texas oil crowd in the 1930's gives a foreshadowing of the shenanigans we can expect to see exposed in the coming months.

As to Goldman, we chronicled their whole Oil to $200, oops it's going to $25 schtick back in 2008.

Buyer (or seller) beware. Here's the dénouement phase in the second half of that memorable year:

June 16, 2008: Goldman, Morgan Stanley Profits Conceal Reliance on Commodities

June 25, 2008: Which Former Goldman Sachs Chairman Should We Listen to on Oil Market Speculators?

August 19, 2008: Goldman’s Oil Thesis: Timing is Everything

October 7, 2008: Goldman: We Got Our Shorts On, Oil not Going to $200.00

October 27, 2008: The Goldman Commodities U-turn, again

November 20, 2008: It’s official, Goldman capitulates on oil

December 2, 2008: Oil speculation: It's back

December 12, 2008: Goldman Cuts Oil Forecast to $45 (vs original $200) Sees Bottom

June 4, 2009: Goldman Raises Year-End Crude Forecast by 31% to $85

Always, always be skeptical of anything Goldman says regarding commodities.*June 5, 2009: Are Goldman's Oil Swaps Clients Piling Back Into Oil?

J. Aron is one of the company's crown jewels and was the springboard for CEO Lloyd Blankfein.**...

...*From our November 20, 2008 post "It’s official, Goldman capitulates on oil":

...Now Goldman is left with the ignomy of summarily abandoning the investors who listen to its research calls, telling them effectively that they’re on their own. On Thursday, Goldman said it was ”closing” its recommendations for oil trades. Meaning that in a perilous time when the traders who pay attention to Goldman’s recommendations could use some guidance the most, Goldman has opted to give them the least. And some traders are furious about it, comparing the maneuver to then-strategist Abby Cohen’s decision to abandon her targets for equity indexes in the fall 2001, citing the uncertainties abounding in the market. Goldman specifically talked about four trade recommendations it previously issued, and said clients shouldn’t put any stock in them any longer. One particular trade, a Nymex-WTI swap on the 2012 contract, issued in September, when crude already had declined to below $70, suggested that the contract would reflate to a range of $120 to $140. Obviously, that hasn’t happened....MOREGoldman marketed the fact that CalPERS and other long-only index buying institutions could piggyback on GS's status as a 'commercial' to avoid position limits by entering into swaps with the bank. The institutions thought it was a sweet deal, until it wasn't. If it comes down to throwing customers under the bus or protecting the propritary trading, there's no decision.

**"When Blankfein asked about his title, a boss at J. Aron said,

'You can call yourself contessa if you want.'"

-Fortune, January, 2006