This is really weird.

No, not the bit thus far, that's just some associatin' to keep the pipes clean, clear out the gunk.

What's weird is: yesterday I was thinking about the Saudi's opening their stock exchange to foreigners on June 15.

That led to memories of a couple other bourses in Muslim countries that we had posted on during the upheavals of a few years ago:

Court Orders Kuwait Stock Exchange to Stop Decliningand more interestingly:

Nov. 2007

Karachi Stock Exchange: KSE’s black Monday — heaviest ever single-day decline

July 2008

Pakistani Investors Stone Karachi Exchange as Stocks Plunge...

Nov. 2008

Karachi: Trade in shares on Pakistan's main stock exchange ground to a halt on Tuesday as investors lost all interest...

But that's not the really weird part.

What's really weird is: as I was looking at this stuff I was thinking about Albert.

To the point that I asked if we had anything recent from him.

I even did a couple news searches. Nothing lately. I wondered if he had died or gotten trapped in his bathtub or something.*

And 24 hours later, here he is.

From FT Alphaville:

An homage to China: “even the Karachi Stock Exchange didn’t come up with something like this”!

On China’s innovative approach to mangling its markets — and whether it’s a dead-cat bounce — here’s SocGen’s Albert Edwards (our emphasis):

Regular readers will know I feel a close affinity with Karachi, my father having grown up there in the 1920s. I have subsequently been to the city many times, visiting a former fund manager colleague and good friend. I also sent my son there when he was 16 to help teach English at an excellent local charitable school foundation (TCF) in a Karachi slum so he could appreciate the value of education – link. Hence in 2008 while the global financial markets were in chaos my attention was drawn to the bizarre events in Karachi more than most commentators.

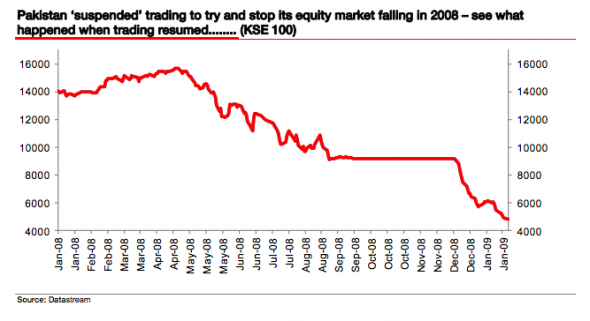

A couple of years back, the highly regarded Pakistani Dawn newspaper reviewed events in 2008: “In that fateful year, the Karachi stock market index of 100 shares had galloped to touch its all-time high level of 15,760 points on April 20, 2008. And then the stock prices collapsed with index plunging by some 6,600 points or 40% in four months. As panic was thick in the air, an entirely insane act was performed. On August 20, 2008, a “floor” was fixed at the level of 9144 points below which the index was not allowed to fall. All investors, including foreigners who wanted to seek an exit were trapped.

...MORE

Simon Cox of Emerging Markets Stock Fund (Hong Kong) says: “I have gone through the record of stock exchanges and never since the oldest stock exchange in the world at Amsterdam was established in 1602, I could locate one example where a stock exchange had ever blocked the exit in violation of basic principles of free market mechanism. Every Dick and Harry who had anything to do with the Pakistan capital market—the regulators, brokers and traders – now fall over each other in condemning the ‘floor’ as an unforgivable blunder. It turned the catastrophe into calamity. The ‘floor’ remained in place for as many as 108 days. When it was finally lifted on December 14, the market, as was feared, came crashing down to the level of 4782 points in fewer than fifteen sessions (another 52%decline in addition to the previous 40% decline)” see full Dawn article here link.

Yesterday, my friend, who was on the board of the Karachi Stock Exchange at the time the floor was put under the market, emailed me a Bloomberg article entitled China Bans Stock Sales by Major Shareholders for Six Months, with the incredulous comment that “even the Karachi Stock Exchange didn’t come up with something like this”!

Here's the bathtub:

*Truth be told, I was probably subconsciously thinking back to 2013's "Hey, Société Générale's Albert Edwards is Still Alive and Still Looking For the S&P to Trade at 450 (and gold at $10,000)":

It's spring and the bears stumble out of their caves, blinking in the sunshine.Beautiful plumage though, know what I'm sayin'?

Albert has been one of the best on bond yields, one of the worst on equity prices and one of the silliest with the bathtub schtick.

From ZeroHedge:...