From ZeroHedge:

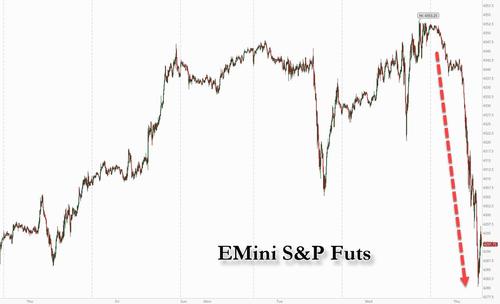

After S&P futures printed at new all time highs on 8 of the past 9 days, one can almost feel sorry for the euphoric bulls (and meme stock traders) who woke up this morning to headlines such as this:

- *S&P 500 INDEX FUTURES RETREAT 1.5%

- *NASDAQ FUTURES DROP 1.5%

- *STOXX EUROPE 600 INDEX DROPS 1.5% TO SESSION LOW

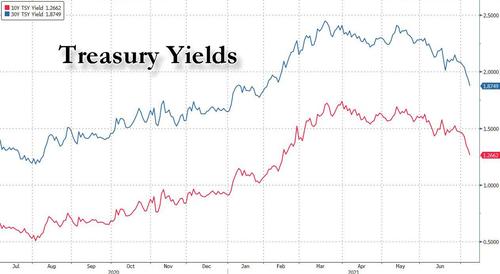

And sure enough, just one day after it appears that nothing could stop markets from exploding to recorder highs day by day by day, on Thursday morning both the reflation and growth trades were a dumpster fire, with Dow e-minis plunging 475 points, or 1.37%. S&P 500 e-minis were down 58 points, or 1.34% and Nasdaq 100 e-minis were down 190 points, or 1.3%, the VIX jumped above 20 after trading at 14 just a few days earlier and 10Y yields dropped as low as 1.25%. Bitcoin tumbled back down to $32,000.

At the same time, the collapse in yields accelerate, with 10Y yields tumbling as low as 1.25% while 30Y dropped below 1.90% for the first time since February as inflation expectations eased.

The catalyst for the rout? The same we predicted more than a month ago when we warned that the most important credit impulse in the world had collasped - China's slowdown, now confirmed by Beijing itself which is preparing to cut RRR rates in coming weeks as proof positive even China is willing to risk much higher inflation to offset an economic slowdown. Not helping is also China's widening crackdown on the tech sector in China coupled with doctored - pardon the pun - fears of pandemic resurgence via the delta covid variant.

“The message markets are sending is that the economic situation is not strong enough to pull back on stimulus and start the tapering process, as the Fed has signaled it will do,” said Ricardo Gil, head of asset allocation at Trea Asset Management in Madrid.

Virtually every sector was down, led by Chinese listed stocks such as e-commerce giant Alibaba Group dropping 2.6%, while internet search engine Baidu shed 3.8%. Didi Global, whose app takedown by the Chinese government had sparked a recent selloff, fell 6.5%, while FAANG gigacaps dropped between 0.9% to 1.7% despite the continued drop in yields as traders now use their FAANG gains to offset margin calls elsewhere. Meme stocks were hit especially hard as all upward momentum was crashed.Here are some of the biggest U.S. movers today:....

....MUCH MORE