From SemiAnalysis, March 11:

China's Dominance Playbook, General Purpose Robotics Is The Holy Grail, Robotic Systems Breakdown, Supply Chain Hardships, The West Is Positioned Backward And Covering Their Eyes, China's Clear Path to Full Scale Automation, Call For Action

SemiAnalysis is hosting an Nvidia Blackwell GPU Hackathon on Sunday March 16th.

It is the ultimate playground for Blackwell PTX tech enthusiasts,

offering hands-on exploration of Blackwell & PTX infrastructure

while collaborating on open-source projects. Speakers will include

Philippe Tillet of OpenAI, Tri Dao of TogetherAI, Horace He of Thinking

Machines, and more. Sponsored by: Together, Lambda, Google Cloud,

Nvidia, GPU Mode, Thinking Machines, OpenAI, PyTorch, Coreweave, Nebius.

Apply to be part of the fun.

This is a Call for Action for the United States of America and the

West. We are in the early precipice of a nonlinear transformation in

industrial society, but the bedrock the US is standing on is shaky.

Automation and robotics is currently undergoing a revolution that will

enable full-scale automation of all manufacturing and mission-critical

industries. These intelligent robotics systems will be the first ever

additional industrial piece that is not supplemental but fully additive–

24/7 labor with higher throughput than any human—, allowing for massive

expansion in production capacities past adding another human unit of

work. The only country that is positioned to capture this level of

automation is currently China, and should China achieve it without the

US following suit, the production expansion will be granted only to

China, posing an existential threat to the US as it is outcompeted in

all capacities.

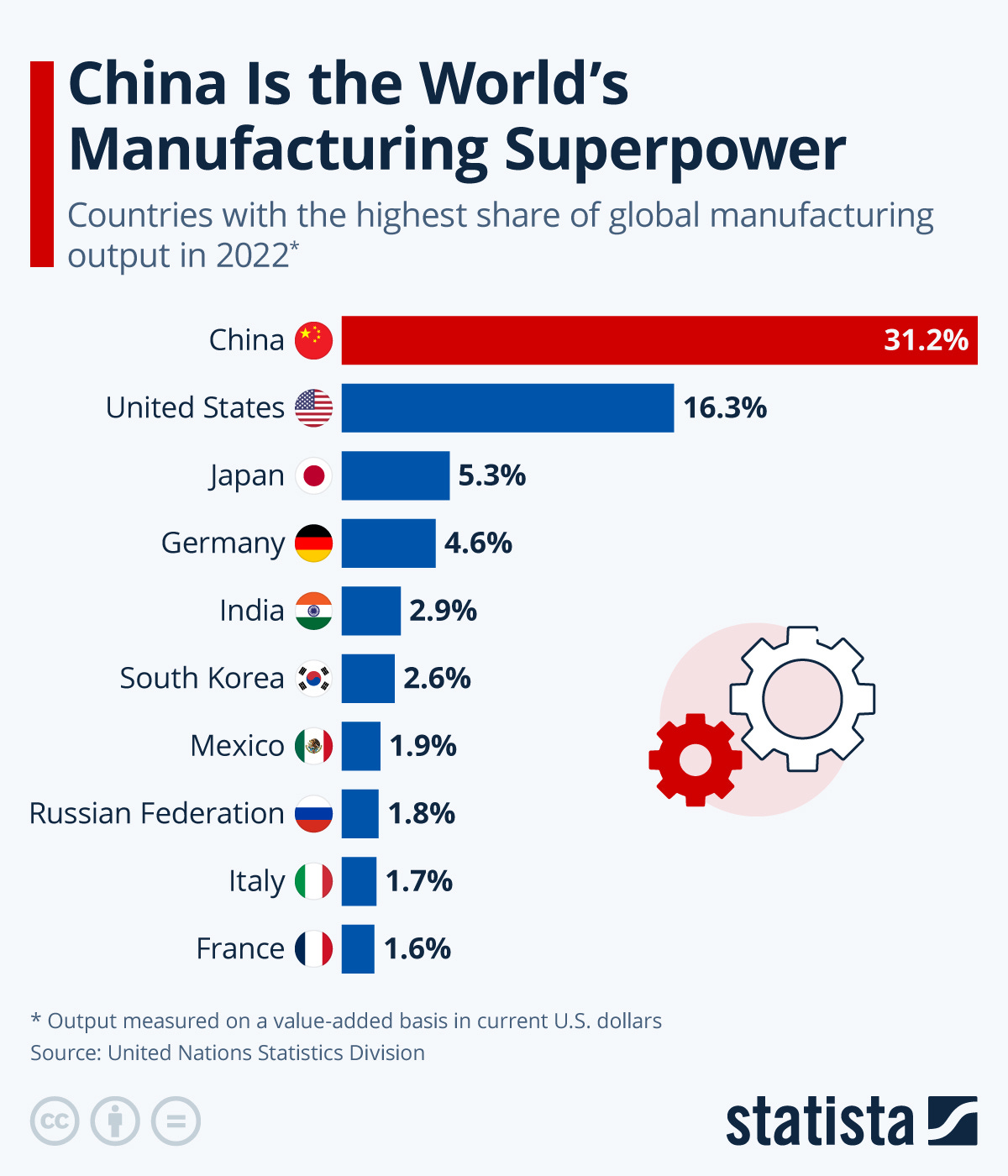

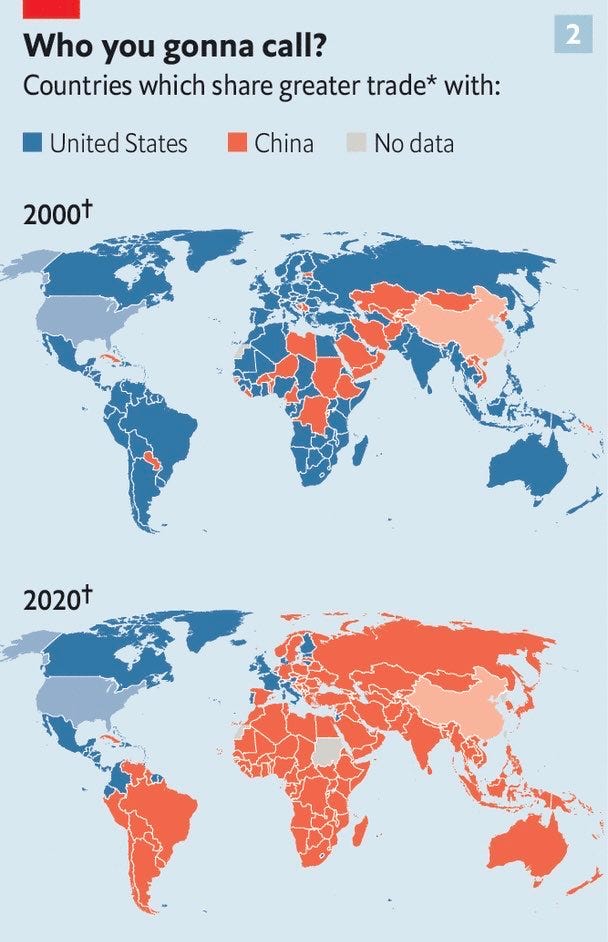

This is the manufacturing playing field that China has dominated for

years now. The country has one of the most competitive economies in the

world internally, where they will naturally achieve economies of scale

and have shown themselves to be one of most skilled in high-volume

manufacturing, at the same time their engineering quality has grown to

be competitive in several critical industries at the highest level. This

has already happened in batteries, solar, and is well underway in EVs.

With these economies of scale, they are able to supply large developing

markets, like Southeast Asia, Latin America, and others, allowing them

to extend their advantage and influence.

The impact of this in robotics will be exponential compared to their

last strategic industry captures. These will be robotics systems

manufacturing more robotics systems, and with each unit produced the

cost will be driven down continuously and the quality will improve, only

strengthening their production flywheel. This will repeat ad infinitum

and as quality inevitably increases it will make it extraordinarily

difficult for other countries to compete. Due to the fact that robotics

is a general purpose technology, this will have horizontal impacts on

all manufacturing sectors and all other currently advantaged industries

as well–textiles, electronics, consumer goods, etc. At the moment, the

West is caught flatfooted: South Korea and Japan have a birth rate

crisis that is throttling their manufacturing capabilities, European

industrial sectors are being eaten alive by China and their inability to

generate power, and the US is focused on other markets and procuring

cheap overseas production, all the while China’s manufacturing capacity

has gotten stronger and robotics is catching fire.

Source: SemiAnalysis, IFR.org.

China’s robotics localization effort is well underway. Local firms

are taking over the world’s largest market, approaching a 50% market

share, compared to just 30% in 2020. While Chinese manufacturers are

currently on par with Western giants in the low-end market, our supply

chain review leads us to believe that local firms are beginning to take

over the higher-end market segments. The rise of Unitree exemplifies

this shift: the only viable humanoid robot on the market, the Unitree

G1, is now entirely decoupled from American components.

Source: SemiAnalysis, IFR.org.

Today, building an identical robot arm (modeled after the Universal Robots UR5e) in the US is ~2.2x more expensive than in China. Under the hood, the situation is even more alarming. Even if those components are labeled “Made in USA”, they rely heavily upon China-made parts and materials – with no viable scalable alternative.

Source: SemiAnalysis

Drones, DJI, GoPro, and How Iteration Speed Paves Victory’s Path

The commercial drone market exemplifies China’s scale/oversupply playbook in every strategic industry it has entered, however, this is the first example of the strategy in a robotics-adjacent market. Local leader DJI today accounts for over 80% of the global commercial drone market… and 90% in the American consumer market! While the company was a first-mover, it maintained and consolidated its market position for over a decade thanks to China’s manufacturing dominance and economies of scale/oversupply strategy.

Source: SemiAnalysis, Industry Estimates

Let us explain how. To properly develop a functional and robust piece

of hardware, the creation + recreation (i.e. manufacturing) must be

iterated repeatedly and rapidly to work out the kinks and perfect the

product before competitors. However, the most challenging thing for

Western competitors is that Chinese markets are built to reward the

company that can scale the fastest, so before a Chinese competitor ever

enters the Western market it has already outclassed them in cost, all

that’s left is for the quality to refine over the coming iterations.

GoPro tried to compete in the consumer drone market despite having

most of its manufacturing based in China, Malaysia, and Japan, which

meant that each iteration of their drone took several weeks – likely

starting the design in California, sending over the details to the

manufacturers in China and having them build it, and shipping it back to

the USA before ever finding out what needed to be ironed out in this

attempt. Contrast this with DJI, which was based in Shenzhen, meaning

the company could get any needed part from any factory in Shenzhen

within hours of ordering and iterate at an unreal speed.

As a result, in 2016, GoPro’s Karma Drone + Hero5 were outclassed by

DJI’s drones. At $999 vs $1,099, DJI was slightly cheaper, had a battery

life 50% longer, had obstacle avoidance already implemented, and the

launch of the Karma was plagued with hardware issues and a recall/refund program

for their faulty product, which sometimes lost power during operation.

GoPro likely could have solved these problems through enough work, but

the company simply didn’t have the time, as DJI had already surpassed

them in every way.

Quickly after entering the Western markets, DJI’s incredible cost

advantage and sheer production capacity quickly led to oversupplying the

market, and capturing a massive amount of market share. Every other

major drone company was quickly undercut heavily by DJI’s aggressive

pricing. GoPro cited “margin challenges” being a reason for disbanding their Karma program, and many other companies crashed

alongside. DJI was the only one to understand that this was a

competition of scale and had long been prepared before entering the

Western markets.

In the world of Robotics, manufacturing dominance is key. To build a

complete and functional robot means recreating the robot countless times

and fine-tuning each minor mistake until a solid, scalable, and

cost-effective product. This luxury is readily available to those who

have the manufacturing capacity nearby and at an affordable cost, and

its absence means a disadvantage. With a share of GDP three times higher

than that of the US, China’s industrial base outcompetes that of

America’s in every possible way.

Source: Worldbank, FRED

Our goal with this multi-part Robotics series is to illuminate

landscape of the robotics and manufacturing industry, and convey the

magnitude of the labor transformation it is poised to unleash. In Part

One, we examine the current state of the market and take a deep dive

into the hardware architecture of commercially available industrial

robots. Our analysis demonstrates that China is rapidly taking over the

market, leaving competing nations behind and preparing to capture a

revolutionary technology. We also explore the broader repercussions for

the Western trailing-edge semiconductor ecosystem.

China’s ascendancy positions it perfectly to lead next-generation

robotics—a field we anticipate will generate significantly higher

macroeconomic benefits. In Parts Two and Three of our series, we will

delve into the intricate hardware and software architectures of

next-generation systems and address the remaining challenges on the path

to achieving “Robotics AGI” across form factors. We will also pinpoint

the likely frontrunners in this emerging market.

For now, let’s start with some basics and explain how why robots are more difficult to build than most understand.

More Than Just A “Robot”

Robotics is a systems engineering problem with the end goal being a machine, or multiple machines, that can produce one or more human unit of work at equal or lower cost than that of a human. The feat is designing both a system of hardware with many many interconnected individual parts integrated with the software layer, where the software layer understands how to move and plan with the hardware. Repeated iterations are necessary to identify the discrepancies between the two systems and resolve them toward perfect accuracy. In essence, this is a delicate dance between two systems, with each iteration of choreography carving synchronicity from complexity. What happens as each etch gets closer to resolution?....

....MUCH MORE