Paul Murphy now heads up the Financial Times' FT Investigations but can still be seen at FT Alphaville from time to time.

Originally posted Dec. 30, 2015 as:

Possibly the Funniest (profitable) Thing We Saw In 2015: FT Alphaville's Founder/Editor Channels Mr. SubliminalThen updated on January 18, 2017 with this:

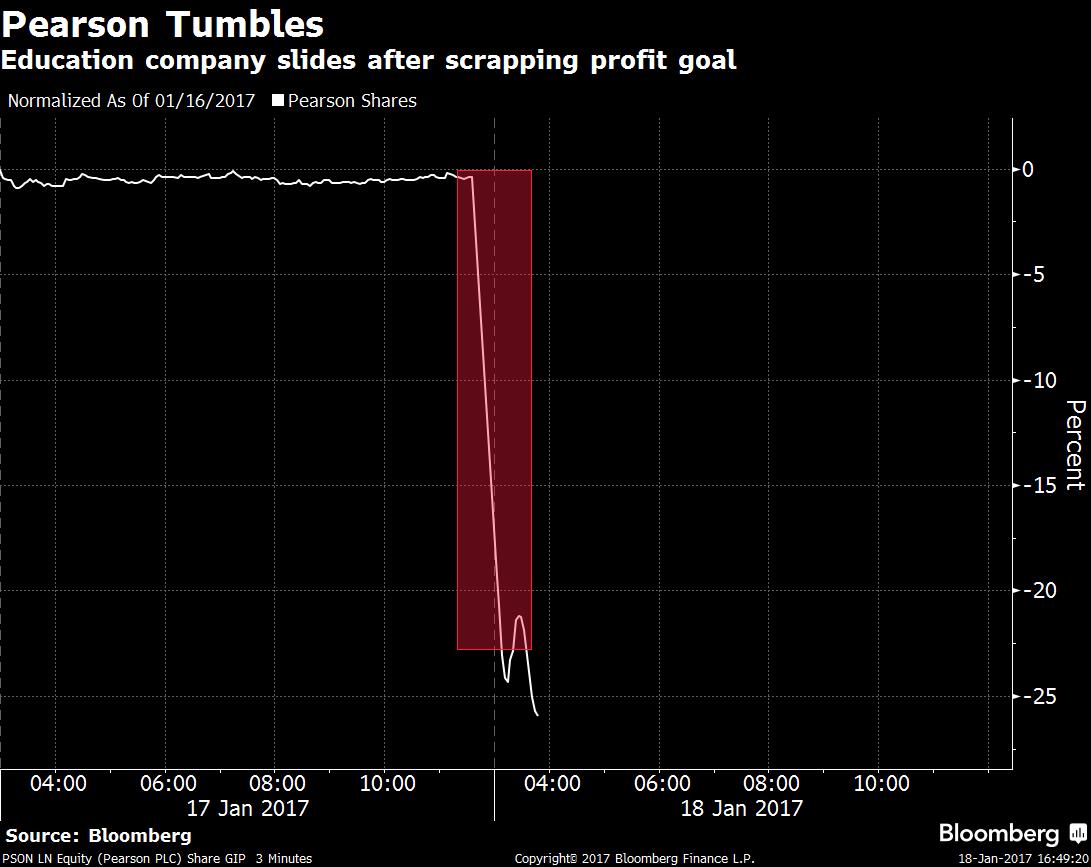

-from Bloomberg's Tracy Alloway (formerly FT Alphavillein)

Original post:

For our younger readers, here is Mr. Subliminal on Donald Trump cheating on his wife Ivana in 1990:

And here's FT Alphaville's editor, Paul Murphy,

on former FT Alphaville owner Pearson and its stock, Dec. 1, the day the Financial Times was handed over to Nikkei, while appearing to be having a normal conversation with Alphavillein Bryce Elder:

--------

(You don’t think another profit warning is coming? Oh course another profit warning is coming! )

--------

--------

-------

-------

-------

-------

--------

--------

--------

---------

...MUCH MORE

The stock is currently trading at 739p, down 11.17% so far this month, after trading under 700 a couple weeks ago....

Updated stock price, January 18, 2017:

For our younger readers, here is Mr. Subliminal on Donald Trump cheating on his wife Ivana in 1990:

And here's FT Alphaville's editor, Paul Murphy,

Hard-bitten journalist

on former FT Alphaville owner Pearson and its stock, Dec. 1, the day the Financial Times was handed over to Nikkei, while appearing to be having a normal conversation with Alphavillein Bryce Elder:

(You don’t think another profit warning is coming? Oh course another profit warning is coming! )

--------

--------

-------

-------

-------

--------

...MUCH MORE

The stock is currently trading at 739p, down 11.17% so far this month, after trading under 700 a couple weeks ago....

Updated stock price, January 18, 2017:

583.50 GBX down 224.50 (27.78%) on the day.And FT Alphaville's latest commentary on Pearson.