From FT Alphaville:

With petrodollars also go global reserves

US energy independence alongside labour re-shoring is contracting the global pool of petro and sweatdollars and with it the business that is petro/sweatdollar recycling, especially to the EM world.

We’ve speculated before that this could create a financing hole that not only slows EM demand and trade, but weirdly enough also leads to the emergence of the petroeuro as the global funding and reserve currency. [Yes. Even accounting for Greece.]

It’s really only the ECB that in our opinion has the global presence, reputation and gravitas — not to mention the need — to be able to extend its balance sheet to the emerging markets, whilst maintaining the euroeuro shadow/parallel market in check.

Whether we’re right or wrong about the euro, one thing’s for certain, the hypothetical eventuality of no more petrodollars is already having an impact on global reserves.

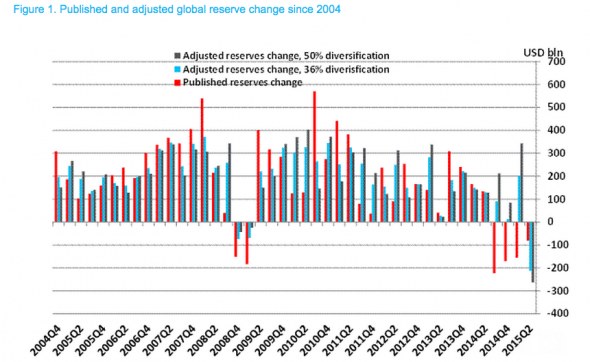

Note the following chart from Citi’s Steven Englander this week (our emphasis):

As can be seen, a simply massive shift is under way. And it totally ties in with the decline in the oil price....MUCH MORE

As Englander comments (our emphasis):

In our judgment the blue bars are better estimates of what reserves managers are actually buying and selling than the red bar which is the change in the value of their reserves portfolios. The Q2 drop in reserves also matches the sharp drop in EM investor FX positioning that we highlighted in Figure 4 of USD position shift, so the story looks like EM reserve managers selling reserves to partially offset the private sector outflow from EM....