From Dragonfly Capital:

Heavy equipment manufacturer Caterpillar, $CAT, ran higher from its October lows taking after its ticker symbol, a wild animal chasing a meal. But now it has pulled back, tired from the run and is looking more like an insect about to become part of the market’s meal. It’s running mate Deere, $DE, is not much better. Let’s take a look.

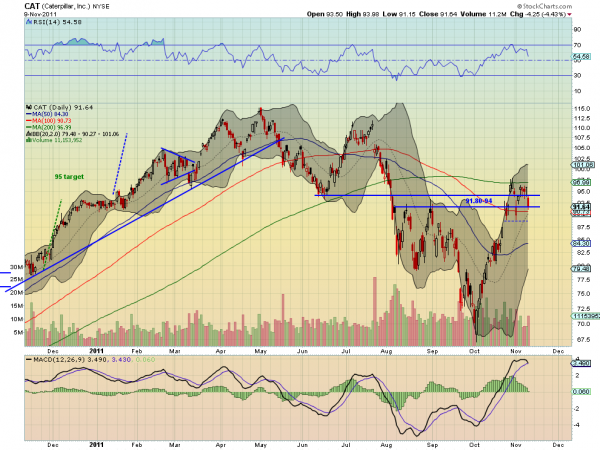

Caterpillar, $CAT, has been printing a series of topping candlesticks over the last 10 days starting with the two candles with long upper shadows piercing through the 200 day Simple Moving Average (SMA) and then the Hanging Man candles more recently. Wednesday it pulled back t the previous support area near 91.80 and has one level of support lower near 88.75 before it closes the gap lower to 87.50 and beyond. The Relative Strength Index (RSI) is also pointing lower and the Moving Average Convergence Divergence (MACD) indicator is about to cross bearishly negative. This looks like a good short under 87.50....MORE