Although the almond market is currently in oversupply* if done right this can be a very profitable area.

From Global AgInvesting, October 19:

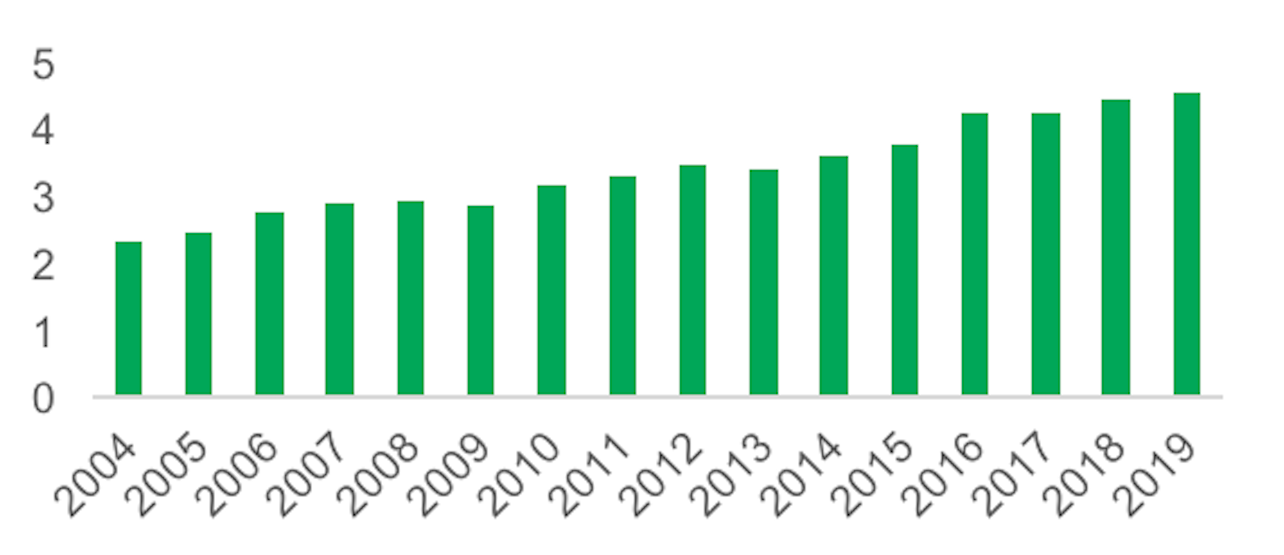

Tree nuts have experienced robust demand growth over the past two decades, as they have increasingly been incorporated into diets across the globe. In the period 2004-2019, global tree nut production sustained a relatively steady expansion at a growth rate of 4.6 percent per year, but market growth has varied dramatically among the different tree nuts. Understanding the underlying demand/supply dynamics for the different major tree nut types is important to effectively evaluate opportunities and incorporate these important permanent crops into a diversified portfolio of agricultural properties.

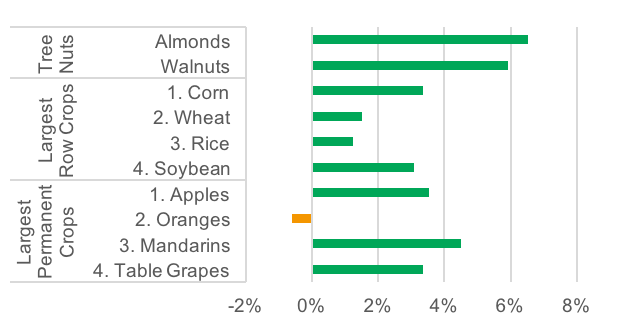

The nine major tree nuts – almonds, Brazil nuts, cashews, hazelnuts, macadamias, pine nuts, pecans, pistachios, and walnuts – have a combined annual production value of $36 billion,[1] which represents just 1 percent of the total global agriculture production value of about $3.7 trillion. Demand and resulting production of these crops has grown faster than most other major permanent and annual crops.[2] Almonds and walnuts grew nearly 6 percent annually during the period 2004-2018, while the leading row and non-nut permanent crops grew in the range of 3 to -4 percent annually.

Global Tree Nut Production Expands at a 4.6% CAGR 2004-2019

Chart 1: Global Tree Nut Production (Million Metric Tons, Shelled Basis, except Pistachios Inshell)[3]

Largest Tree Nuts Grow Faster than Largest Row or Permanent Crops

Chart 2: Global Production Growth of Crops by Production Volume, 2004-2018 CAGR[4]

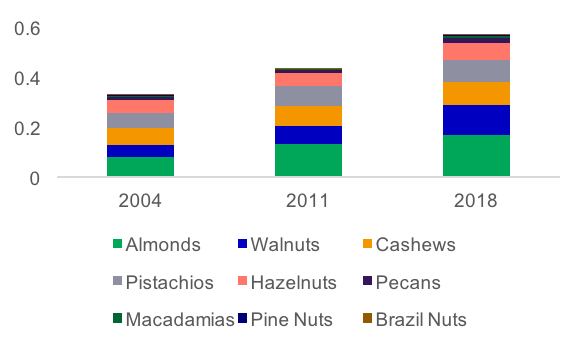

Consumption

Tree nut demand has grown as consumer food choices have expanded with the development of larger retail stores, international trade, and most recently, through additional online grocery delivery. Globally, per capita consumption of tree nuts across the major varieties has steadily moved higher at a robust pace since 2004 as illustrated in Chart 3.

Almonds, Walnuts, Cashews and Pistachios Drive Increased Total Tree Nut Consumption

Chart 3: Global Per Capita Tree Nut Consumption (Annual Kilograms per Capita)[5]

Growth in tree nut consumption is occurring in both developed and emerging markets. While Europe remains the top consumption region (26 percent share), North America and Asia have been experiencing more pronounced increases in per-capita consumption and are closing the gap with Europe. North America and Asia now represent 23 percent and 20 percent, respectively, of global tree nut consumption.[6] Almonds are the most consumed nut by a wide margin (30 percent), followed by walnuts (20 percent), cashews (16 percent), pistachios (16 percent), hazelnuts (12 percent) and pecans (3 percent).[7] All other tree nuts combined comprise just 3 percent of total global tree nut consumption.[8]

Almonds Are the World’s Most Valuable Tree Nut Crop....

....MUCH MORE

*Almonds: Production Up 18%, Exports Up 4% Means Cheaper Nuts For U.S.

All those trees planted in 2014 - 2015 have yet to begin producing in size, so this situation could stick around for another two to four years.