From the Bank of England, October 2017:

Abstract

This paper presents a new dataset for the annual risk-free rate in both nominal and real terms going back to the 13th century. On this basis, we establish for the first time a long-term comparative investigation of ‘bond bull markets’. It is shown that the global risk-free rate in July 2016 reached its lowest nominal level ever recorded. The current bond bull market in US Treasuries which originated in 1981 is currently the third longest on record, and the second most intense.

The second part of this paper presents three case studies for the 20th century, to typify modern forms of bond market reversals. It is found that fundamental, inflation-led bond market reversals have inflicted the longest and most intense losses upon investors, as exemplified by the 1960s market in US Treasuries. However, central bank (mis-) communication has played a key role in the 1994 ‘Bond massacre’. The 2003 Japanese ‘VaR shock’ demonstrates how curve steepening dynamics can create positive externalities for the banking system in periods of monetary policy and financial uncertainty.

The paper finally argues that the inflation dynamics underlying the 1965–70 bond market sell-off in US Treasuries could hold particular relevance for the current market environment...

....MUCH MORE (40 page PDF)

HT: Medievalists.net:

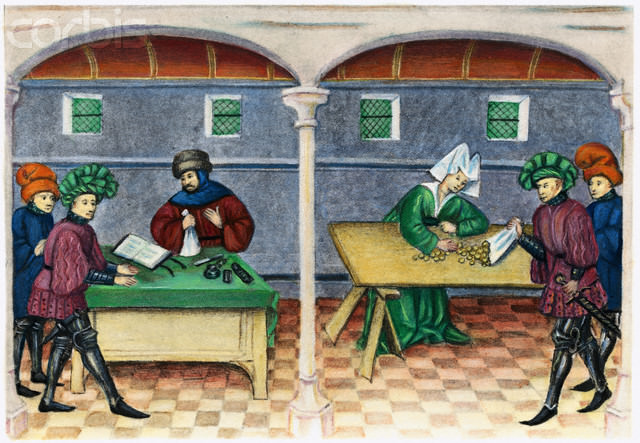

ca. 15th century — Medieval miniature of banking operations. — Image by © Bettmann/CORBIS

And the article at Medievalists.net I was going for when serendipity struck:

Employment on a Northern English Farm, 1370-1409

which was going to be part of the introduction to a post on "Secrets Of Defrauding Your Medieval Lord"

Imagine yourself working for a medieval lord, running his farm and taking care of his business. Would you be tempted to skim off some of his profits? If so, a 13th-century writer can offer you six ways to commit fraud.

Robert Carpenter was a freehold farmer and former bailiff living on the Isle of Wight in the 1260s when he wrote up a formulary – a collection of form letters and legal texts that would be useful for local administration. For unknown reasons, Robert also included here a set of detailed instructions on committing six different types of fraud....

Which is also to be found at Medievalists.net.

It was ever thus.