From Alhambra Investments:

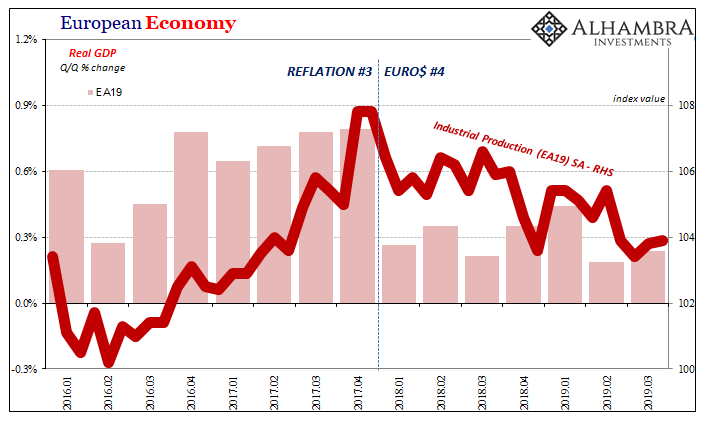

Eurostat confirmed earlier today that

Europe has so far avoided recession. At least, it hasn’t experienced

what Economists call a cyclical peak. During the third quarter of 2019,

Real GDP expanded by a thoroughly unimpressive +0.235% (Q/Q). This was a

slight acceleration from a revised +0.185% the quarter before.

The real question, though, is whether

the business cycle approach means anything in this day and age. I don’t

think it does, and that’s a big part of why there’s so much confusion

about both cause and effect.

For most people, certainly every

monetary policymaker and central banker around Frankfurt, the more

important number is 26. As in, Real GDP across all of the nineteen

countries of the Euro Area has been positive for twenty-six straight

quarters. It’s a seemingly impressive run of now six and a half years.

Mario Draghi has taken full credit for this, beginning long before he retired recently.

But upon closer examination you can see

how something is just not right. Recession is the wrong bogeyman to

focus on. There are, actually, much bigger problems and concerns hidden

within these figures which remain on the plus side of zero. These are

obscured because of the way in which we measure “expansion”, in linear

terms.

First, though, the cause. US President

Trump beginning to talk seriously about imposing tariffs on Chinese

goods in the middle of 2018 cannot ever explain why the economy for

nearly all of Europe clearly ran into a wall at the end of 2017.

Economists, including those in Europe and at Europe’s central bank, have

tried very hard to blame if not directly those trade tariffs then trade

war and general protectionist sentiment.

According to their view, because we all

know it cannot possibly be a global monetary problem, not with so much

global QE’s and “money printing”, German and Italian industrial firms

must have been worried about an issue that hadn’t yet been raised and so

began cutting scaling back for a far distant future event that didn’t

actually concern them. Yeah, it doesn’t come close to adding up.

No, what changed right at the outset of

2018 was the euro – meaning the dollar. The early warning signs of late

2017 were swallowed up by the inflation hysteria sweeping the globe,

especially in Europe, where it was said recovery had been found at long

last. Mario Draghi most of all.

While he was saying it, though, the

economy fell out right from beneath his feet. It didn’t lead to the

mainstream view of recession, several negative quarters of GDP, but it

has added up to something like that already. With these new figures in

hand, that’s seven quarters and counting of…something.

Here’s what I mean:

Not only did the underlying financial

circumstances change, they did so in economic circumstances going right

through the industrial sector.

...

MUCH MORE