On the other hand, show her something genuinely useful and she might write about that.

From FT Alphaville:

Citi’s back with the upcoming third edition of its Disruptive Innovations report, with ten new big opportunities to stop and think about.

These include:

- Autonomous driving

- Drones

- Machine learning/artificial intelligence

- Biosimilars

- Floating LNG

- Public API

- Sharing economy

- Virtual reality

- Marketplace banking

- Robo-advisors

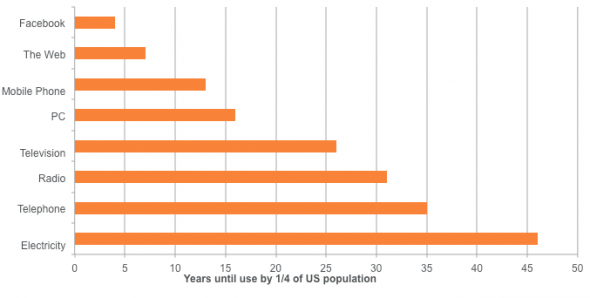

But first, the report strives to reconcile the conflicting things we’re hearing about the rate of innovation. On the one hand the work of Robert Gordon (supported by productivity data) implies the low hanging fruits of innovation have all been picked. On the other hand, we all intuitively feel that the pace of technological change has been speeding up, with charts like this reflecting the quickening pace of new technological adoption:

Albeit “new technology” increasingly seems to consist of software upgrades and new ways of organising data and information, or alternatively anything that encourages hyper-connectivity and herding/predictable behaviour.

Regarding this growing connectivity amoeba effect, Citi says:...MUCH MORE

Increasing connectivity opens up new markets, aids collaboration and unlocks brainpower to help solve the world’s problems — all driving the pace of innovation. The next stage for connectivity is a move from connecting people to connecting things through machine-to-machine communication, i.e. the ‘Internet of Things’. In 2013, Cisco estimated that 99.4% of physical objects were unconnected, equating to 10 billion connected devices. They forecast the number of connected devices will increase to 50 billion by 2020 and 500 billion by 2030 meaning machine-to-machine communication will surpass human communication.Then there’s the fact that the costs of innovation are falling. No note, however, on whether we’re moving to an innovation cycle where just having an original “creative thought” which is distinct from the wider amoeba qualifies for a mass capital market award.

Here’s Citi:

The rise of the Internet has allowed new open source models to develop, offering universal access via the free license of a product’s design and its subsequent enhancements. These models allow thousands of developers to take part in opensource projects driving better, cheaper, easier and faster products when compared to proprietary alternatives. Without open source many cloud computing, big data and mobile applications would not exist. Google’s Android platform, Tesla (electric vehicles and energy storage), Toyota (hydrogen cars), Khan Academy (already the world’s largest education organization) and some 3D printing blueprints are all examples of open source ecosystems that help foster further innovation. So too does the App Economy, where the cost of innovation appears low (a recent survey by OMS’s Carl Frey estimated the average cost to develop an app was just $6,453) and the gains for some can be substantial (both Apple and Google share 70% of the gross bookings with app developers).So why the disconnect between our perception of innovation and actual productivity figures? Citi points to the ‘in vogue’ argument among Silicon Valley billionaires which is that the productivity gains are being incorrectly measured....