At some point borrowers just don't want to borrow, regardless of how many bps the central banks cut.

That said, Upfina is always worth, at minimum a quick look, if not an in-depth study.

December 12

The December Fed meeting was one of the least discussed in about 1.5 years. The statement really was boring as there were hardly any significant changes. That’s not necessarily a bad thing for the Fed. Interestingly, after a run of bad returns on Fed days since Powell became chair, the stock market has been up 3 straight times, not that Powell is trying for a small temporary increase in stocks. This meeting wasn’t hyped because the Fed wasn’t expected to move rates (it didn’t) and isn’t expect to move them in the near future. There wasn’t uncertainty about this meeting and there isn’t much for the next few.

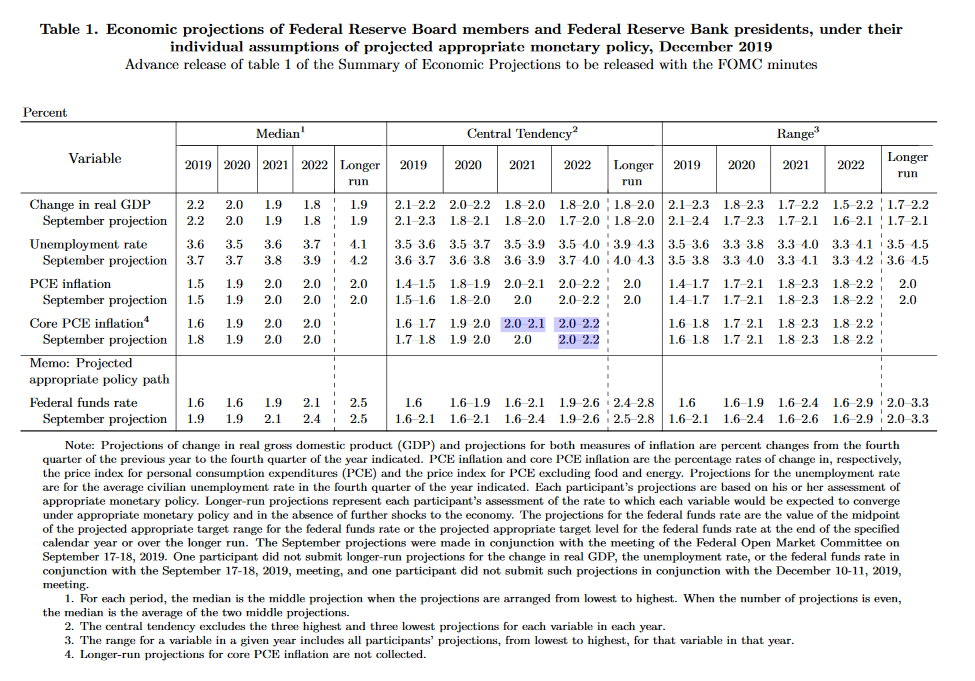

While this meeting wasn’t exiting, it was important because it’s one of the few which includes an update to guidance. The table below lists all the changes to expectations.

— Gregory Daco (@GregDaco) December 11, 2019

The most notable change can’t be seen. At the September meeting, 9 FOMC members stated they wanted to hike rates in 2020 and one even called for 3 hikes. 8 stated they wanted rates to stay the same. This time, just 4 of 17 called for a hike. It’s worth noting that voting Fed members will be rotated next year. This makes the March meeting important as it’s the next with economic projections. If the Fed is in agreement with policy, this rotation might not matter. The most active Fed member on Twitter, Neel Kashkari, will become a voting member.....MUCH MORE

The table shows rates staying the same in 2020 and then increasing once in 2021. It’s interesting to see the stock market increasing slightly on Wednesday because the Fed funds futures market hasn’t been pricing in any chance of a hike for months. The Fed not calling for any hikes in 2020 is it catching up to the market. In the past few weeks we’ve been watching the odds for a cut not a hike. On the other hand, this is a dovish move for the Fed, so stocks rallied slightly even though no hikes have been priced in for a while.

The other important point in this table of economic projections is that the Fed sees core PCE and headline PCE inflation being 1.9% in 2020. That’s important because, as we will get to next, the Fed won’t hike rates unless inflation spikes. If the Fed is expecting 1.9% inflation, it would need to, at the very least, get above that before the Fed acts. Throughout this cycle, core PCE inflation has only briefly gotten above 2% when it has had easy comps, making Fed rate hikes to combat inflation in 2020 unlikely....