Unmarked soldiers have seized both Sevastopol and Simferopol airports, and have established roadblocks at key locations in the Crimea. The deposed president, Viktor Yanukovych, who still maintains he is the legitimate head of state, is due to give a press conference shortly in Rostov-on-Don in Russia. While Russia continues to vow that it will respect the territorial integrity of Ukraine, it appears ever more likely that a Russian intervention in Crimea is already under way....MUCH MORE

Yesterday’s liveblog can be found here. For an overview and analysis of this developing story see see our latest podcast.

Below, we will be making regular updates throughout the day:

2134 GMT: Independent media going off the air?

Ayder Muzhdabayev, deputy editor of Moskovsky Komsomolets, reported on Facebook 2 hours ago:

Urgent from Crimea

Armed divisions have seized the state television station (GTRK) of Crimea. All the staff have gathered together at the Crimean Tatar TV channel ATR, hundreds of others have come. They are waiting for the seizure. Several APCs have arrived. For now, they’ve passed by. They are also expected seizure of the building of the Crimean Tatar’s Medjlis [Assembly]. People are already going there. Everyone is afraid of what will happen tonight. There it is.

Friends, colleagues, take care of yourself! Don’t resist the military. God save Crimea!

2134 GMT: Russian blogger Lev Shlosberg who writes for the newspaper Pskovskaya Guberniya has written this report today at 4:42 pm (translated by The Interpreter) that says that Russian “Officers and Contractors of the 76th Chernihov (Pskov) Storm Troops Division” are now in Ukraine:

According to one of the participants in the operation, officers and contractors of the 76th Shock Troops Division have been re-locating to Ukrainian territory since last week. By early this week, there were already more than 100 soldiers. The last of the famous detachments was sent on Thursday, 27 February. They are fully armed, with 5,000 rounds of ammunition per person. There is one truck per 10 soldiers, and they are completely loaded with weapons including flame-throwers. Upon arrival on the territory of Ukraine, they did not report their geographical locations to people, and they were assigned local tasks. Most likely, this was Sevastopol and Simferopol. Emergency troops remain in Yysk, and did not take part in the operation. The barracks of the 76th Storm Troops Division on Margelova Street in Pskov is practically empty.

2128 GMT: Vladimir Zhirinovsky, a Russian politician who is the founder of the Liberal Democratic Party of Russia (LDPR) and is also a colonel in the Russian army, says he is stuck in Crimea, and he’s blaming Kiev:

2123 GMT: UNN has this report (translated by The Interpreter).

Crimean Parliament Creates Berkut Division of Ex-Berkut Soldiers The Verkhovna Rada or parliament of Crimea has created a Berkut special division to protect public order which will be subordinate exclusively to the republican [Crimean] government, says Rustam Temirgaliev, first vice premier of the Council of Ministers of Crimea, unn.com.ua reported, citing Temirgaliev’s Facebook page. “I met with the soldiers from Berkut late last night and agreed to create a Crimean Berkut special division to protect public order which will be subordinate exclusively to the Republican government,” he said. Verkhovna Rada deputies have already passed the relevant decision.

2113 GMT: UNN reports that the entire command of the Ukrainian navy has resigned. This may be a rumor, however, since the UNN report also notes that the Ministry of Defense has no mention of this on their website, and their press service has not reported it.

Friday, February 28, 2014

Ukraine Liveblog Day 11: Airports Seized

From The Interpreter:

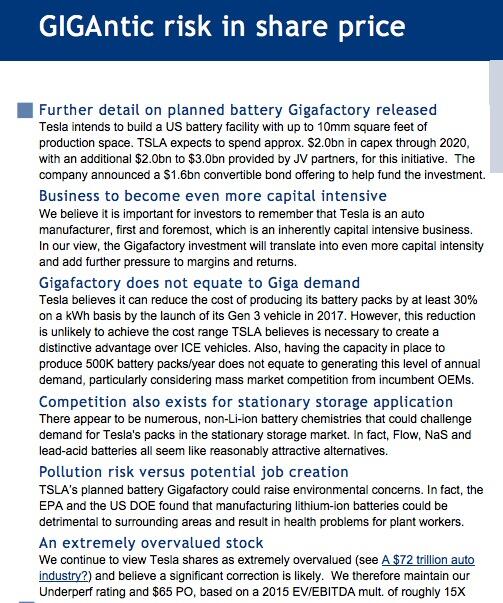

Chartology: The Gap in the Tesla Chart (TSLA)

The stock was down $7.73 (3.06%) today, the biggest decline since the earnings report on the 19th when this run started at $193.64.

From The Canadian Technician at StockCharts:

Does WhatsApp and Tesla Remind Anyone Else of Ballard Power?

.....MORE

From The Canadian Technician at StockCharts:

Does WhatsApp and Tesla Remind Anyone Else of Ballard Power?

...Well, here is TSLA. TSLA went from 196 to 260 in a week on Gigafactory discussions. That's no comedy! Everybody rushed into the stock with the greatest idea of the century.

.....MORE

Ethanol: "No, Medieval people didn't drink booze to avoid dirty water"

From io9:

It seems to be common wisdom that Europeans in the Middle Ages drank primarily beer and wine because water wasn't generally safe to drink. This, however, is a rather persistent myth as water was a regular part of the Medieval diet.Food historian Jim Chevallier examines what he calls "The great Medieval water myth" at his blog Les Leftovers. He cites a handful of modern writers who have specifically examined water in Medieval Europe, including Paolo Squatriti, author of Water and Society in Early Medieval Italy, AD 400-1000, and Steven Solomon, author of Water: The Epic Struggle for Wealth, Power, and Civilization, and looks back at primary sources from the time, which, he says, are always uncritical when they mention the drinking of water.He notes that some Medieval writers laid out instructions on how to tell bad water from good (and sometimes even recommended boiling water that smelled iffy), and mentions one physician who recommended against drinking too much water....MORE

Although the story has a pretty good picture to illustrate it there are better ones they could have used:

(Image of a serf using a primitive beer bong from the Luttrell Psalter)

(Image of a serf using a primitive beer bong from the Luttrell Psalter)

Racing Alongside the Machines: "The jobless economy"

From Noahpinion:

The jobless economy

The jobless economy

I was recently interviewed by Tom Ashbrook for NPR's "On Point" about the "jobless economy" - basically, the "rise of the robots" that everyone is talking about. Erik Brynjolfsson and Andy McAfee, authors of the new book The Second Machine Age, were also on the program. You can listen to the audio here.

Erik and Andy had very coherent and well-prepared points, which is not surprising given that they've just written a book on the subject. I haven't yet formed a single dominant thesis about the "rise of the robots", so my thoughts were separated into a number of distinct points. Those points were:

1. Technology has not been as important a force behind inequality and unemployment during the last 15 years as many people think; up til now, the much bigger story has been globalization (especially China). This is supported by Mike Elsby's research on the subject. But going forward, the "rise of the robots" may be a much bigger worry, and we need to think about how to respond to it.2. It's not yet clear if human labor will find a way to remain valuable en masse in the age of automation and the digital economy. That ended up happening in the Industrial Revolution, but there is no guarantee that it will happen again. We need to be prepared for the possibility that large numbers of humans are rendered nearly obsolete by new technology.3. In the short term (~5 yrs), infrastructure spending can boost our economy and help people get more jobs and higher wages. But that opportunity will be played out and will not repeat itself....MORE

"Cascading effects of mental accounting by traders in the natural gas markets."

We made a judgement error in Tuesday's "Chartology: Natural Gas Appears To Have Found A Short Term Bottom" thinking the new front month would rise to the old rather than the March price declining to meet the April contract.

The emerging chart pattern still looks correct.

$4.6190 last up 10.8cents. The development of a head-and-shoulders means more upmove to create the right shoulder before the bottom falls out.

From Turnkey Analyst:

Natural Gas Trading and Mental Accounting

Feb 25

Updated--Goldman Sachs on Natural Gas

Feb 24

Natural Gas: As the British Nature Shows Used To Say...

After trading as low as $4.788 natty has bounced back to $4.8520 and may be setting up the right side of a head-and-shoulders pattern on the daily chart.From FinViz:

The emerging chart pattern still looks correct.

$4.6190 last up 10.8cents. The development of a head-and-shoulders means more upmove to create the right shoulder before the bottom falls out.

From Turnkey Analyst:

Natural Gas Trading and Mental Accounting

It has been a long, cold winter on the East Coast. This has been very good for anyone long natural gas.While it’s been a nice ride overall, prices have obviously fallen rapidly recently.

Below is a chart, as of February 26, for the April natural gas futures contract during 2014:

The February 26 version of the WSJ Journal included an article about this dramatic decline in natural gas prices, with the dramatic headline: “Futures Prices Decline 17% in Two Days as a Chill Sets in for Natural Gas.”

Within the article, Gelber & Associates was quoted as commenting in a research note:

The downward move started a chain reaction as long traders quickly exited their positions while they were still profitable.So the traders wanted to get out while the trade was still profitable? Okay, makes sense.

Later in the same article was the following observation:

Analysts and forecasters said the underlying dynamics that have driven this year’s rally in natural-gas prices are unchanged: forecasts for extraordinarily cold weather through the final weeks of winter remain in place, suggesting continued strong demand for heating-related fuels.So the underlying weather-related fundamentals have not changed in the market.

Wait, what?

How can it be that prices have dropped 17% with no material change in the fundamental outlook?

The article seems to suggest that the answer may have something to do with traders wanting to lock in their gains....MORESee also:

Feb 25

Updated--Goldman Sachs on Natural Gas

Feb 24

Natural Gas: As the British Nature Shows Used To Say...

Chartology: Frackers Breaking Out (HAL; SLB; NOV; BHI)

Although definitely not a day trading site, we have much shorter or much longer timeframes, watching the daily movers is necessary because, as they say, the long term is just a series of short terms.

From Afraid to Trade:

Trend Day Trading Stocks on the Breakout for Feb 28

And from Barron's on Monday:

Halliburton: Buy the Frac King

NOV $76.77 up 2.77%

SLB $93.75 up 1.27%

BHI $63.48 up 1.80%

Estee Lauder also moves a lot of oil but not our kind.

From Afraid to Trade:

Trend Day Trading Stocks on the Breakout for Feb 28

It’s the last day of February 2014 and US Stock Market indexes are breaking to all-time highs.

Which stocks are leading the pack and topping our daily “Intraday Trend Day” scan list?

Let’s focus our attention on the bullish/uptrending names today:

And from Barron's on Monday:

Halliburton: Buy the Frac King

Raymond James analysts J. Marshall Adkins and Collin Gerry are big believers in the U.S. oil revolution and, as an extension, Halliburton (HAL) and Baker Hughes (BHI).HAL $57.33 up 2.94%

Adkins and Gerry explain why they like Halliburton, which they upgraded to Strong Buy from Outperform:

Baker Hughes’ rating got an even bigger boost from Adkins and Gerry, who upgraded the stock to Strong Buy from Market Perform. They explain why...MOREHalliburton derives 52% of revenues from North America and currently holds the market-leading position in the pressure pumping industry. We are updating our y/y NAM revenue growth assumptions to 20% in both 2014 and 2015 (versus prior estimates of 10% and 3%). Likewise, we now model exit rate 2014 NAM margins of 20.6%, up from our prior estimate of 19.3%. The net result is our new 2014 EPS estimate of $4.30, 10% higher than consensus and a $5.85 EPS estimate for 2015, 17% higher than consensus…

In the last upcycle, Halliburton’s FCF margin (FCF over revenues) was close to 4%. We expect it could be closer to 6-10% in 2014 and 2015 due to 1) significant working capital initiatives and 2) lower international capex. This should facilitate continued dividend and share buyback increases.

NOV $76.77 up 2.77%

SLB $93.75 up 1.27%

BHI $63.48 up 1.80%

Estee Lauder also moves a lot of oil but not our kind.

Follow-up: Gold/Platinum Pair Trade (GLD; PPLT)

PPLT is the physical platinum ETF while GLD does the same for auric.

After getting to 6% to the good Jan. 22, the short gold/long platinum trade actually dipped into the red before it started going in our favor again this week:

5 day via Yahoo Finance:

and the three month:

Jan. 25

The Gold/Platinum Pair Trade: What a Difference a Couple Days Make (GLD; PPLT)

South Africa Gold Strike Delayed, Platinum Walkout Is On" (GLD; PPLT)

More on South Africa's Striking Mineworkers

Jan. 20

UPDATED--South African gold producers receive strike notice from AMCU

And where this madness began:

Nov. 26, 2013

"Platinum deficit to widen while prices decouple from gold"

Nov. 24, 2013

If You Absolutely Have to Have Precious Metals Exposure, Consider Platinum (HSBC)

After getting to 6% to the good Jan. 22, the short gold/long platinum trade actually dipped into the red before it started going in our favor again this week:

5 day via Yahoo Finance:

and the three month:

Previously:

Jan. 25

The Gold/Platinum Pair Trade: What a Difference a Couple Days Make (GLD; PPLT)

I fear I may have some 'splainin' to do at the Monday morning meeting.Jan. 22

South Africa Gold Strike Delayed, Platinum Walkout Is On" (GLD; PPLT)

This is about as good as it gets for our little short gold/long platinum pair trade.Jan. 20

More on South Africa's Striking Mineworkers

Jan. 20

UPDATED--South African gold producers receive strike notice from AMCU

And where this madness began:

Nov. 26, 2013

"Platinum deficit to widen while prices decouple from gold"

Nov. 24, 2013

If You Absolutely Have to Have Precious Metals Exposure, Consider Platinum (HSBC)

"The Kardashian Bottom in Uranium" (CCJ)

File under: Things I did not know.

From All Star Charts:

From All Star Charts:

This is one of my favorite patterns in all of technical analysis. Edwards and Magee, authors of Technical Analysis of Stock Trends back in 1948, didn’t know who Kim Kardashian was of course. So they called this pattern a “Rounding Bottom”. When it comes to these reversal patterns, the bigger and more round they are the better. Today we call this formation, the “Kardashian Bottom”.

The best part about these big, round Kardashian Bottoms is how explosive the market moves become upon completion.......MORE

Questions From MIT's 'Internet of Things Festival'

From O'Reilly Data:

Internet of Things in celebration and provocation at MIT

IoTFest reveals exemplary applications as well as challenges

Internet of Things in celebration and provocation at MIT

IoTFest reveals exemplary applications as well as challenges

Last Saturday’s IoT Festival at MIT became a meeting ground for people connecting the physical world. Embedded systems developers, security experts, data scientists, and artists all joined in this event. Although it was called a festival, it had a typical conference format with speakers, slides, and question periods. Hallway discussions were intense.

However you define the Internet of Things (O’Reilly has its own take on it, in our Solid blog site and conference), a lot stands in the way of its promise. And these hurdles are more social than technical.

Some of the social discussion we have to have before we get the Internet of Things rolling are:

We already have a lot of the technology we need, but it has to be pulled together. It must be commercially feasible at a mass production level, and robust in real-life environments presenting all their unpredictability. Many problems need to be solved at what the Jim Gettys (famous for his work on the X Window System, OLPC, and bufferbloat) called “layer 8 of the Internet”: politics....MUCH, MUCH MORE

- What effects will all this data collection, and the injection of intelligence into devices, have on privacy and personal autonomy? And how much of these precious values are we willing to risk to reap the IoT’s potential for improving life, saving resources, and lowering costs?

- Another set of trade-offs involve competing technical goals. For instance, power consumption can constrain features, and security measures can interfere with latency and speed. What is the priority for each situation in which we are deploying devices? How do we make choices based on our ultimate goals for these things?

- How do we persuade manufacturers to build standard communication protocols into everyday objects? For those manufacturers using proprietary protocols and keeping the data generated by the objects on private servers, how can we offer them business models that makes sharing data more appealing than hoarding it?

- What data do we really want? Some industries are already drowning in data. (Others, such as health care, have huge amounts of potential data locked up in inaccessible silos.) We have to decide what we need from data and collect just what’s useful. Collection and analysis will probably be iterative: we’ll collect some data to see what we need, then go back and instrument things to collect different data.

- How much can we trust the IoT? We all fly on planes that depend heavily on sensors, feedback, and automated controls. Will we trust similar controls to keep self-driving vehicles from colliding on the highway at 65 miles per hour? How much can we take humans out of the loop?

- Similarly, because hubs in the IoT are collecting data and influencing outcomes at the edges, they require a trust relationship among the edges, and between the edges and the entity who is collecting and analyzing the data.

- What do we need from government? Scads of data that is central to the IoT–people always cite the satellite GIS information as an example–comes from government sources. How much do we ask the government for help, how much do we ask it to get out of the way of private innovators, and how much can private innovators feed back to government to aid its own efforts to make our lives better?

- It’s certain that IoT will displace workers, but likely that it will also create more employment opportunities. How can we retrain workers and move them to the new opportunities without too much disruption to their lives? Will the machine serve the man, or the other way around?

"New Spy Technology to Spawn Oil Revolution"

From OilPrice:

The future of oil exploration lies in new technology--from massive data-processing supercomputers to 4D seismic to early-phase airborne spy technology that can pinpoint prospective reservoirs.

Oil and gas is getting bigger, deeper, faster and more efficient, with new technology chipping away at “peak oil” concerns. Hydraulic fracturing has caught mainstream attention, other high-tech developments in exploration and discovery have kept this ball rolling.

Oil majors are second only to the US Defense Department in terms of the use of supercomputing systems, which find sweet spots for drilling based on analog geology. These supercomputing systems analyze vast amounts of seismic imaging data collected by geologists using sound waves.

What’s changed most recently is the dimension: When the oil and gas industry first caught on to seismic data collection for exploration efforts, the capabilities were limited to 2-dimensional imaging. The next step was 3D, which gives a much more accurate picture of what’s down there.

The latest is the 4th dimension: Time, which allows explorers not only to determine the geological characteristics of a potential play, but also tells them how a reservoir is changing in real time. But all this is very expensive. And oilmen are zealous cost-cutters.

The next step in technology takes us off the ground and airborne—at a much cheaper cost—according to Jen Alic, a global intelligence and energy expert for OP Tactical.

The newest advancement in oil exploration is an early-phase aerial technology that can see what no other technology—including the latest 3D seismic imagery—can see, allowing explorers to pinpoint untapped reservoirs and unlock new profits, cheaper and faster.

“We’ve watched supercomputing and seismic improve for years. Our research into new airborne reservoir-pinpointing technology tells us that this is the next step in improving the bottom line in terms of exploration,” Alic said.

“In particular, we see how explorers could reduce expensive 3D seismic spending because they would have a much smaller area pinpointed for potential. Companies could save tens of millions of dollars.”

The new technology, developed by Calgary’s NXT Energy Solutions, has the ability to pinpoint prospective oil and gas reservoirs and to determine exactly what’s still there from a plane moving at 500 kilometers an hour at an altitude of 3,000 meters.

The Stress Field Detection (SFD) technology uses gravity to gather its oil and gas intelligence—it can tell different frequencies in the gravitational field deep underground....MORE

Pearson May Be Rethinking That "Sell the Financial Times" Strategy

First up, the Press Gazette:

FT Group boosts profits to £55 million as business daily's digital subs rise to 415,000

Pearson Plunges as Earnings Drop on Education in North America

FT Group boosts profits to £55 million as business daily's digital subs rise to 415,000

The FT Group made a profit of £55 million last year despite plunging print circulation figures for the FT according to results reported this morning.And from Bloomberg:

Profit was said to be up 17 per cent year on year, on an underlying basis.

According to parent company Pearson, the FT’s total circulation grew by 8 per cent to 652,000 when digital subscribers are added to the print total.

The FT claims that this circulation figure is the highest "paying readership" in the newspaper’s 126-year history. The current print circulation of the FT is 234,000 - of which 23,764 are bulk copies.

FT Group said in a statement: “FT.com digital subscriptions grew 31 per cent to 415,000, more than offsetting planned reductions in print circulation. Digital subscribers now represent almost two-thirds of the FT’s total paying audience and corporate users grew nearly 60 per cent to more than 260,000....MORE

Pearson Plunges as Earnings Drop on Education in North America

Pearson Plc (PSON) fell as much as 8 percent after saying it wouldn’t emerge from a difficult transition period until 2015 after earnings plunged last year on weak demand in U.S. higher education and restructuring costs.

Adjusted operating profit fell 21 percent to 736 million pounds ($1.23 billion) in 2013 from 932 million pounds a year earlier, the London-based publisher of the Financial Times newspaper said in a statement today. Sales rose 2.3 percent to 5.18 billion pounds, missing the 5.8 billion-pound estimate by analysts in a Bloomberg survey.

Pearson, which earns about 60 percent of revenue in the U.S., said in January that lower freshman enrollments and bookstore purchases hurt earnings in the country. Pearson has been reorganizing to speed growth in emerging markets and digital services as a slowdown in some large textbook markets restrains profit. Pressure on its U.S. performance should ease from 2015 as curriculum changes take effect and college enrollments stabilize, it said today....MORE

"Norway's Oil Fund To Debate Fossil Fuel Investments

It's all just theater until they shut down the Statfjord and Ecofisk oil fields.

Prop bet anyone?

From the Financial Times:

Prop bet anyone?

From the Financial Times:

Norway is to debate whether the world’s largest sovereign wealth fund should stop investing in oil, gas and coal companies.

The two governing centre-right parties and two of their allies have agreed to set up an expert group to look into Norway’s $840bn oil fund’s investments in fossil fuels.Oil and gas companies represent 8.4 per cent of the oil fund’s equity investments, amounting to about $44bn, according to its annual report. Three of its top 10 holdings as of December 31 were in oil companies Royal Dutch Shell, BG Group, and BP.Norway’s oil fund is one of the world’s most closely-watched investors as it owns 1.3 per cent on average of every listed company. Its biggest holdings at the end of last year were Nestlé, Royal Dutch Shell, Novartis, HSBC and Vodafone. The rest of its 10 largest holdings were Roche, BlackRock, BG, Apple and BP.

The debate over fossil fuel investments started when the opposition Labour party proposed last autumn that the oil fund exit all its coal investments, despite the fact that Norway runs several coal mines....MUCH MORE

Thursday, February 27, 2014

The Google Barge Is Moving to Stockton (GOOG)

The bankrupt city shall henceforth to be called Mountain View with a Water View.

From Pulse 2.0:

Google is moving their barge to Stockton, California

"Is Google building a hulking floating data center in SF Bay?" (GOOG)

"San Francisco Mystery Google Barge Revealed: It's A VIP Party Boat" (GOOG)

"Why is Google's Eric Schmidt heading to North Korea?" (GOOG)

From Pulse 2.0:

Google is moving their barge to Stockton, California

The Google Barge is being moved to Stockton, California around next week. The Google Barge is moving from its current construction site on Treasure Island in the San Francisco Bay. Google confirmed the move of Google Barge to Stockton with CNET.

Previously:

Treasure Island operations head Mirian Saez manages the leases and has confirmed that Google Barge may head to Stockton as early as next week if the weather permits. The Google Barge is believed to be a floating showroom for Google X products.

The San Francisco Bay Conservation and Development Commission said that Google either had to get a permit to finish the construction of the barge project on Treasure Island or move it somewhere else. Otherwise Google would have to pay fines of up to $30,000. Google was given a 35-day grace period to take some kind of action....MORE

"Is Google building a hulking floating data center in SF Bay?" (GOOG)

"San Francisco Mystery Google Barge Revealed: It's A VIP Party Boat" (GOOG)

"Why is Google's Eric Schmidt heading to North Korea?" (GOOG)

Portfolios of SEC Employee Stock Picks Earn Excess returns of 4-8.5% Per Year

From ZeroHedge:

Want To Outperform The Market? Just Trade Alongside The SEC

I see that Turnkey Analyst posted earlier than ZH but no HT from ZeroHedge, or alternateively, explanation of why they were browsing the University of Virginia website. Sometimes I think ZeroHedge wants their acolytes to believe ZH is omniscient when it is actually I who Sees all, Knows some and Tells a little.

Or not.

whatevs, jus' sayin'

(stylebook: use apostrophes)

Want To Outperform The Market? Just Trade Alongside The SEC

Goodbye SAC Capital. Hello SEC Capital.

A new study released by Rajgopal of Emory and White of Georgia State confirms what most have long known: SEC employees are immaculate stock pickers and "that a hedge portfolio that goes long on SEC employees’ buys and short on SEC employees’ sells earns positive and economically significant abnormal returns of (i) about 4% per year for all securities in general; and (ii) about 8.5% in U.S. common stocks in particular." But those wily regulators are tricky indeed: instead of frontrunning good news and outperforming on the upside, the "abnormal returns stem not from the buys but from the sale of stock ahead of a decline in stock prices." In other words, in a market in which hedge funds have given up on shorting stock, the best outperformer is none other than the very entity that is supposed to regulate and root out illicit market activity!

From the study's summary:

What questions? By now it is abundantly clear that enforcing a fair and efficient market is the last thing on the minds of SEC staffers. It is now also quite clear that in such times when said staffers are not browsing porn on the taxpayers' dime, they are trading stocks on illegal, market-moving information.We use a new data set obtained via a Freedom of Information Act request to investigate the trading strategies of the employees of the Securities and Exchange Commission (SEC). We find that a hedge portfolio that goes long on SEC employees’ buys and short on SEC employees’ sells earns positive and economically significant abnormal returns of (i) about 4% per year for all securities in general; and (ii) about 8.5% in U.S. common stocks in particular. The abnormal returns stem not from the buys but from the sale of stock ahead of a decline in stock prices. We find that at least some of these SEC employee trading profits are information based, as they tend to divest (i) in the run-up to SEC enforcement actions; and (ii) in the interim period between a corporate insider’s paper-based filing of the sale of restricted stock with the SEC and the appearance of the electronic record of such sale online on EDGAR. These results raise questions about potential rent seeking activities of the regulator’s employees.

And since not even the most sophisticated hedge funds can generate returns through shorting, maybe it is time for the government to do something right, and spin off SEC Capital as a standalone hedge fund....MORE"Stock Picking Skills of SEC Employees" (52 page PDF)

I see that Turnkey Analyst posted earlier than ZH but no HT from ZeroHedge, or alternateively, explanation of why they were browsing the University of Virginia website. Sometimes I think ZeroHedge wants their acolytes to believe ZH is omniscient when it is actually I who Sees all, Knows some and Tells a little.

Or not.

whatevs, jus' sayin'

(stylebook: use apostrophes)

"Catastrophic Solar Storm Inevitable, Insurers Warn"

There was a method to the madness when we posted "Space Weather Forecast" on Sunday.

From the Wall street Journal's Risk and Compliance Journal, Feb. 26:

From the Wall street Journal's Risk and Compliance Journal, Feb. 26:

The sun erupted on Monday, releasing a powerful flare that happened to point away from earth, a lucky break for earthlings. In 1859, a similar solar eruption knocked out telegraph systems across Europe and North America, and had Rocky Mountain gold miners up for breakfast at 1 a.m. because they thought it was daytime. Analysts say that another solar storm as severe as that 1859 event is inevitable, will be much more costly–and they note ominously that the sun is now near the peak of its activity cycle.

”The risk is real, and it will happen one day–we know that,” Romain Launay, advisor to the chairman and chief executive officer of the Paris-based reinsurer, SCOR SE, told Risk & Compliance Journal in an interview, “The uncertainty lies in the exact consequences.”

- NASA

- A strong solar flare on the surface of the sun is seen in this image from NASA’s Interface Region Imaging Spectrograph taken Jan. 28.

The consequences are likely to be more severe than in the horse-and-buggy 19th century. According to a new report from SCOR they could include long power blackouts affecting millions of people, and causing trillions of dollars in damage. “The more we rely on the Internet, the availability of all sorts of communication channels, GPS, etc., the more we are dependent on power. That’s the major exposure driver,” said Reto Schneider, head of emerging risk management at Swiss Re, which has also raised concerns about the risk. Lloyd’s last year reported that a major solar storm is “almost inevitable”, estimating the frequency at one every 150 years, and said that 20 million-40 million people in the U.S. are at risk of power outages lasting from two weeks to two years. Of course, it has been 155 years since that last really big one in 1859.

The threat of solar storm is serious enough that in January, the Federal Energy Regulatory Commission proposed adoption of new standards to address “potentially severe, widespread effects on reliable operation of the nation’s bulk-power system,” according to a statement. Last year, Commissioner Cheryl A. LaFleur said in a statement, “While there is debate over whether a severe GMD [geomagnetic disturbance] event is more likely to cause the system to break apart due to excessive reactive power consumption or to collapse because of damage to high-voltage transformers and other vital equipment, there is no debate that the widespread blackouts that could result under either scenario are unacceptable.”

Despite the severity of the threat seen by regulators and insurers, businesspeople ranked solar weather near the bottom of their 50 priority risk concerns in last year’s Lloyd’s Risk Index . Because so-called Carrington events (named for British astronomer Richard C. Carrington, who observed the 1859 solar activity) are infrequent, it may be too easy to ignore the potentially catastrophic results. “For various people it’s an unthinkable scenario. What if the Internet is not available?” said Mr. Schneider.

Insurance may not be much help, while paradoxically the insurance industry could be hurt. Few insurance policies even mention solar risk. Actual physical damage is often required to activate business interruption policies, and a company may be without power yet without physical damage in a solar storm that knocks out the electricity grid. Sublimits on other insurance policies could limit what a company might expect to recover after a shutdown....MORE

Markowitz attacks hedge fund diversification claims

From Risk:

Nobel prize winner Harry Markowitz says alternative investments may not deliver the diversification benefits sought by investors

Nobel prize winner Harry Markowitz says alternative investments may not deliver the diversification benefits sought by investors

Harry Markowitz, one of the pioneers of modern portfolio theory and 1990 Nobel prize winner, has claimed alternative investments such as hedge funds rarely offer the diversification benefits sought by their investors.

"The people selling these products claim they have higher expected returns and lower correlations and volatilities than traditional investments. But if you dig deeper, you'll find that isn't really true in most cases," says Markowitz, professor of finance at the University of California in San Diego.

Markowitz's comments came after a BNY Mellon study found nearly 80% of institutional investors have an allocation to alternative investments, compared to 40% in 2009. Investors also expect to raise their allocations to virtually every category of alternative investment over the next five years. Asked why they were allocating to alternatives, 69% of respondents cited the diversification benefits.

"Investors clearly believe alternatives can enhance diversification. They expect to achieve a good return, but the real reason for investing in alternatives is to increase portfolio diversification, so that if there is another market event – which everyone is convinced there will be – they will be better protected on the downside," says Debra Baker, head of BNY Mellon's global risk solutions group.

The idea behind modern portfolio theory is to combine assets with low correlations to reduce the variance, or riskiness, of a portfolio. Alternative investments are thought of as effective diversifiers of risk because of their low correlations to traditional assets. But that benefit is offset by the higher average volatility of alternatives, according to Markowitz. "The fact is alternatives tend to be more volatile investments, which makes them poor diversifiers," he says....MORE

Absolute Return: Helping Hedge Funders Cope With Prison

An oldie (May 2013) but goodie from Absolute Return:

On May 13, Level Global Investors co-founder Anthony Chiasson was sentenced to more than six years in prison.

He'll be joining a small but growing number of incarcerated hedge fund professionals thanks to the government's aggressive prosecution of insider trading cases. Galleon Group founder Raj Rajaratnam is serving an 11 year prison sentence. FrontPoint Partners portfolio manager Chip Skowron is in for five years. SAC Capital Advisors PM Donald Longueuil is nearing the end of a 30-month term.

They and others from the industry had elite legal help, but were they ready for life inside the big house? What type of personal transformation is possible once behind the razor wire? And is there anyone to help this relatively fortunate group?

That's where Jeff Grant comes in. As founder and director of the Progressive Prison Project in Greenwich, Conn. and head of prison ministries of the First Baptist Church in nearby Bridgeport, Grant has devoted his life to helping prisoners. While he has focused on poor communities, Grant has increasingly worked with people accused of white collar crimes, including hedge fund managers, in learning to cope with life in prison.

Grant's advice comes from personal experience. In 2006, he was sent to a low security federal prison for 14 months after pleading guilty to federal criminal fraud charges. A corporate lawyer, Grant operated an office in Mamaroneck, New York. In the aftermath of September 11, 2001, he fraudulently claimed to have a Wall Street office that was hurt by a decline in business following the terrorist attacks in order to obtain a low-interest $247,000 loan under the U.S. Small Business Administration's Economic Injury Disaster Loan program (he repaid the government $365,000 as part of his civil settlement, including penalties).

Grant is writing a book entitled “The Art of Surviving Prison" due out this fall. Absolute Return asked him about his work and how it relates to the hedge fund community.

Absolute Return: How did you become involved in helping prisoners?

Grant: The most obvious answer is that I served time in Federal prison for a white-collar crime, and I had to work my way through my own feelings of shame and remorse. This put me in touch with others' feelings about these issues, too. Prison served as a time of transformation that influenced me to attend Union Theological Seminary and then to my calling in prison ministries.

There are a few lessons about prison that I think might be helpful to hedge funders. It might be comforting to know that I never really felt threatened, but there was a big difference between not feeling threatened and the realization that prison could be a very dangerous place. I realized that I had a few things going for me in order to survive. First, I was old. At 48, I was older than most of the other inmates and was outside of my fellow inmates’ need for bragging rights. Second, I had a skill. Once word got out that I had been a lawyer, this was a highly sought after commodity, although I never accepted any money or favors. Third, I learned, albeit the hard way, that the best way to earn respect on the compound was to simply pay respect to everybody. Respect was the absolute most important thing in prison. It came in all kinds of shapes and sizes, and was expected in all kinds of ways in return. It was a wolf pack and I was the omega.

I walked 3,500 miles around the exercise track in one year there. Whoever wanted to walk and talk with me could. It was a rich beautiful experience in a very stark and barren place....MORE

How did you begin working with hedge fund guys?

Jeff Grant (Photo: Progressive Prison Project)

It happened quite unexpectedly. I live in Greenwich, where there are many hedge funds, and word got around about my personal experience and my work in inner city prison ministry. I had been moonlighting in helping white-collar types on an ad hoc basis for years. Then one afternoon last year I received a call from the friend of a hedge fund manager who had less than five weeks before he was to report to Federal prison. Nobody had ever discussed with him and his family anything that they would need to survive the ordeal ahead. The three of us met together in a diner and it was eye opening because I realized a trend--there were a lot of white-collar families with little or no places to turn for experienced and compassionate support.

I founded the Progressive Prison Project in Greenwich as a direct outgrowth of my inner city prison work at the First Baptist Church of Bridgeport, and as Vice Chairman of Family Reentry, a nonprofit serving the ex-offender community of Fairfield County – the disparity between how they the legal system treats the rich and the poor is a well documented issue. But I was also hearing these other stories about the isolation felt by people accused of white collar crimes, and the issues of their families’ who had done nothing wrong but were suffering scorn and ridicule in their communities. I felt that if I could bring people and stories of all communities closer together, everyone could benefit.

I understand you can't use names, but can you characterize those from the industry you've worked with and what their situations were?

I am meeting with an ex-employee of a large Stamford-based hedge fund that's been in the news a lot. He's been notified as the target of an investigation, so it's likely he'll go to prison. Earlier preparedness is always a good thing. For him it was first things first: he needed assistance in finding substance abuse counseling for alcohol and drugs and a rehab program. There are marital concerns: whether his marriage will survive. That's always the case, by the way. There are also some broader psychiatric issues. And last on the list is vocation. How is he going to make a living? How is he going to support his family? What are they going to do during the imprisonment?

Another hedge funder, the guy I met with in the diner, told me that he had what he called an army of professionals and had everything covered. As the conversation unfolded it became clear that although the lawyering and many of the other professional pieces had been handled well, nobody had ever discussed with him, or his wife, how to survive the prison experience and then put their lives back together on the other side.

I asked him, for example, if he understood that once he surrendered he would be a prisoner of the Federal Bureau of Prisons, and that it was possible that he would be placed into the solitary unit for days or weeks before he was put on the main compound. Did his wife know how to track his movements if he was transferred to another prison? Did anybody prepare his wife for her first visit to the prison visiting room, so that she wasn’t sent home due to wearing the wrong clothing? Or because of incidental drug residue on her clothes or money she might bring in to buy him food in the vending machines? He looked dumbfounded. I suggested that he start taking notes. We called the waiter over and asked for a stack of place mats and a pen. We talked for the next four hours.

What do you usually help them with?

Mostly, I help with the isolation they experience from being cut off from their community, and from their inability to find any prison-related or other services to give them good, dependable information and support. It's not their fault. There are actually many more criminal justice and prison ministry-type services available in communities like Bridgeport than there are in places like Greenwich.

My basic advice is to mind your Ps and Qs. Be very respectful and manage your day pretty closely. There was one very well known hedge fund guy in particular who had a very gregarious personality. He decided he would be authentic to himself. It worked out great for him. In being authentic he was able to be friendly and engaging in a non-threatening and very real way. The things that made him successful in the hedge fund world actually made him so in prison. I wouldn't say that would work for everybody, but his particular manner was not very threatening to begin with. It was very engaging. He was able to befriend everybody. He didn't use wealth or power as his calling cards. He used humor and vulnerability. He was clearly in the midst of some sort of spiritual transformation that made him more vulnerable in a positive way.

So being vulnerable can be an asset?

It's counterintuitive. In a minimum security prison, there's a lower ratio of guards to prisoners. You actually have to be more aware of your surroundings. Everything is dramatized on TV. What happens in prison most of the time is very boring. You get to read a lot. But once in a while something happens that is outside of the ordinary where you have to pay a lot of attention to it. For those things you have to be prepared. And unfortunately in prison those things are way outside the ordinary.

What are some of those dangers?

In a minimum security prison there are gangs. They are not allowed to rove or collect, yet they are there. It's mostly for mutual protection. There's generally no pressure to align with a gang when you show up. Outliers in terms of age or socioeconomic background are pretty much left alone.

You can still do something wrong. It's unfortunately easy to maintain an attitude of entitlement that wouldn’t be looked upon favorably. Bumped up against people of lesser economic circumstances could lead to an issue. It could be on the chow line. It can be getting a haircut. It can be at the infirmary. Anywhere people have to wait their turn and where they're not doing that, for example.

Once you draw attention to yourself, then you can get hurt. I've seen people get beat up. I've seen people get killed. I never saw a hedge funder or doctor or lawyer or stock broker get killed, but I did see gang members get killed in prison. And I was in a minimum security prison. It was the first time I had ever seen someone get killed in my life. So I help people understand that something like that can happen in a moment with no notice whatsoever. It's terrifying.

When people go to prison there's kind of an egalitarianism that takes over and a relearning state where the things we were supposed to learn in kindergarten get relearned. Please and thank you.

Respect in prison is mostly a matter of learning what not to say. It can be an incredibly counterintuitive assignment for the types of people who become Wall Street executives. It is a real comeuppance when they learn that nobody cares about what they have to say about anything, or that if they do it can be for the wrong reasons. In one case, a former hedge funder made the mistake of talking about the sale of his Hamptons property. I think you can imagine some of the difficulties.

Can they use their money to buy protection?

Not that I know of....

What British Spies Who Collected Data From Yahoo Webcams Discovered

From The Wire:

Your tax dollars at work

"Unfortunately … it would appear that a surprising number of people use webcam conversations to show intimate parts of their body to the other person...."...MORE

Your tax dollars at work

Chartology: The Reversal in the CRB Commodity Index

The index is currently at 295.62 up 0.03. The 52-week high was 302.20

From Dragonfly Capital:

Recent Inflation Will Abate

...MORE

From Dragonfly Capital:

Recent Inflation Will Abate

That is what the Bond Market is saying. The chart below shows the the CRB Index (an inflation measure) with the Treasury Inflation Protected Bonds ($TIP) as the blue area. The TIP’s are the Bond market equivalent of a measure of inflation as they adjust to protect holders from losing value due to changes in inflation. These bonds have been right before too. Looking at point A as the CRB Index started to fall so did the TIP’s, indicating inflation would be lower. At point B the TIP’s refused to follow the CRB Index higher and it did fall back. Now with the spike from the middle of January TIP’s are refusing to follow again. And over the last week the CRB has consolidated, printing a Shooting Star reversal candle in the middle of the consolidation. Momentum is waning as well with the Relative Strength Index (RSI) hitting 80 and leveling.

...MORE

Atlanta Fed: It Is Young Firms, Not Small Firms, That Create Jobs

An idea we'd sure like to see get some traction in the political class.

From the Federal Reserve Bank of Atlanta's Macroblog:

The Pattern of Job Creation and Destruction by Firm Age and Size

HT: FT Alphaville's Further Reading post.

Previously:

One More Time: It's Not Small Businesses that Create Jobs...

"Think Small Business Is Job Engine? Think Again"

The Death of IPO's and What it Means for You and The Country

From the Federal Reserve Bank of Atlanta's Macroblog:

The Pattern of Job Creation and Destruction by Firm Age and Size

A recent Wall Street Journal blog post caught our attention. In particular, the following claim:

It’s not size that matters—at least when it comes to job creation. The age of the company is a bigger factor.This observation is something we have also been thinking a lot about over the past few years (see for example, here, here, and here).

The following chart shows the average job-creation rate of expanding firms and the average job-destruction rates of shrinking firms from 1987 to 2011, broken out by various age and size categories:

In the chart, the colors represent age categories, and the sizes of the dot represent size categories. So, for example, the biggest blue dot in the far northeast quadrant shows the average rate of job creation and destruction for firms that are very young and very large. The tiny blue dot in the far east region of the chart represents the average rate of job creation and destruction for firms that are very young and very small. If an age-size dot is above the 45-degree line, then average net job creation of that firm size-age combination is positive—that is, more jobs are created than destroyed at those firms. (Note that the chart excludes firms less than one year old because, by definition in the data, they can have only job creation.)

The chart shows two things. First, the rate of job creation and destruction tends to decline with firm age. Younger firms of all sizes tend to have higher job-creation (and job-destruction) rates than their older counterparts. That is, the blue dots tend to lie above the green dots, and the green dots tend to be above the orange dots....MORE

HT: FT Alphaville's Further Reading post.

Previously:

One More Time: It's Not Small Businesses that Create Jobs...

"Think Small Business Is Job Engine? Think Again"

The Death of IPO's and What it Means for You and The Country

Berkshire Buys More DaVita (DVA)

The stock is up 45 cents to $67.95

From CNBC:

From CNBC:

Warren Buffett's Berkshire Hathaway purchased 1.13 million more shares of DaVita HealthCare Partners this week, raising its stake in the kidney dialysis company to 17.7 percent.

The purchases bring Berkshire's total stake in the company to 37.62 million shares. At Wednesday's close of $67.50, the stock had a market value of $2.54 billion.

An SEC filing said the purchases were made from Monday through Wednesday at prices between $66.12 and $68.

Berkshire has been buying DaVita shares since the fall of 2011. Last May, it agreed not to increase its stake above 25 percent. It also promised it would not push for board seats or launch a proxy fight....MORE

Goldman Sachs Raises Price Target on Tesla, Lowers Estimates (TSLA)

From The Street Street Insider:

Sorry about the earlier mis-attribution.

Goldman Sachs maintained a Neutral rating on Tesla Motors (NASDAQ: TSLA) and raised its price target to $170.00 (from $118.00). Comments follow and update on plans for its Giga factory and a $1.6 billion convertible notes offering.In late pre-market trade the stock is changing hands at $260.47, up $7.47.

"We estimate the transaction will be dilutive to TSLA EPS by ~15% over the next three years but by a much smaller 4% in 2018, the year on which we base our valuation. As such, our 2014/2015/2016 EPS estimates decline to $1.40/$2.00/$4.50 from $1.79/$2.37/$4.87. Our estimates fall as the offering increases Tesla's borrowing costs from the combination of increased cash interest expense as well as amortization of the original issue discount (OID) related to the embedded convert option," said analyst Patrick Archambault....MORE

Sorry about the earlier mis-attribution.

"Could newly discovered gold coins be the haul stolen by disgraced San Francisco Mint employee in 1901? Treasure hunting enthusiasts weigh in on origins of couple's $10 million find"

From the Daily Mail:

An unnamed couple in their 40s stumbled on the historic find on their property last spring

The gold coins dating from 1847 to 1894 were stashed in eight cans along a trail the couple had walked for years

Treasure hunting enthusiasts believe the coins may be have been stashed away by Walter Dimmick in 1901

He worked at the San Francisco Mint and was imprisoned after $30,000 worth of gold coins went missing

The dates on the coins fit the time frame and the type and denomination of the coins match too

The couple who found the coins maintain that they researched

who might have hidden the coins and have come up with nothing

Speculation

is that they haven't released their names for fear the coins could be

claimed by descendants of whoever put them in the

ground

The mysterious haul of gold coins discovered by a Northern California couple while out walking their dog – and valued at $10 million – may well be a previously undiscovered bounty that an employee of the San Francisco Mint was convicted of stealing in 1901.

The couple, who haven’t been named, stumbled across the haul of 1,427 rare, mint-condition gold coins, nearly all dating from 1847 to 1894, buried in the shadow of an old tree on their Gold Country property in February 2013.

The face value of the Saddle Ridge Hoard, as they’ve called it, added up to about $27,000, but some of the coins are so rare that experts say they could fetch nearly $1million apiece.Scroll down for video

+13

Treasure hunting enthusiasts believe the $10m

fortune found by a couple in northern California could be the same gold

coins that Walter N. Dimmick was accused of embezzling from the San

Francisco U.S. Mint in the early 1900's

The couple went public with their amazing discovery on Tuesday, and treasure enthusiasts have been quick to suggest that the coins could be the same ones stolen by Walter Dimmick, an employee of the San Francisco Mint in the late 1800′s, reports Altered Dimensions.

Dimmick began working at the mint in 1898 and by 1901 was trusted with the keys to the vaults – until an audit revealed a $30,000 shortage in $20 Double Eagle coins, six bags in all.

He quickly became the prime suspect as he was the last person to see the missing gold coins and had already been caught practicing how to forge the Superintendent’s name.

After a month-long trial, Dimmick was convicted of stealing the coins and sentenced to nine years at the San Quentin prison in California.

Booty: A trove of rare Gold Rush-era coins

unearthed in California last year by a couple as they walked their dog

may be the greatest buried treasure ever found in the United States,

worth more than $10million

The coins that Dimmick stole were never found, leaving some to now wonder if the Saddle Ridge Hoard is the very same set of lost coins.

There is certainly compelling evidence to link the two bounties. According to 1901 reports, 500 coins were stolen by Dimmick - only 73 coins less than the 1,427 discovered at Saddle Ridge.

The dates on the coins fit the time frame and the type and denomination of the coins match too.

The couple who found the coins, known only as Mary and John, maintain that they and their attorneys researched who might have hidden the coins and have come up with nothing.

'The nearest we can guess is that whoever left the coins might have been involved in the mining industry,’ said veteran numismatist Don Kagin, who is representing them....MORE

"EU Searches for Meaning of Derivative as Rules Take Effect"

One of the great, possibly existential, questions of our time.

Combined with "German Regulators To Identify “Risky Investments” For You" and it's akin to a Hegel, Schopenauer and Wittgenstein hoedown.

From Bloomberg:

Here's the whole gang debating the issue:

Combined with "German Regulators To Identify “Risky Investments” For You" and it's akin to a Hegel, Schopenauer and Wittgenstein hoedown.

From Bloomberg:

What is a derivative? Don’t ask the European Union -- you might get 28 different answers.HT Matt Levine who says Everything is a Derivative

The EU’s top markets regulator, the European Securities and Markets Authority, asked the European Commission to clarify what a derivative is as it grapples with harmonizing trade reporting rules across the 28-nation bloc.

“There is no single, commonly adopted definition of derivative or derivative contract in the European Union, thus preventing the convergent application” of the reporting rules within the European Market Infrastructure Regulation, Steven Maijoor, ESMA’s chairman, said in a Feb. 14 letter to Michel Barnier, the commissioner for financial services....MORE

Here's the whole gang debating the issue:

Wednesday, February 26, 2014

Momentum As The Only Reliable Market Anomaly

Besides the temperature outside the NYMEX for natural gas.

From the Optimal Momentum blog (Oct. 2013):

Momentum...the Only Practical Anomaly

Unfortunately for all the Momo Mamas out there Optimal Momemtum posts very infrequently, most recently January 13, 2014.

Balancing the frequency there are some interesting tidbits for the hardcore among us e.g. from Sept 6, 2013:

Momentum Back Testing

From the Optimal Momentum blog (Oct. 2013):

Momentum...the Only Practical Anomaly

Interest in momentum is growing as it gains recognition as the premier market anomaly. Our purpose here is not to report on every item or research finding related to momentum. We prefer instead to point out those that are most important or interesting often because they seem exceptionally good, or, occasionally, because they seem exceptionally bad.

One exceptionally good piece of research is the working paper by Israel and Moskowitz (I&M) called "The Role of Shorting, Firm Size, and Time on Market Anomalies." This paper has important implications not only for momentum investors, but also for those who are interested in size and value investment tilts. I&M look at all three with respect to firm size, long or short market exposure, and results stability over time.

Most research papers on relative strength momentum present it on a long/short basis where you buy winning stocks and short losing ones. In some papers, you can find some long-only results buried in a table somewhere. Except in my papers, it can be challenging to find visual representations or detailed analyses of long-only momentum. However, I&M offer insightful analysis of long-only momentum. It is important to look at long-only results for two reasons. First, most investors are interested only in the long side of the market. Second, in the words of I&M:

Using data over the last 86 years in the U.S. stock market (from 1926 to 2011) and over the last four decades in international stock markets and other asset classes (from 1972 to 2011), we find that the importance of shorting is inconsequential for all strategies when looking at raw returns. For an investor who cares only about raw returns, the return premia to size, value, and momentum are dominated by the contribution from long positions.

Therefore, even if you are open to shorting, it does not make much sense from a return perspective.

I&M charts and tables show the top 30% of long-only momentum US stocks from 1927 through 2011 based on the past 12-month return skipping the most recent month. They also show the top 30% of value stocks using the standard book-to-market equity ratio, BE/ME, and the smallest 30% of US stocks based on market capitalization.

Long-only momentum produces an annual information ratio almost three times larger than value or size. Long-only versions of size, value, and momentum produce positive alphas, but those of size and value are statistically weak and only exist in the second half of the data. Momentum delivers significant abnormal performance relative to the market and does so consistently across all the data....MORE

Balancing the frequency there are some interesting tidbits for the hardcore among us e.g. from Sept 6, 2013:

Momentum Back Testing

In 1937, Cowles and Jones published the first study showing that relative strength price momentum leads to abnormally high future returns. These findings are just as valid today as they were 75 years ago. Academics have been very diligent in studying momentum further, since it flies in the face of the efficient market hypothesis (EMH). EMH says you cannot beat the market using publicly available information. Hundreds of subsequent tests over the past 20 years have confirmed the veracity of momentum investing. Momentum is slowly gaining the attention it deserves as the investment world's "premier market anomaly" that is "beyond suspicion" (words of Fama & French)....MORE

Who knew Cowles was onto momentum? See also "The World's Longest Backtest" but do it warily.

Cowles himself only built his indices back to 1871 because of reasons we've covered elsewhere: the preponderance of banks, survivorship bias among the canal, guano and whale oil companies and others.

We are fans of Cowles and a lot of the folks who worked for him, see "Does Stock-Market Data Really Go Back 200 Years?":

"Several Cowles associates have won Nobel prizes for research done while at the Cowles Commission.

These include Tjalling Koopmans, Kenneth Arrow, Gerard Debreu, James Tobin, Franco Modigliani, Herbert Simon, Lawrence Klein, Trygve Haavelmo and Harry Markowitz". -Marginal Revolution

Add the current keeper of the Cowles Commission, Yale's Robert Shiller to the laureate list

Also Professor Cowen's "What do I think of the Cowles Commission?".

Also Professor Cowen's "What do I think of the Cowles Commission?".

And our "Can Stock Market Forecasters Forecast?":

Can Stock Market Forecasters Forecast? is the title of a paper by one of my heroes, Alfred Cowles III.

It appeared in Vol.1, No. 3 of Econometrica, after having been read to a joint meeting of the Econometric Society and the American Statistical Society.

Mr. Cowles' answer to the question?

It is doubtful.December 31, 1932.

Subscribe to:

Comments (Atom)