And 2020 may shock the bears.

The only thing left to those hoping for economic chaos is to convince Iran to block the Straits of Hormuz.

More on that in a few weeks.

For now, Saxo Bank via ZeroHedge:

Summary: OECD's newest data on global leading indicators suggest October was the turning point taking the global economy from the contraction to the recovery phase. Since 1973 this phase has been the best one for equities in terms of relative performance to bonds. In today's equity update we show which countries and industries have typically done best in this phase.

* * *

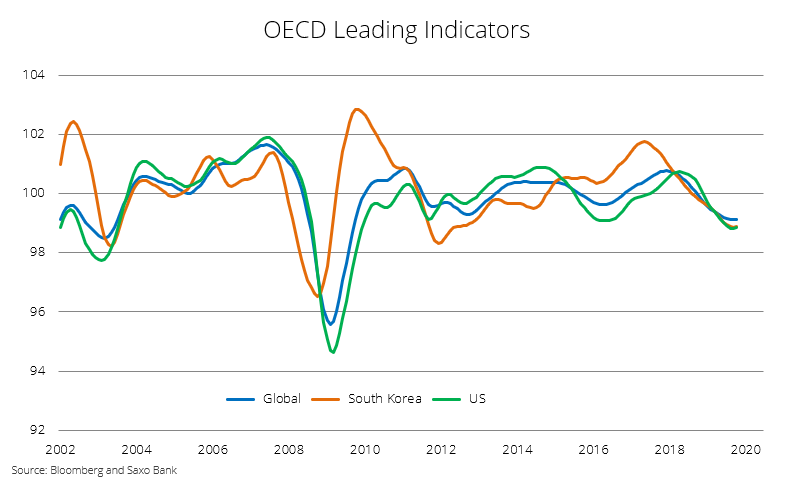

For almost two years the South Korea economy has been declining as China slowed down and the US-China trade war hit investments and global trade. Today, OECD released its global leading indicators hinting that the global economy turned a corner in October moving from the contraction phase and into the recovery phase. The uncertainty is still high and adjustments over the coming months could wash away this on the surface turning point in the global economy.

The quote below is the official press release text.

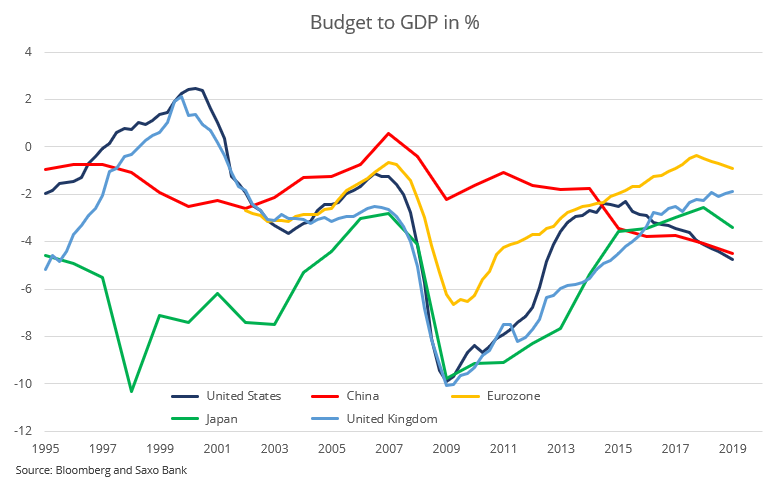

“Stable growth momentum is anticipated in the euro area as a whole, including France and Italy, as well as in Japan and Canada. Signs of stabilising growth momentum are now also emerging in the United States, Germany and the United Kingdom, where large margins of error remain due to continuing Brexit uncertainty. Among major emerging economies, stable growth momentum remains the assessment for Brazil, Russia and China (for the industrial sector). On the other hand, the CLI for India continues to point to easing growth momentum.” (OECD – Paris, 9 December 2019)Regardless of October being a turning all the numbers are suggesting that growth momentum is stabilising in all key economies including Germany. For now it looks like the policy action from central banks have stopped the bleeding. Add to this announced fiscal stimulus by Japan last week and South Korea last month. In addition Europe is planning large green investments next year. The fiscal impulse could lift growth momentum into 2020. If this is the case then on the margin that is net positive for Donald Trump’s aspirations for being re-elected.

Our business cycle map on country level going back to 1973 suggests that if the turning point came in October then we are entering the most rewarding period for investors in equities relative to bonds. The average outperformance for equities vs. bonds in USD terms has been 9.4% for every recovery phase. Historically the best performing equity markets have been Hong Kong, China, Singapore, Sweden, Brazil, South Africa and Australia. This should not be a big surprise given the pro-cyclicality of these markets. Another positive aspect of these markets is that their valuations are below the global average........MORE