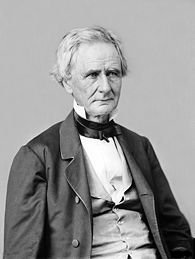

There's a reason the first inductee into the prestigious Climateer 'Our Hero' Hall of Fame was Simon Cameron, Democrat and Republican Senator from Pennsylvania:

...Finally for investors in rent-seeking organizations there is the real risk that the politicians will change the rules. Heed the words of Sen. Simon Cameron (R&D!-Pa.):

"The honest politician is one who when he is bought, will stay bought."

Our Hero

From the BBC:

The offices of London's carbon trading companies are a little quieter than usual.

The firms - many based in the City - buy and sell one of the world's newest commodities: carbon dioxide.

The trade in such permits allows polluters to pay for emissions reductions made elsewhere.

The market could be huge, but its future is now uncertain. It depends on how governments decide to tackle climate change beyond 2012.

The trade was first created by the Kyoto protocol in 1997.

Abyd Karmali was then an energy and climate change officer with the United Nations Environment Programme.

He now heads up the Carbon Markets & Investors Association, and is the global head of carbon markets at Bank of America Merrill Lynch....

...Professor Dieter Helm is a former government advisor and now a fierce critic of the system."What we had was the worst form of capture of economic rents or lobbying you could imagine... everyone uses whatever is available to ensure its in their economic interest," he claims....MORE

You'll see a lot of the Carbonistas* are former politicians or bureaucrats, the trend, naturally enough, is most pronounced in Europe with guys like Nicholas Stern and Tony Blair in the carbon business.

In the U.S. Al Gore is the most famous, his Generation Investment Management owns a chunk of carbon trader Camco. Lots of U.N. types in the biz too.

*We've also considered Carboñeró , The Great Carbono (for Al), etc.

An even gloomier take on the hazards of Political Capitalism/Corporatism from Reuters:

Carbon trade on brink of boom - or backwater

Emissions trading stands at a crossroads -- a future as a $2 trillion market if the United States bolsters it, or as a modest sideline to energy and commodities trade if a new climate treaty is not agreed.

Some players have bet on the growth of the $126 billion global carbon market after 2012 but regulatory uncertainty will be drawn out for another year as a deadline for a binding treaty on greenhouse gas emissions was pushed back to 2010 this week.

That uncertainty about the future form of emissions trading after the Kyoto Protocol expires in 2012 could put off new entrants and discourage banks, brokers, funds and commodity traders from expanding their operations.

"It looks like carbon trading will remain a small backwater in commodities markets," said David Metcalfe, chief executive of UK-based research group Verdantix.

"With fewer participants coming into the market because of remaining uncertainty, there will be less trading parties, less liquidity and less commission.">>>MORE