From the Baiguan substack, July 31:

“The Chip War cannot be rushed, but the War of AI cannot be delayed”

Today, we are presenting an interesting article on China-US tech rivalry, because in our eyes it reflects how many of the Chinese elite look at the US technology ban on China. These are the main ideas of the article:

One important consequence of the US embargo is that it helps create a huge market demand for China’s semiconductor industry, so the market mechanism replaces government subsidies as the main driving force.

Building a domestic semiconductor industry is hard, and will take very long time, but China is no stranger to this type of development. It’s only a matter of when and how fast.

However, the revolution in artificial intelligence adds a new variable to the game, something China must seize on as quickly as possible (you may read here on how Chinese government is responding with the final version of AIGC regulation).

The original article is written by Boss Dai 戴老板, a famous technology and business influencer in China. Our translation is not reviewed by the author.

关于芯片战争的二三事 A few things about the Chip War

By Boss Dai

Recently, Janet Yellen visited China with reportedly many "tasks" to accomplish. Foreign media summarized one of her tasks as "convincing Chinese officials that the series of measures taken by the US to prevent China from accessing sensitive technologies such as semiconductors in the name of national security is not intended to harm the Chinese economy."

It is already 2023, and the US has launched more than ten rounds of bans on China's chip industry. The number of mainland enterprises and individuals on the entity list has exceeded 2,000. It is heartwarming that they can still come up with such a noble reason.

It is estimated that even the Americans cannot stand it anymore. This statement was soon refuted by another article on the New York Times.

Four days after Yellen left China, Alex Palmer, a well-known China reporter for foreign media, published an article in the NYT that explained the essence of the US chip blockade in the title: "This is an Act of War."

Alex Palmer graduated from Harvard and was among the first Yenching Scholar at Peking University. He has been reporting on China for a long time, covering topics such as Xu Xiang, fentanyl, and TikTok. He is a familiar figure who has been “hurting the feelings of the Chinese people”. However, in the matter of chip technology, he managed to extract the truth from the Americans.

In the article, one interviewee bluntly stated, "Not only will we not allow China to make any technological progress, but we will also actively reverse their current technological level." The chip ban is essentially aimed at eradicating China's entire advanced technology ecosystem.

The Americans used the word "eradicate," which carries the meanings of "exterminate" and "uproot," often associated with diseases like smallpox or Mexican drug cartels. Now, this word is being used to describe China's high-tech industry. The author predicts in the article that if these measures succeed, it could impact the progress of an entire generation in China.

Anyone who wants to understand the severity of this war only needs to repeatedly ponder the word "eradicate."

An upgraded war

The rules of competition and the rules of war are two completely different things. Business competition is a contest under legal framework, but war is different. The opponent will almost never consider any rules or restrictions and will do whatever it takes to achieve their strategic objectives. Especially in the chip industry, the United States can even keep changing the rules - as soon as you adapt to one set, it will immediately switch to a new one to deal with you.

For example, in 2018, the US Department of Commerce sanctioned Fujian Jinhua by using the "Entity List," directly leading to the latter's shutdown (which has since resumed operations); after this kind of small success, [The US Government] also included Huawei in the Entity List in 2019, restricting US companies from providing products and services to it, such as EDA software and Google's GMS.

After discovering that these methods were not enough to completely "eradicate" Huawei, the US changed the rules: starting in May 2020, all companies using US technology could not supply Huawei, such as TSMC's foundry. This directly led to the stagnation of HiSilicon and the significant decline of Huawei's smartphones, bringing more than 100 billion yuan in losses to the Chinese industrial chain every year.

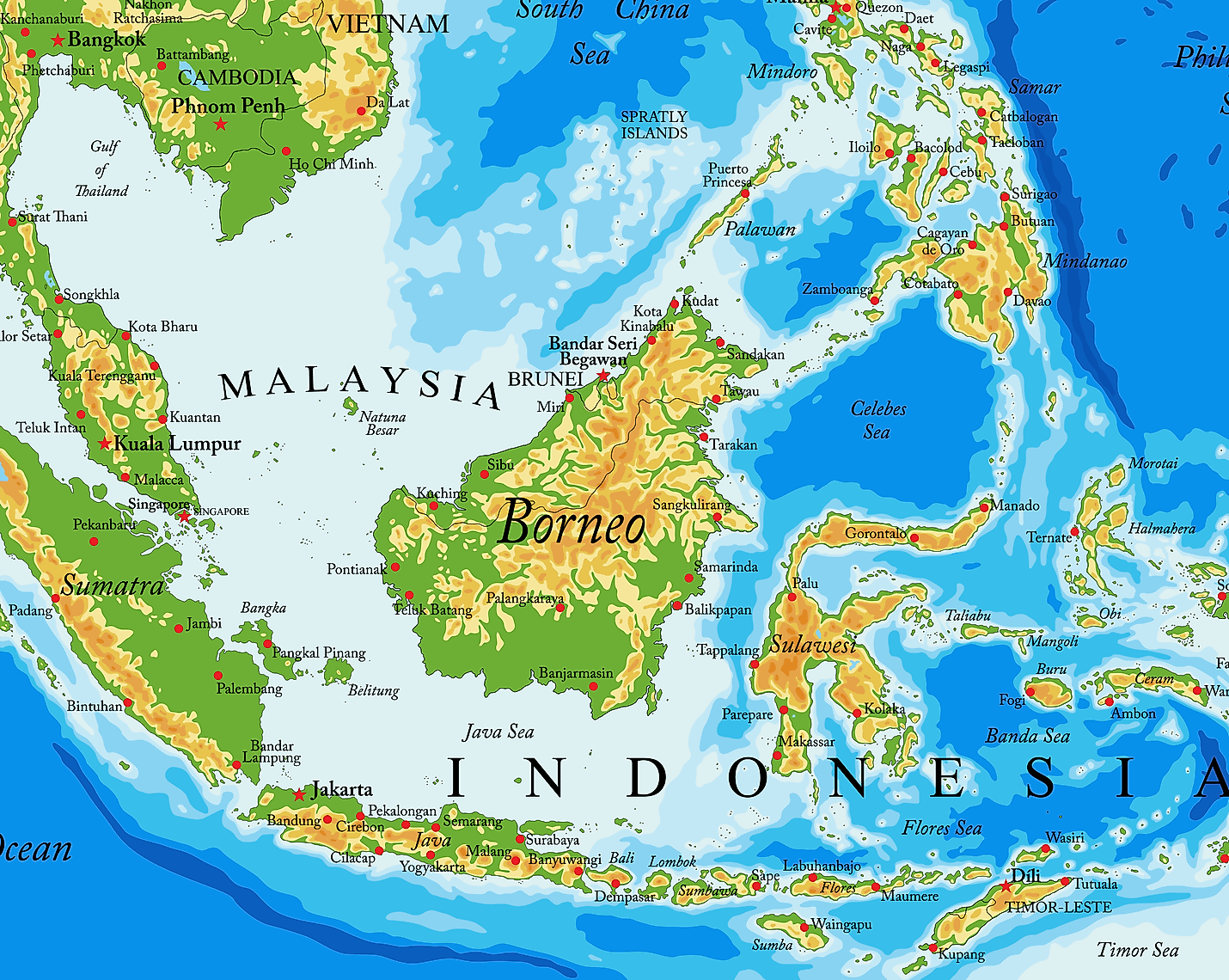

Afterward, the Biden administration escalated its targets from "companies" to "industries," and a large number of Chinese companies, universities, and research institutions were subsequently included in the ban list. On October 7, 2022, the Bureau of Industry and Security (BIS) of the U.S. Department of Commerce issued new export control regulations, effectively imposing a "ceiling" on Chinese semiconductors. Logic chips below 16nm or 14nm, NAND storage with 128 layers or more, and integrated circuits (DRAM) below 18nm are restricted from export. Additionally, computing chips with a performance exceeding 4800 TOPS and interconnection bandwidth exceeding 600GB/s are also restricted from supply, whether through manufacturing or direct sales.

Using the words of a Washington think tank: Trump targeted companies, while Biden is targeting industries.

When reading the novel "The Three-Body Problem," ordinary readers can easily understand the plot of the Trisolarans to lock down Earth's technology [Baiguan note: This novel is a widely-read and widely-cited Chinese sci-fi series, in which the aliens, called the Trisolorans, used a super technology to keep a lid on basic science research on Earth]. However, in real life, many non-industry individuals tend to have a certain perception when observing the chip ban: as long as you comply with U.S. rules, you won't be targeted; if you are targeted, it means you did something wrong.

Having such a perception is normal because many people's thinking is still within the framework of "competition." However, in a “war”, this perception may be just an illusion. In recent years, many semiconductor executives have expressed that when a company ventures into advanced fields in R&D (even just in preliminary research), they will encounter an invisible barrier.

The development of high-end chips is based on a global technology supply chain. For example, to make a 5nm SoC chip, one needs to license from ARM, software from Cadence or Synopsys, patents from Qualcomm, and coordinate production capacity with TSMC. By doing these actions, one will come under the purview of the BIS’s regulations....

....MUCH MORE, the Baiguan outro analysis is food for thought as well.

I think I'll consult Alanis Morissette on the topic, "Isn't it ironic."