From FT Alphaville, November 6:

The fool’s gold of emerging market valuations

*****

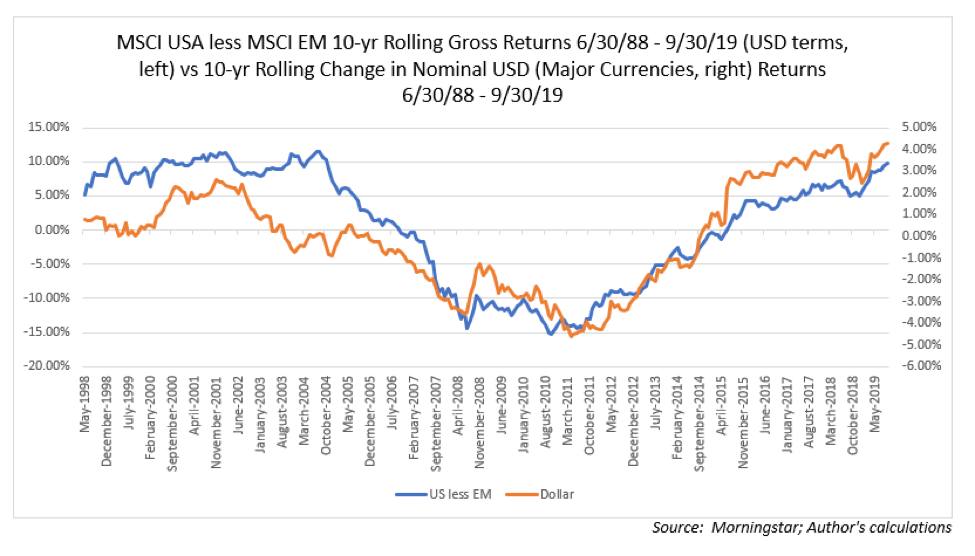

...It is true that the CAPE ratio has certainly been a reliable tool for forecasting real equity returns in both the US and EM, but, as Joachim Klement of Fidante Partners observed in 2012: “[I]t is clear that emerging market stocks can only outperform developed market stocks if their respective currencies continue to appreciate versus the US Dollar or other developed market currencies.”

For a US investor, this is a critical point; over the decades since MSCI’s EM index began in June of 1988, excess returns for EM relative to the US have coincided with significant dollar weakness:

As you can see from the chart, the great EM bull market (relative to US stocks) of the 2000s coincided with a substantial bear market in the dollar, and its end coincided with the resurgence of the greenback circa late 2011.....MUCH MORE (we only snipped the bit that confirmed our priors)

Mr. Friedman does acknowledge the dependence of excess EM equity performance on USD weakness, but suggests EM currencies are currently positioned favourably to the dollar, which GMO believes is due for a period of weakness on a relative basis.

I’m no expert in currency valuation, so I am agnostic on this point, but it seems a rather tall order to have one’s equity bets so reliant on something as fickle as the currency market....

And why bring this up now?

The dollar has been weakening since the September - October double top:

And the EMXC (iShares MSCI Emerging Markets ex China ETF) which has been under-performing both the S&P 500 and the EEM (emerging, including China ETF) is poised to go above a line on a chart:

Merry Christmas.

See also:

World Econ: "Was October The Turning Point?"