Tough duty but someone had to do it.

But before Bali there was Kyoto, which Enron pushed with all their—then considerable—might.

When the Protocol was agreed in 1997, Enron's top lobbyist, John Palmisano, senior director for environmental policy and compliance emailed from Kyoto:

If implemented [the Kyoto Protocol] will do more to promote Enron’s business than will almost any other regulatory initiative outside of restructuring of the [electricity] and natural gas industries in Europe and the United States…. The endorsement of emissions trading was another victory for us…. This agreement will be good for Enron stock!!It was time to turn deeds into dollars, he added:

Enron now has excellent credentials with many ‘green’ interests including Greenpeace, WWF [World Wildlife Fund], NRDC [Natural Resources Defense Council], GermanWatch, The US Climate Action Network, the European Climate Action Network, Ozone Action, WRI [World Resources Institute], and Worldwatch [Institute],” reported Palmisano. “This position should be increasingly cultivated and capitalized on (monetized).And we were off and running. Here's our first link o' the Bored Whore in June 2007:

The Bored Whore of Kyoto

"I don't know if climate change is caused by burning coal or sun flares or what," said the Moscow-based carbon cowboy. "And I don't really give a shit. Russia is the most energy inefficient country around, and carbon is the most volatile market ever. There's a lot of opportunity to make money."

"As a bonus, Putin also received a miasma of environmental credibility, which suited the Russian president like a negligee on Andre the Giant."

I like this writer. To my Russian speaking friends, WTF, you never told me about Zaitchik, the eXile and Freezerbox?Here's the introduction to his piece, it slips into gear so smoothly you don't even notice:

Alexander Zaitchik co-founded Freezerbox in 1998. He lives in Moscow.

BY ALEXANDER ZAITCHIK 06.01.2007 | ENVIRONMENTThat $20 billion estimate of the market was peanuts compared to where the architects of the plan were heading. As—now Lord, then Sir—Nicholas Stern, vice-chair of carbon consultancy IdeaCarbon, and author of the eponymous report said at Bali:

Nothing drove home Russia's place in the growing pollution-trading business better than what one carbon finance guy told me at a conference last month sponsored by Gazprom and the World Bank. We were on drink number three or four at the reception when he dropped the green pretense and came clean. "I don't know if climate change is caused by burning coal or sun flares or what," said the Moscow-based carbon cowboy. "And I don't really give a shit. Russia is the most energy inefficient country around, and carbon is the most volatile market ever. There's a lot of opportunity to make money."

This is what all the PowerPoint arrows and boxes had been spelling out in bureaucratese during the conference entitled "Kyoto: Carbon Market Opportunities for Russian Enterprises," but it was nice to hear it in plain English. I toasted the fellow's honesty and promised not to use his name. Some of his colleagues, he explained, were "first generation" carbon finance types. More idealistic, they don't appreciate the crass cash take on the business. For two days I listened to speakers probe the dry nexus between development finance, commodity trading, and environmental policy. It didn't keep me on the edge of my seat, but it did open a window into how the architects of Kyoto imagined Russia's role in the treaty. Boiled down to its essence, they scripted Russia as a poor dirty whore in need of a shower and some nice new clothes.

These were treats European governments, financiers, and carbon traders could provide, in exchange for a little something. The purpose of the Gazprom/World Bank event was to introduce Russia to these Kyoto-era carbon suitors, and to educate local industry about how best to profit from the growing trade in carbon credits. Because what's climate change about if not profit? The global market for carbon reduction credits is worth more than $20 billion and booming. The business bustles at the heart of "market-friendly" Kyoto. Carbon trading is basically a loophole -- a "flexible mechanism" in Kyoto-speak -- that allows developed nations continue with business as usual while claiming to address the climate crisis.

Because most industrialized Kyoto signatories won't sacrifice short-term economic growth to cut emissions at home -- best accomplished by mandatory absolute cuts accompanied by a draconian carbon tax -- Kyoto lets them instead make efficiency investments in places like Russia and China, where it's cheaper to reduce CO2 and where there's plenty of low-hanging fruit. How many tons of CO2 countries save abroad equals how many carbon credits they get toward meeting their own national targets. Targets that they are in reality missing, in some cases by a wide margin. The idea is similar to the one behind the trendy personal "carbon offset" industry, but transferred to the international level. Just as Brad Pitt and Al Gore can invest in some reforestation project in Tamil Nadu and then declare themselves "carbon neutral" without changing their carbon-intensive lives, so too can France invest in Russia and claim Kyoto success without cutting its domestic CO2 output.

Critics of personal offsets and Kyoto's credit scheme have compared them to the medieval Church practice of selling Indulgences to sinners. It's a good analogy. Kyoto's carbon-trading game allows signatory nations to think they're going to heaven while we continue slouching toward likely global warming hell....MORE

“Bali will set in motion a process that will define the structureAnd:

of the carbon markets for decades to come”

“By 2020 the global carbon market could be worth EUR 240-

450 billion”

-Sir Nicholas Stern

"This (climate change) is much too important to leave to environment ministers"Good times, good times.

-Sir Nicholas Stern

to Finance Ministers basking in Bali

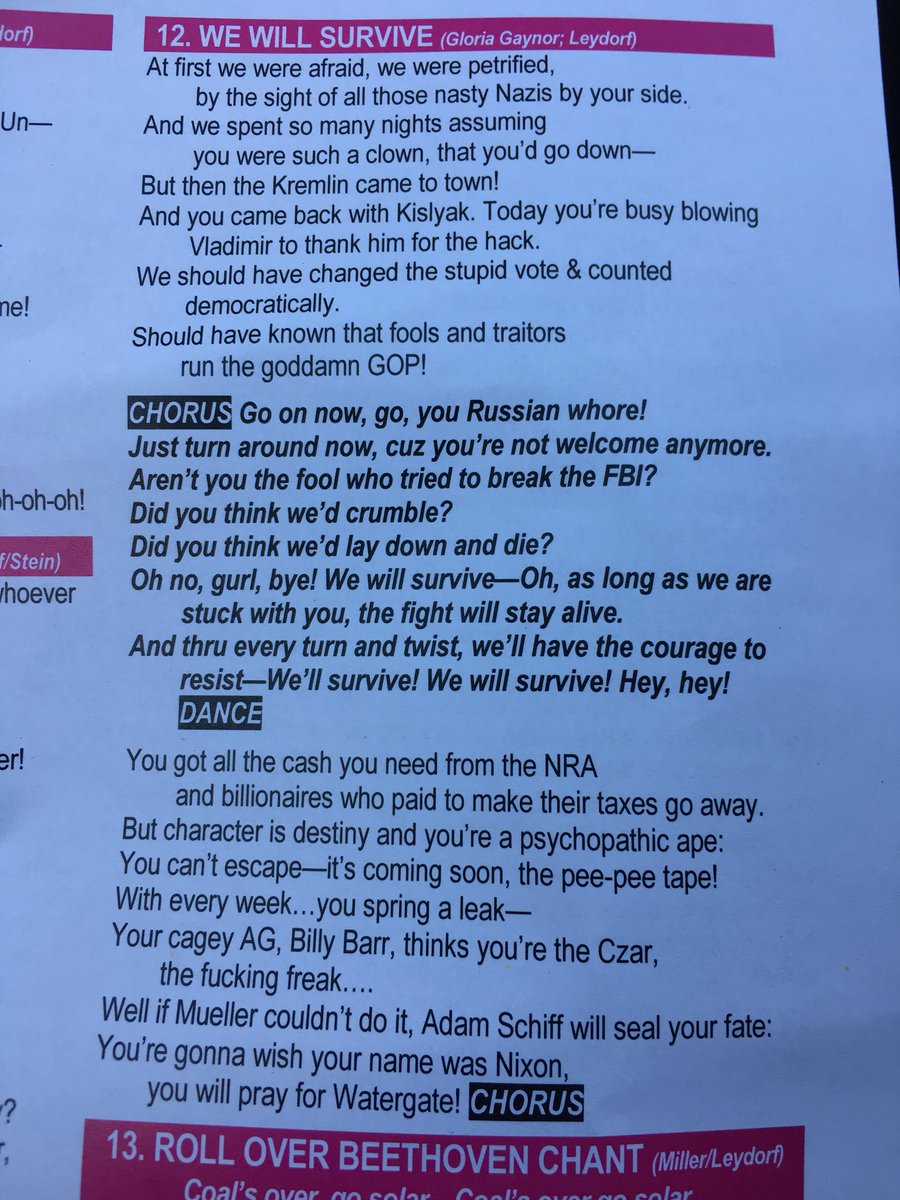

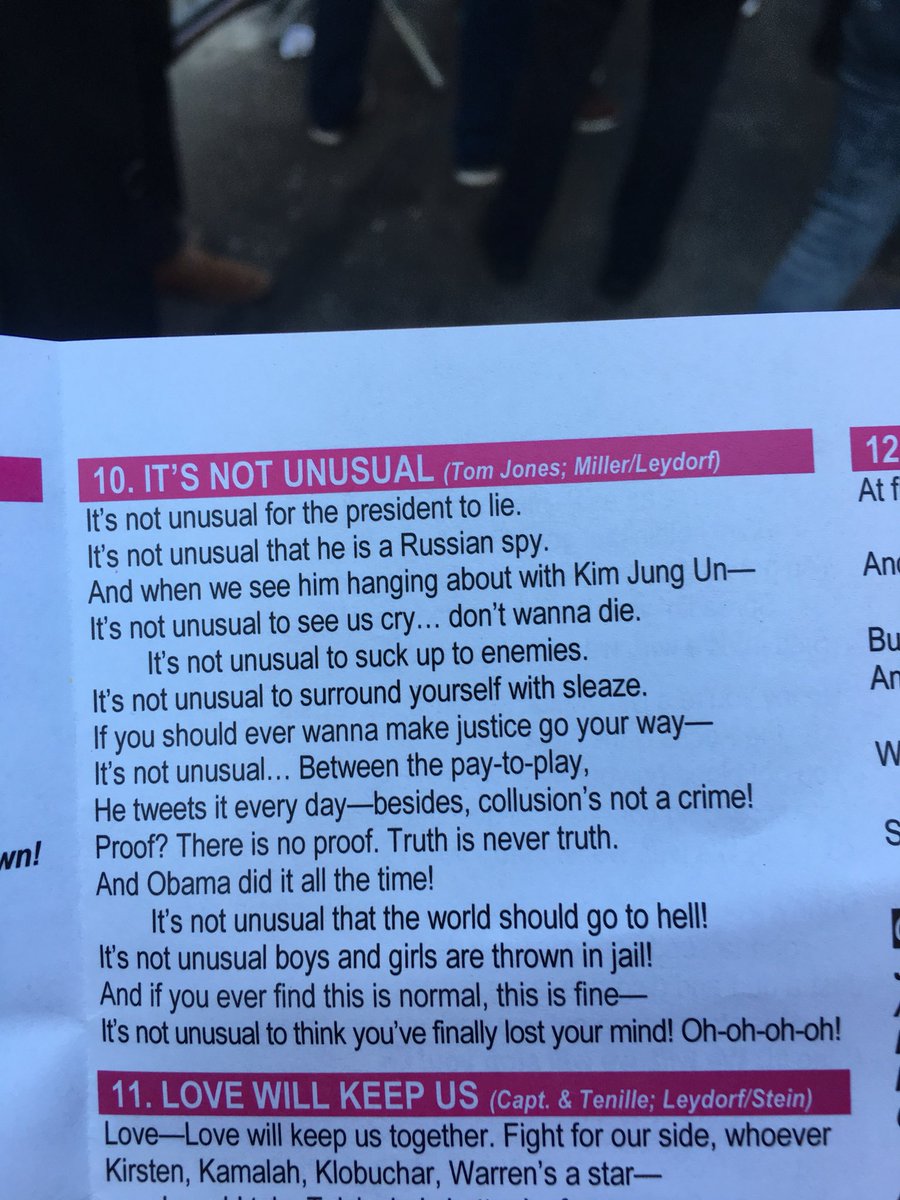

And why this trip down Memory Lane? There was a pro-Mueller rally in Washington last night with singing and other festivities. On the song sheets besides the always popular "It's not unusual":

And "My Favorite Things" (blasphème!)

Was: