"The honest politician is one who when he is bought,

will stay bought."

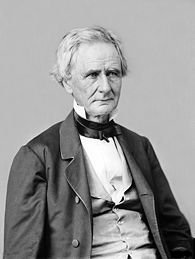

The first recipient (April, 2007) of the prestigious "Climateer: Our Hero" award,

Sen. Simon Cameron, Republican and Democrat of Pennsylvania.

Just making the point that if your business model depends on politicians, you'd best bet on dependable politicians.

Or stock up on Depends.

First up, Bloomberg:

Cornwall, the poorest county in England, said five months ago it expected a “gold rush” of $1.6 billion in solar energy investments. Now, the U.K. government may get in the way.And from Eric Rosenbaum at TheStreet:

The central government said this month it’s considering cutting incentives and reducing the size of projects, concerned that the above-market rates it promised through April 2012 may lead to too many solar farms.

Britain is moving faster than any other European country to contain a surge in solar power and prevent the boom-and-bust seen in Spain and predicted for the Czech Republic. The risk is scaring off the investors who would create the “green jobs” Prime Minister David Cameron is seeking to revive the economy.

“It’s going to completely kill the market,” said Tim German, renewable energy manager for the local government in Cornwall at the U.K.’s southwest tip. “Investors are starting to get cold feet.”

Sharp Corp., the Osaka-based electronics maker which employs 1,100 U.K. workers after doubling the size of its panel factory in Wales, says the government may cripple the industry. Already, companies are scaling back. Matrix Group Ltd. and Ingenious Media Holdings Plc suspended solar funds seeking 55 million pounds ($89 million). Low Carbon Solar Ltd. says it can’t spend the 70 million pounds it secured from pension funds.

At Good Energy Group Plc, a clean electricity retailer based in Chippenham, England, Chief Executive Officer Juliet Davenport says she may only get 4 percent of the 100 megawatts of solar power-purchase agreements she wanted.

‘Rug Has Been Pulled’

“It was an industry that for the first time was moving fast and attracting investment,” Davenport said. “Suddenly, the rug has been pulled and everybody’s saying ‘What’s the future? Should we go off to North Africa and develop there and forget about the U.K.?’”

The solar surge began April 1, when the government brought in so-called feed-in tariffs guaranteeing prices as much as 12 times the market rate for electricity generated from the sun. Last year, developers doubled the capacity of solar power generation in the U.K. to 66 megawatts, enough for 9,000 homes....MORE

Shares of most of solar stocks were down broadly on Monday as fears of more sudden, and more severe, changes in the boom market of Italy overtook the stocks. Several Street reports indicated that a new draft being introduced this week in Italian parliament would cap solar installations at 8 gigawatts, and the cap would be implemented immediately and with no grandfathering clause.

Trading in solar stocks was heavy on Monday morning, with several of the most traded stocks in the space reaching average daily volume levels before the midday mark. The selloff in solar stocks began on Friday, when the new draft was introduced, though not widely reported by the Street firms.

For any solar investor, the most important caveat in digesting the latest from Italy is to remember that a draft is only a draft. It's far from the final package of solar subsidy changes to be approved in Italy. However, the language in the draft was more extreme than the market expected. The tension that exists in Italy hasn't changed: Is it a market scenario 2011 that is a repeat of Spain 2008 or Germany 2010?

n both cases, the solar industry was confidently predicting that the changes would not be as severe as feared. In the case of Germany in 2010, the industry was right; in the case of Spain 2008, the industry was wrong. Recent commentary about potential changes in Italy has focused on any changes to its solar support being pushed out to 2012, which allowed solar stocks to rally. Germany has slowed, but it didn't play out as the original draft legislation introduced at the beginning of 2010 would have implied....MORE