Imagine having to do a high wire act, allowing the rouble to fall, keeping rates up to counteract the inflationary tendency that introduces, trying to account for the huge asset flows in the underground/oligarch economy while all the while Putin is yelling at you from the sidelines.

She is very good at what she does.

First up ZeroHedge a few hours ago:

Russia Says It Can Weather $25 Oil For Up To 10 Years

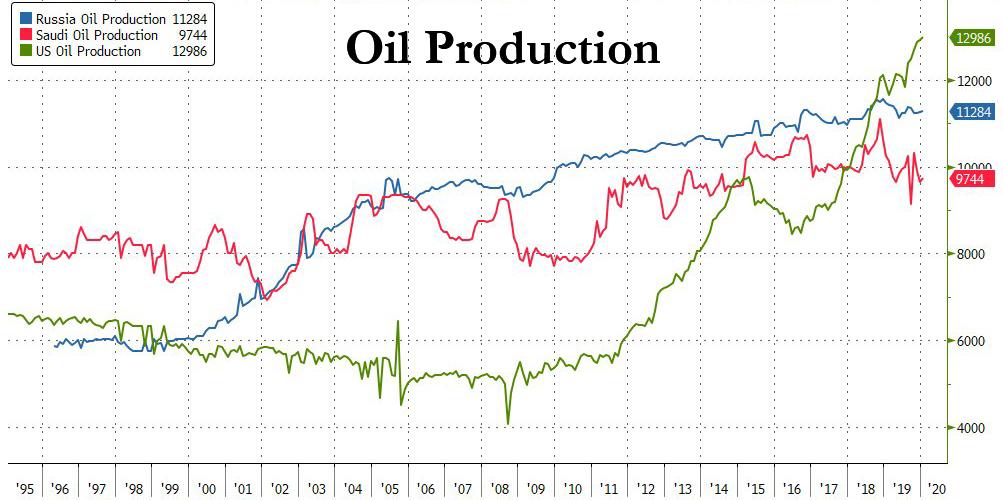

Now that both OPEC+ and OPEC no longer exist, and it's a free-for-all of "every oil producer for themselves" and which Goldman described as return to "the playbook of the New Oil Order, with low cost producers increasing supply from their spare capacity to force higher cost producers to reduce output", the key question is just how long can the world's three biggest producers - shale, Russia and Saudi Arabia...

... sustain a scorched-earth price war that keep oil prices around $30 (or even lower).

While we hope to get an answer on both Saudi and US shale longevity shortly, and once the market reprices shale junk bonds sharply lower, we expect the US shale patch to soon become a ghost town as money-losing US producers will not be solvent with oil below $30, assuring that millions in supply will soon be pulled from the market, moments ago we got the answer as far as Russia is concerned, when its Finance Ministry said on Monday that the country could weather oil prices of $25 to 30$ per barrel for between six and 10 years.

Incidentally, this may explain why over the past two years, Putin has been busy dumping US Treasury and hoarding gold: he was saving liquidity for a rainy day, and as millions of shale workers are about to find out today, it's pouring.

As noted in the introduction to yesterday's "Assume Crash Positions: Goldman Cuts Brent Price Target To $30 'With Possible Dips Near $20'":

Two quick points before the story.Now Russia cannot compete at $20, the infrastructure is too old and creaky.

If oil in the ground should someday become a stranded asset, the Saudi's plan since the rise of MbS has been to be the producer that pumps the last barrel. And although Ghawar is no longer able to produce at $2-5 per barrel, $10-20 is definitely achievable meaning there are very few places in the world that can compete on price.....

But they definitely can compete at $35 which we know because Elvira told us so back in 2015:

Russia Central Bank Prepares For Three Years of $35 Oil

And in the last half-decade she has had time to refine the plan and the government almost surely can survive at $30.

$25 might be a stretch but long before that becomes a problem, over half of American shale production becomes uneconomical to the point of bankruptcy.

Previously on the fanboi channel:

May 27, 2019

Interview With One Of The Sharpest Central Bankers In the World, Russia's Elvira Nabiullina

We've been singing her praises for a few years now. Here's the introduction to a 2018 post:

"Russia’s central bank quietly raised its key interest rate by 0.25 percentage points on Friday"

If you think having Donald Trump question the Fed head for raising rates is playing rough, just imagine working for Vlad Putin as his popularity drops.(astute reader will note eco-friendly intro recycling)

Considering the hand she's been dealt, the chief of the Russian central bank, Ms. Nabiullina, should have garnered a couple more Euromoney Central Banker of the Year awards to sit next to the one she received in 2015.

Seriously, since she took over in 2013 oil prices collapsed, then doubled, the annexation of Crimea led to the first set of sanctions, the rouble fell 50%, the U.S. Treasury threatened Russian banks with exclusion from SWIFT, the second set of sanctions on companies and oligarchs led to the retraction of multi-billion dollar credit facilities which had to be replaced internally and a couple other things that I'm having trouble remembering.

And all the while Vladimir is looking over your shoulder.

Anyway, all good mini-rants come to an end, here's the headline story fromSputnikCNBC

What Changed In Russian Central Banking? "Turning the Russian petro-monetary transmission mechanism upside-down"

Old Model of Russian Economic Growth Exhausted Itself - Central Bank Head

And many more, use the 'search blog' box if interested.