This Is The Chart Albert Edwards Is Watching To Decide When The US Becomes 'Japanified'

Last week, in order to help the Fed find some of that oh so "mysterious" inflation it has been so powerless in tracking down for the past decade, we showed a chart of healthcare inflation which is now soaring at a record 20% (for a complete discussion of soaring US healthcare costs, see here).

healthcare inflation pic.twitter.com/pioYdZ9eZH— zerohedge (@zerohedge) November 26, 2019

At least one person was not impressed, however.

Commenting on this particular surge in health insurance premiums, SocGen's restless permabear said that such inflation "proves temporary." Which, coming from Albert, is to be expected: while some say the world will end in fire, to Edwards it will be ice as far as the eye can see - after all, it was Edwards who first coined the term "ice age" some two decades ago to explain the deflationary singularity that will consume everything, and as such it is understandably why to him any surge in inflation is a one-time event.

There is another reason why Edwards dismisses any incipient signs of inflation in the US: his latest piece is titled "Japanification of the US beckons", in which he writes that despite the Fed's recent announcement of a halt to further rate cuts, "GDP growth looks fragile and there is good evidence to suggest that core CPI inflation is set to collapse towards zero. In fact, a resumption of Fed easing on the back of recessionary data and sliding inflation is likely to accelerate the convergence of US yields towards negative eurozone and Japanese yields."

Hence, the Japanification of the US, and as he further notes, if the US economy slides into recession, it is clear that "inflation will likely fall ever closer toward Japanese-style deflation. But a rapid decline in key inflation measures, like core CPI, may be beginning to unfold already, irrespective of whether a recession is about to start or not."

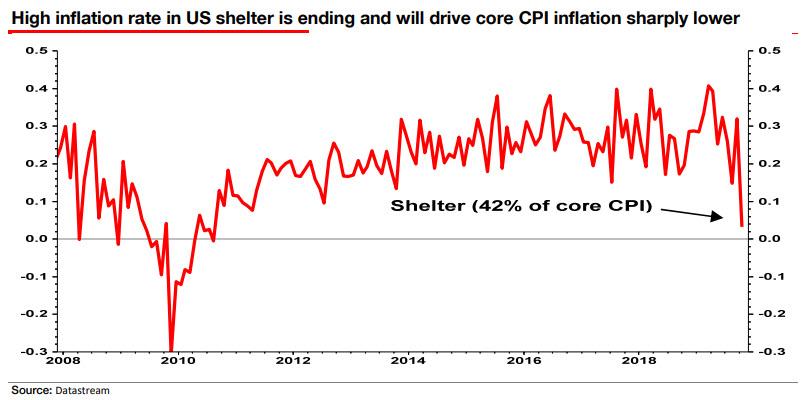

To make his point, Edwards points out the October CPI data which "shocked" him, but not for the surprisingly high 0.4% headline rise M/M, but because of a specific data set that he will now be watching very closely to determine if US inflation is indeed converging with that of Japan: shelter CPI.

it was this key component of the CPI basket that last month collapsed to almost zero. And since shelter has a very heavy 33% weighting in the overall CPI and an overwhelmingly dominant 42% weighting in the closely watched core CPI (ie ex food and energy), it's only a matter of time before the decline in shelter hits the broader inflation basket.

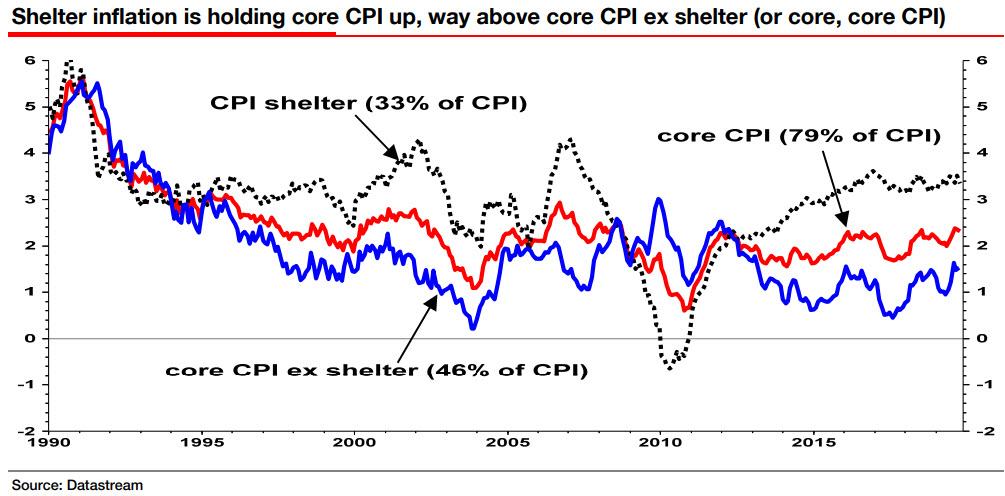

There is another reason why Shelter is such a key inflationary metric: as the next chart shows, inflation for core CPI has exceeded the Fed's preferred inflation measure, the core PCE deflator, since 2014, largely because the dominant shelter component has been running around 3½%, pulling up core CPI sharply. Without shelter, core, core CPI has been running just above 1% (blue line in chart below)

The SocGen strategist then notes that if, as he believes, the recent burst of rapid shelter inflation is ending, this will reveal core, core CPI inflation only just above 1%, especially if and when the abovementioned burst in healthcare inflation fades.

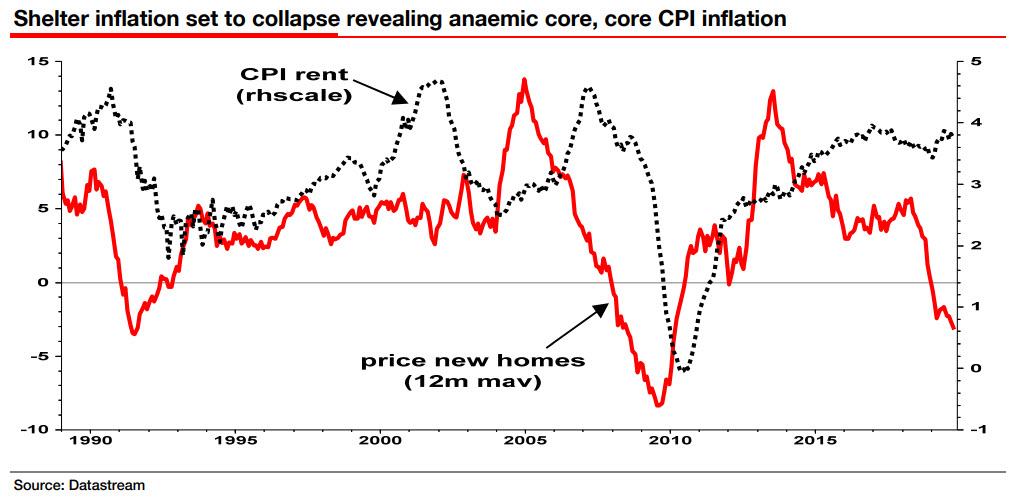

Finally, to determine in which direction shelter inflation is headed in the future, Edwards looks at the price of new homes, which suggests that shelter and rent inflation may now be falling away rapidly: "This will come as a surprise to investors, as even without a recession, core CPI could quickly head towards zero. The markets will then embrace the Japanification theme in the US, just as they have done in Europe."

Putting it all together, Edwards concludes that "I had been waiting for a while for the shoe to drop and now it has started to fall towards the floor, revealing that core CPI inflation in the US is closer to zero than many assumed. And the obvious question arises that if this is all the consumer price inflation that the US economy can produce at the end of the longest cycle in history, what will happen when it falls into recession?"

His rhetorical answer: "The Japanification of the US awaits", but just in case he is wrong - something even Edwards admits to being more often than not - keep an eye on that shelter inflation chart...