Action Baby, Action: "Now Sixteen Volatility ETPs, Four of Which Are Optionable" (VIX; TVIX; VXX)

From VIX and More:

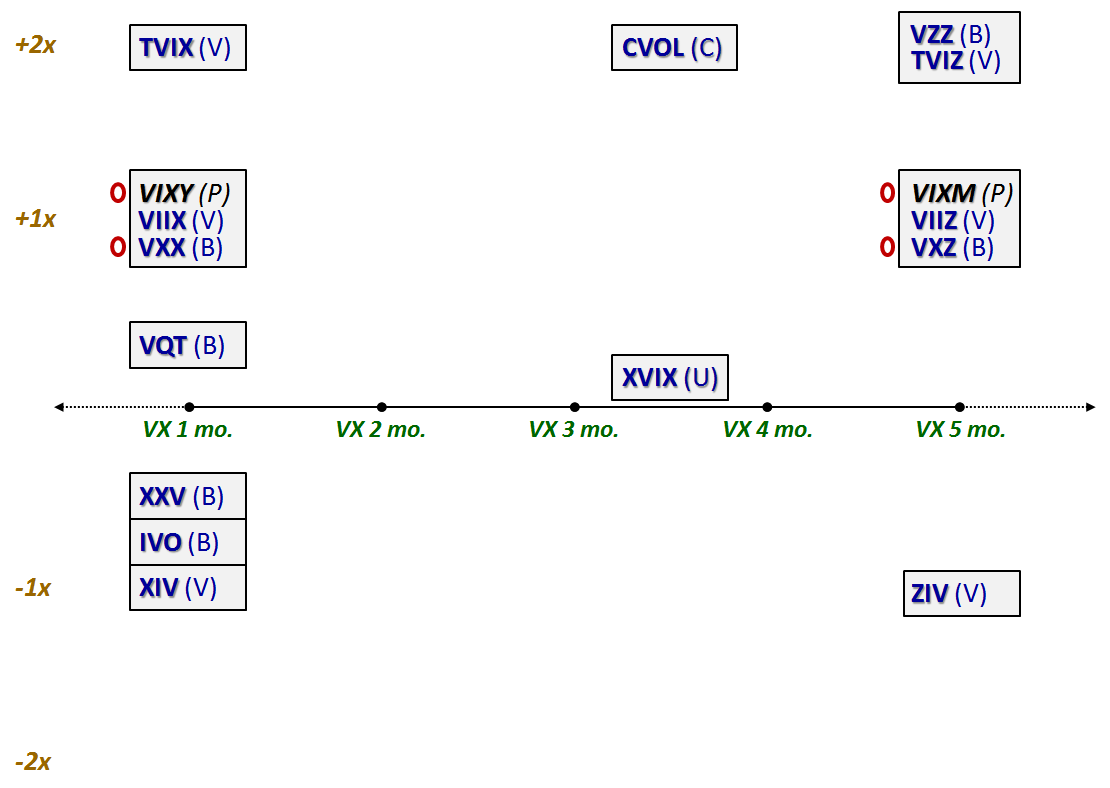

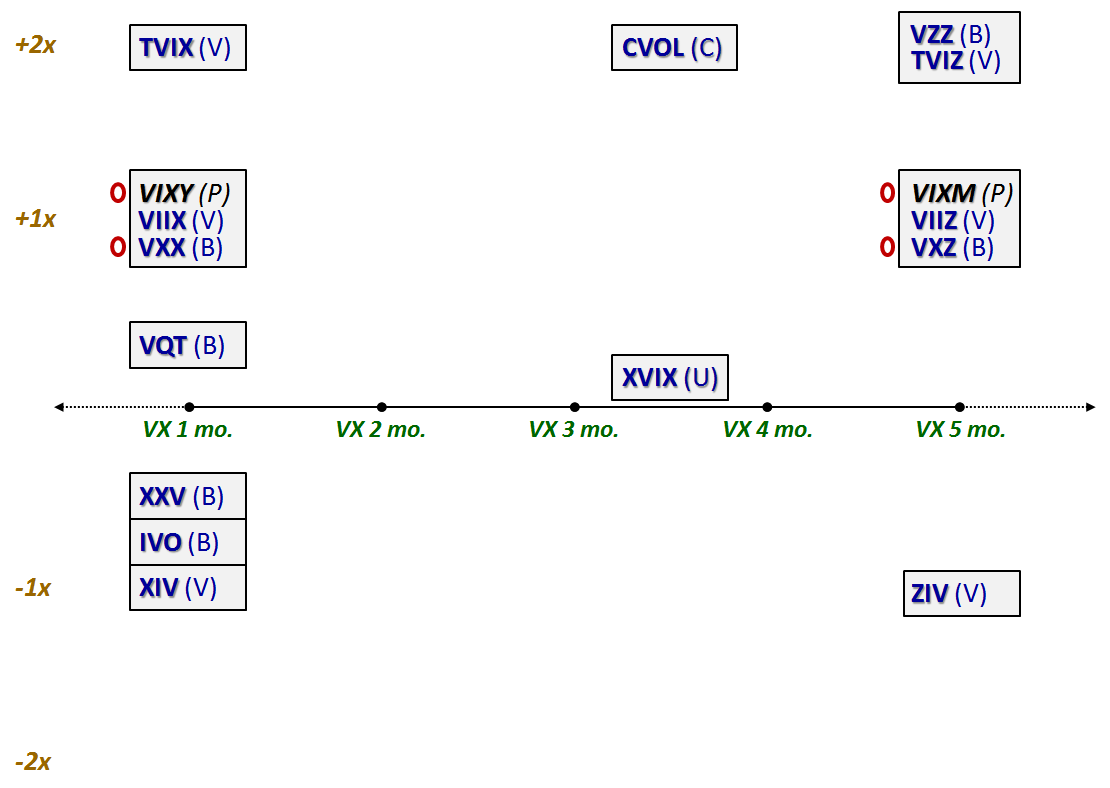

The graphic below is part of my ongoing effort not only to maintain a list of all the volatility-based exchange-traded products, but present them in a manner which helps to highlight the distinctions among these products.

Since I last updated this picture, in early December, three new VIX-based ETPs have entered the fold. Two of these are the first VIX-based ETFs and also represent the first products in this space from industry heavyweight and leveraged/inverse ETF heavyweight ProShares:

- ProShares VIX Short-Term Futures (VIXY)

- ProShares VIX Mid-Term Futures (VIXM)

As the chart below shows, VIXY enters the already-crowded space of VIX-based ETPs targeting VIX futures with one month maturity, while VIXM is aimed at the five month maturity space. ProShares undoubtedly hopes that by differentiating its products as ETFs rather than ETNs, the absence of credit risk associated with ETNs will resonate with investors. I have highlighted this distinction by using black italics for the ticker symbol of both ETFs....MORE